Land

Ground Rule Trouble: Built-To-Rent Land Rush Stresses Publics

Clashing land valuation models -- IRR vs. gross and net yield REIT valuations -- have upped the antes, raised the risks, and elevated the stakes in the residential land acquisition landscape.

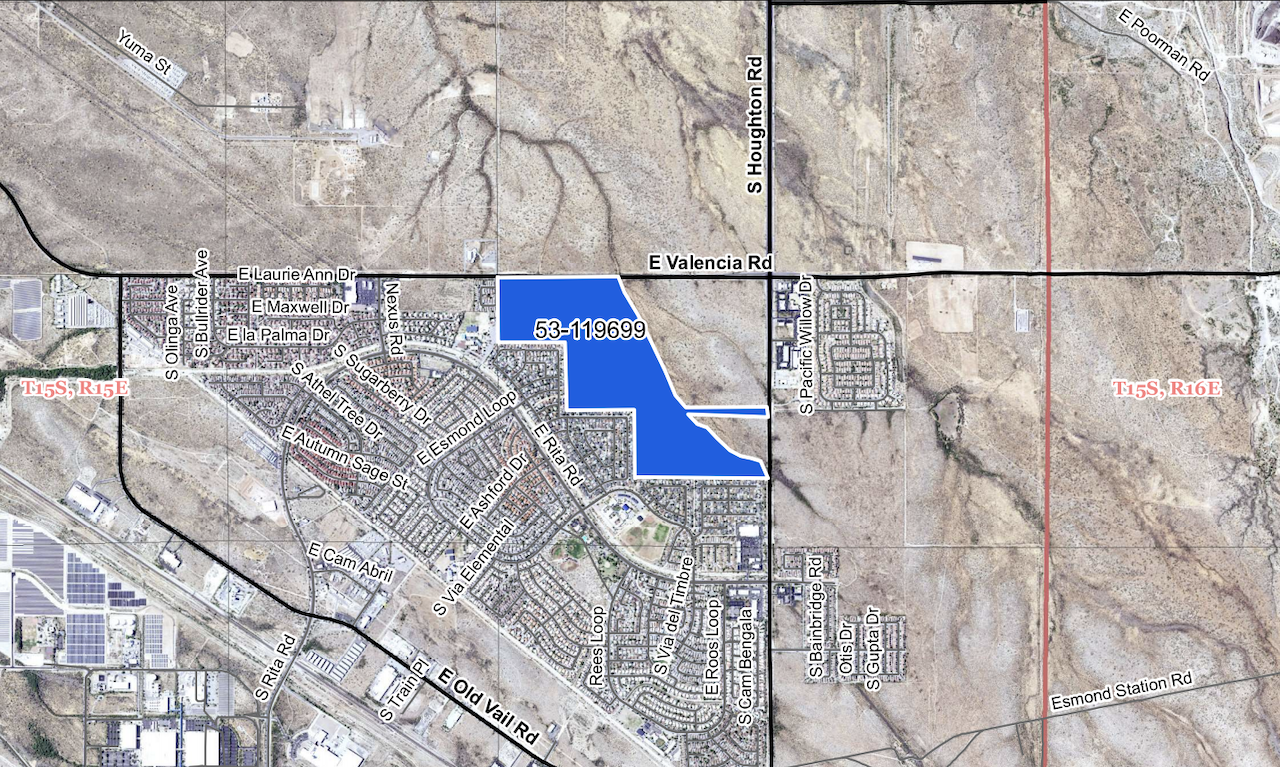

Bids came in* [see correction below] for a July 21 live auction of a 184-plus acre site, west of the southwest corner of Valencia and Houghton Roads in Tucson.

The appraised value of the funky-boot-shaped parcel – which had been granted to the Arizona state land department by the federal government in preparation for statehood in 1912 – was $14.5 million, which was set as minimum bid.

The tract – in a desirable location within stone's throw distance of what recent Census data confirm to be the fastest-growing city in the U.S., and newly-minted 5th largest city in the country – checked all the boxes raw land-hungry single-family, market-rate, for-sale homebuilders regard as critical for lot pipeline replenishment beyond 2022 or '23.

