Land

Land Deals Pivot From Fast-Forward To Pause, But For How Long?

Wait-and-see kicks into effect, with a few noteworthy walk-aways and some agreements falling through at the 11th hour. The question is how long land in limbo can last.

Buy land, they're not making it anymore." – Mark Twain

Both sellers and buyers of land have struck a note of caution. We're seeing a market in the first stages of softening. We expect further slowing. It's just the beginning." Jody Kahn, senior VP, John Burns Real Estate Consulting

That, and other sage pieces of advice seem to flow in abundance in residential real estate almost directly inverse to those rewarded by heeding it all.

An annual trillion-dollar-plus business community predicated largely on wins, losses, and oblivion in cycle-timing front-loaded investments in land has pivoted suddenly from the broad sweep of an upcycle offensive to the fiercely specific intricacies of defense.

Since new-home sales pace and price activity and the business models they propel showed signs of flux in the first quarter of 2022, and tipped into full inflection in the just-finished calendar second quarter, that finite raw resource necessary to all things new residential construction – and a direct impactor of opportunity, risk, and threat to homebuilders, 25% to 35% of whose costs for each new home tie to land – hangs now in limbo.

That assessment may be arguable, mostly depending on where you sit, owing to the first, second, and third determinant of value risk and reward: location, location, location.

What's clear – and this is important, because so much is and will remain unclear when it comes to the magnitude and duration of economic disruption ahead – is a very fast direction reversal, from mach speed growth to a sudden check-up in forward-looking 2024 and beyond land acquisition.

Here, in response to a query from Wedbush senior vp for equity securities research Jay McCanless about the sudden emergence of "finished lot deals", is LGI Homes' chairman and ceo Eric Lipar's verbatim response during this week's Q2 earnings call. This is how a public homebuilding company ceo looks at the new calculus of risk and opportunism suddenly evident in the market:

I was in Colorado last week for a Board meeting and spent some time in the field with our acquisitions team. And for the first time in a couple years we had a couple of finished lot opportunities we were looking at. So there’s a lot of developments going on across the United States and we are pretty excited about the potential opportunities that may come about with a more normal market. But a lot of the land coming to market, and a lot of developments have been financed with more expensive debt, more expensive land banking, and will those communities come online? We will see. We are starting to see some of those opportunities, but it’s early.

That's one take on what limbo in the domain of land acquisition sounds like.