Those land-hungry homebuilders – many of them with publics, with capital dry powder to spare – were in for a shock when the gavel dropped.

The winning bid, an all-cash offer, came from American Homes 4 Rent (AMH), at $44 million.

Jaws dropped ...

Again ... for this was just the latest case of radical new rules of engagement at work in the U.S. residential land game. These new rules bring apples to oranges business and real estate investment financing models into a collision point that hinges on the question of the trajectory and duration of America's fast-evolving single-family rental housing preference and asset class.

"AMH's bid came in 20% higher or more than the publics on the Arizona land buy, and they're getting outbid by REITs," says an real estate executive with knowledge of the land acquisition market dynamic. "The publics are getting annihilated because they can not model that kind of appreciation into their bids. I don't think they ever could have factored in the REITs making all-cash offers, 20% or 30% higher by default of their business model."

This is our focal point, and we'll unpack it.

First, briefly, however, it should not be ignored that AMH's bounty will mean much-needed new housing development, adding inventory and options to Tucson, and pouring resources into the No. 1 beneficiary of the State land sales, generating revenue from property sales, interest on the property loans, leases and fees. The Real Estate Daily News reports:

Arizona’s K-12 schools are the top beneficiary, receiving about 80 to 85 percent of monetary benefits from the sale and lease of trust parcels. Approximately 8 million acres of trust property is designated for K-12 public education.

Other beneficiaries are the state’s three public universities, the Arizona School for the Deaf and the Blind; the state legislative, executive and judicial buildings; the Arizona State Hospital in Phoenix; the Arizona Pioneers’ Home in Prescott; the Arizona Department of Juvenile Corrections; and the Arizona Department of Corrections.

Those considerations aside, the strategic and risk-reward-assessment challenges are twofold.

- For pure-play market rate, for-sale homebuilding enterprises, the question is one of how they continue to compete for an essential raw material resource – land – in an arena whose players draw from an altogether different arsenal of finance tools and tactics?

- For real estate investment trust players, such as AMH and a horde of other REITs clamoring into the SFR and built-to-rent space with abandon, the question is, given an expected ballooning of horizontally-developed new residential rental inventory in the next few years, how sustainable are the gross and net-yield rate growth assumptions underlying land bids the likes of the Arizona land buy a few weeks ago?

Land acquisition and finance in the early 2020s – now that COVID-19 has settled in for a long-haul, for-sale home prices are testing and exceeding household elasticity limits, and Millennials have become a fully-awakened former sleeping giant – features the clash of two dramatically different residual land valuation models currently playing out in the fever of single-family-built-to-rent development.

Builders pencil residual land valuation based on Internal Rate of Return "hurdle rate" model assumptions to validate land investments. REITs use gross and net yields – based on ongoing cash generation and asset values – in their land valuation diligence.

"Fact is, an IRR gross margin model will always kick out a lower residual land valuation than a gross yield or a net yield model," says the land and capital investment executive we spoke with. "The question is, if they have to pay more to win the bids, to they have to pay that much more? Will those kinds of valuations be sustainable in a pivot to fundamentals-based operating funds?"

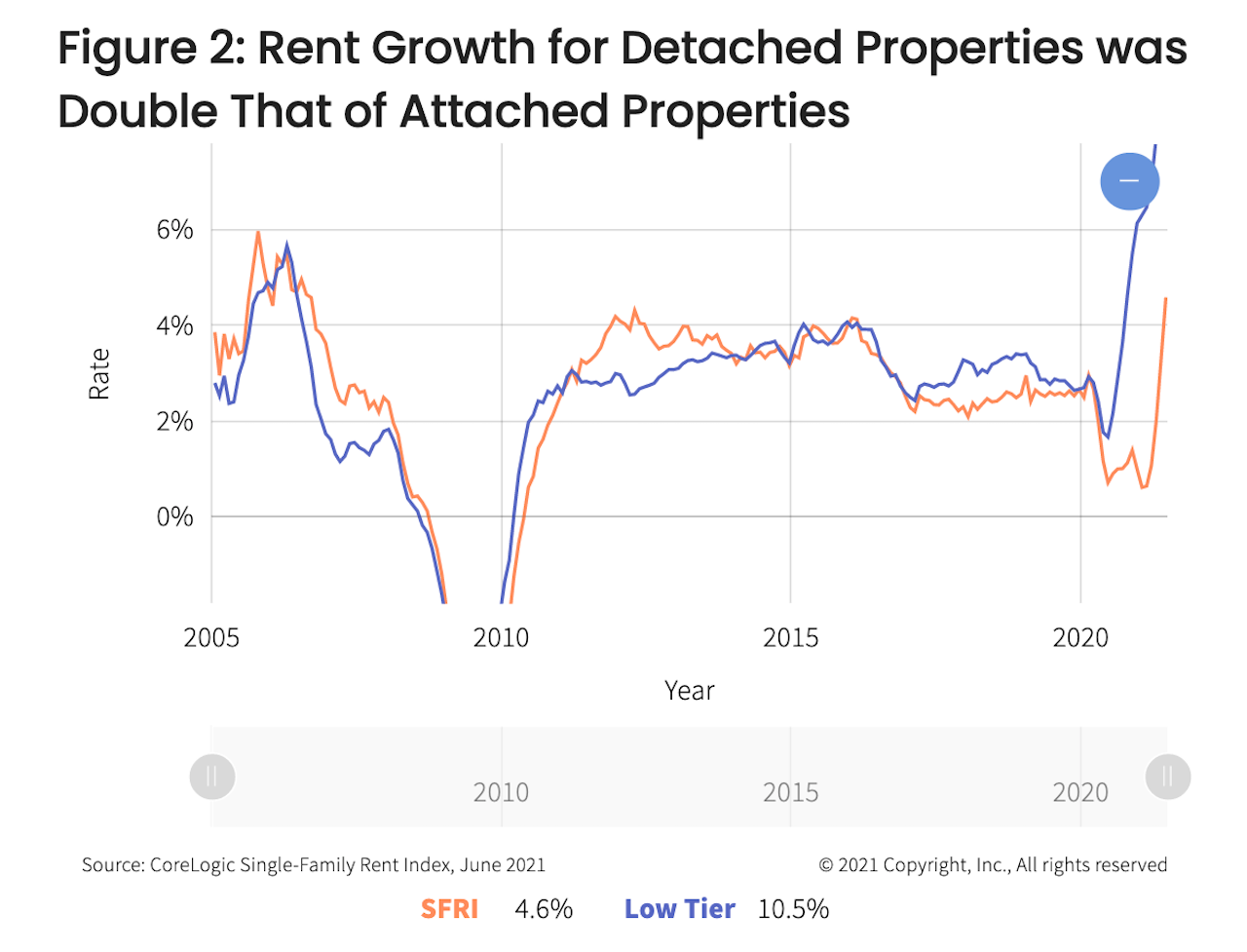

Land fever, and its recent vertigo-producing imbalances springing from the phenomenal momentum of SFR and BTR community development strategies, has been the talk of residential real estate for 24 months. On cue, this week, CoreLogic principal/economist Molly Boesel brought out new data evidence supportive of the gross and net yield growth modeling among the REITs.

U.S. single-family rent growth increased 7.5% in June 2021, the fastest year-over-year increase since at least January 2005[1], according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The June 2021 increase was more than five times the June 2020 increase, and while the index slowed to a post-pandemic low last June, rent growth is running well above pre-pandemic levels when compared with 2019.

Pure-play single-family-built-to-rent REIT American Homes 4 Rent ceo David Singelyn had this commentary in Q2 financial results, which featured highlights that AMH rents and other single-family property revenues increased 11.7% to $313.7 million for the second quarter of 2021.

"The second quarter of 2021 was one of the strongest operational performances in the history of American Homes 4 Rent with quarterly Core FFO per share growth of nearly 23%," stated David Singelyn, American Homes 4 Rent's Chief Executive Officer. "Additionally, we recently achieved numerous milestone capital accomplishments, including the highly successful debut issuance of 30-year unsecured bonds, which puts us in a position to further expand our 2021 external growth expectations. Coupled with our record-breaking operating results, we are increasing the midpoint of our full-year Core FFO guidance to $1.32 per share, which now represents nearly 14% anticipated year-over-year growth."