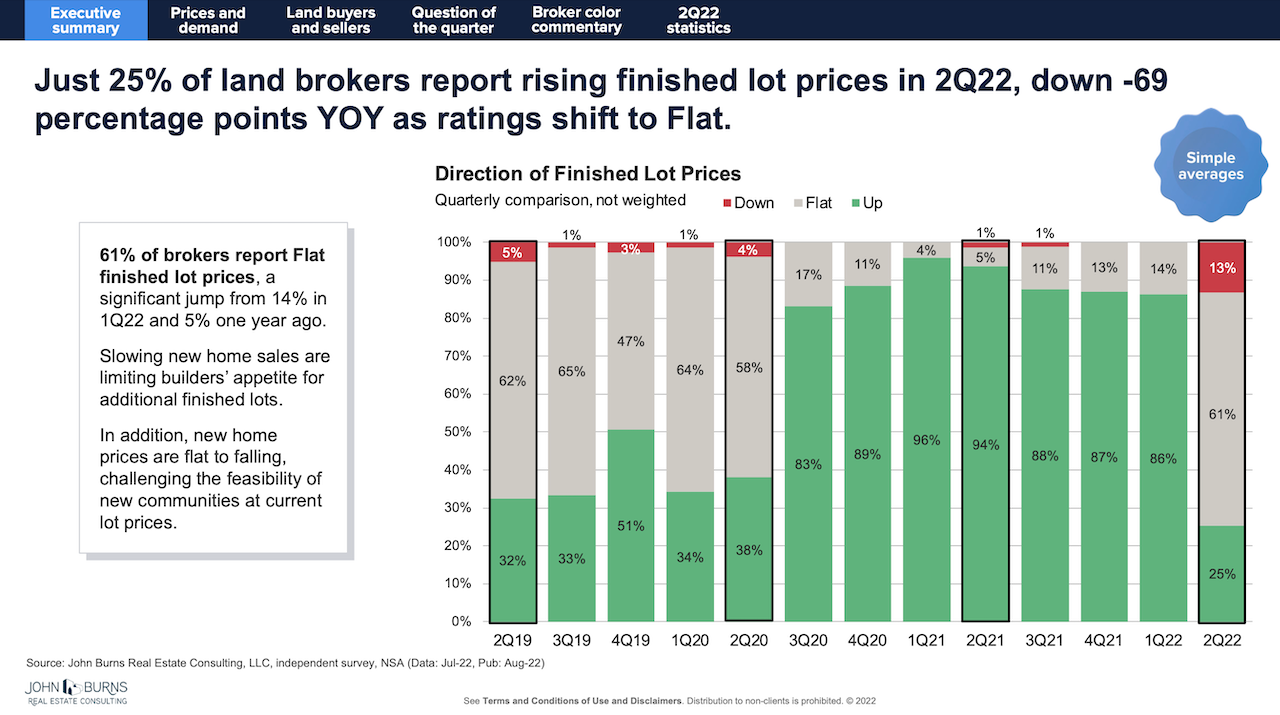

Here's what it looks like, from John Burns Real Estate Consulting's recent Q2 Land Survey:

- Just 25% of land brokers note rising finished lot prices in 2Q22, collapsing from 86% in 1Q22. [61% of land brokers indicate finished lot prices were flat in 2Q22, jumping from just 14% in 1Q22].

- Finished lot prices increased 15% YOY in good A-B locations nationally in 2Q22, cooling from 19% YOY in 1Q22. [Undeveloped land prices increased 19% YOY in good locations nationally in 2Q22, easing from 24% YOY in 1Q22.]

- Lot and land price appreciation decelerated even more in outlying C-D locations, as poor affordability in typically drive to qualify locations discourages builders from adding additional lot supply. [Finished lot appreciation in C-D locations slipped to 11% YOY in 2Q22 from 17% YOY in 1Q22, and undeveloped land appreciation cooled to 14% YOY in 2Q22, down from 21% YOY in 1Q22.]

- 15% of the land brokers report price declines YOY for undeveloped land and sometimes for finished lots. [Most of these price declines are concentrated in California, and specifically in the East Bay, Sacramento, and Riverside-San Bernardino. Individual brokers in Jacksonville, Charlotte, and Tucson also report some price declines.]

The cascading decision to press pause on pending land investment agreements – including some on the verge of funding as recently as last week – bears a cause-effect relationship with the break in home price elasticity the Fed's funds rate policy and quantitative tightening pivots triggered.

The result – a monthly payment increase of 32% over this time last year – reflects just how sensitive the daisy chain of price and pace to land investment is, according to JBREC's Jody Kahn.

As an indication of just how suddenly and steeply the mindset and transactional behavior of sellers and buyers in the land market redirected downward, Kahn compares the quarter to quarter change from Q1 2022 to Q2 2022 with the convulsive shock of COVID-19 in 2020.

The swing in demand for finished lots from Q1 to Q2 in 2020 actually netted positive for rising prices. When you look at that compared with 2022, you see that the year on year swing is a minus 69 percentage point shift to flat. That's an enormous about-face."

Kahn notes that even as homebuilders curb their once ravenous appetites for land, and tread water on pending deals, bids on some parcels may appeal to other types of real estate acquirers – developers, investors, build-for-rent players, etc. The question, as pencils get sharpened for upcoming 2023 budget season and future planning, is whether the deceleration in land investment and pricing activity stabilizes or succumbs further to gravitational forces still in play.

The surprising thing, in Kahn's view, is that sellers and brokers have relatively quickly shifted from hyper-aggressive pricing tactics to a repertoire of more negotiable terms and conditions, even for some of the deals they have in place – reducing take-down schedules, extending out the terms of lot deals, looking for price reduction opportunities, etc.

That's part and parcel of a market pivot. However, whether those more malleable conditions will be enough to keep their big land buying client bases on the hook or not begins to be a source of worry.

What keeps me up at night has to do with the amount of spec inventory builders have going under construction so that they could offset supply chain delays and give their customers as much visibility and certainty as possible for closing dates," says Kahn. "Builders had planned to bring these homes under construction to a sheetrock stage before they released them, banking on a deep stream of demand that would match right up with those homes when they're released.

What's clear now is that a percentage of those soon to be completed spec homes will not be matched up to a buyer, and that surplus is when you'll see yet another series of price actions kick in that will further impact land investment and buying activity.

In other words, Kahn wonders, what happens when the pause button runs out of time, say in the next 100 days many buyers and sellers have agreed to stay tuned and hold on. She doesn't see the Federal Reserve coming to the rescue any time soon. At that point, she wonders, will we see land buyers and investors looking for the "eject" button.

Join the conversation

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.