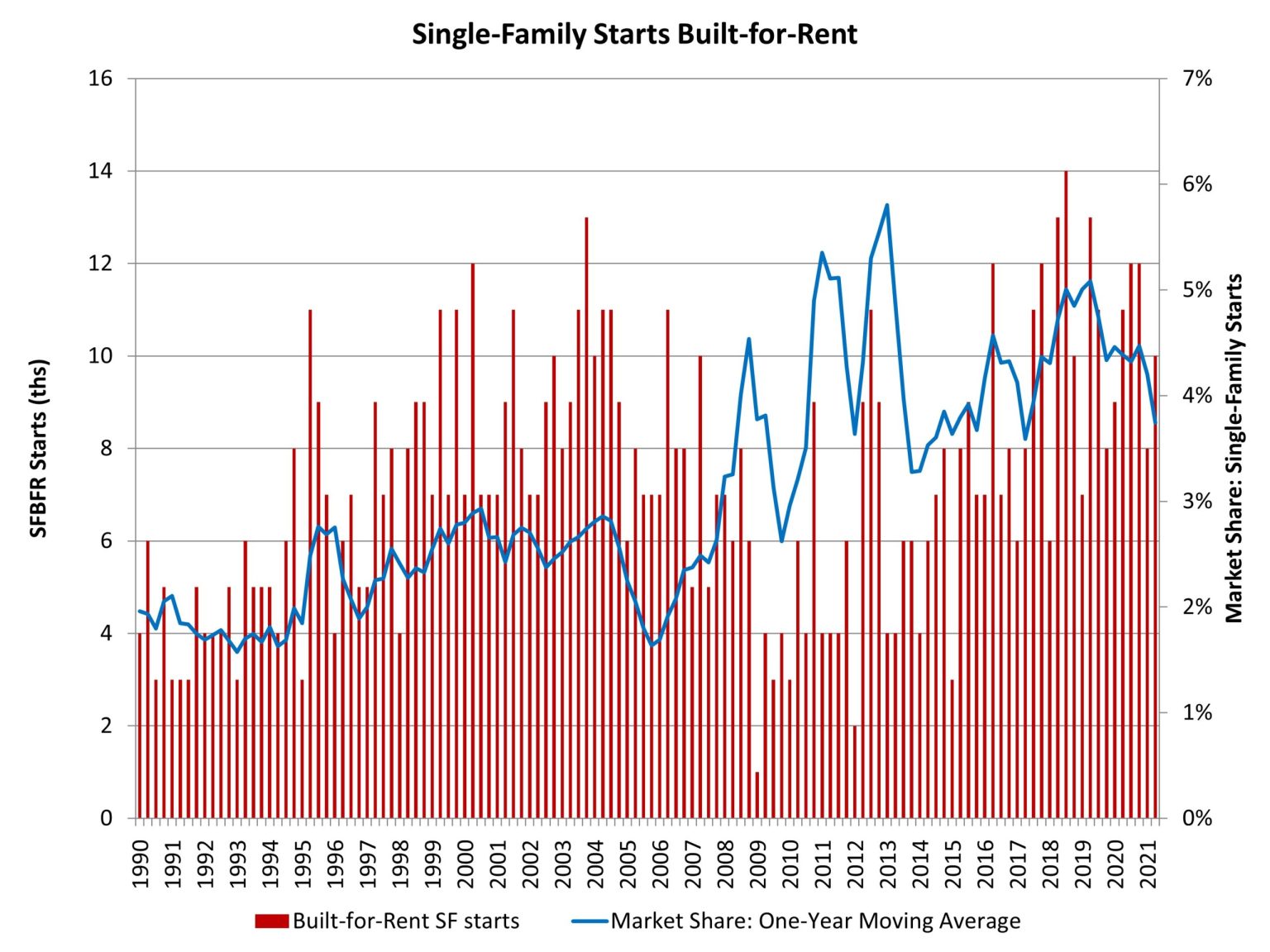

The biases and distortions that come with the turf of high rates of change in a context of relatively low absolute numbers make new rules of land-buying engagement all the more dizzying. Robert Dietz, chief economist for the National Association of Home Builders writes:

With the onset of the Great Recession and declines in the homeownership rate, the share of built-for-rent homes increased in the years after the recession. While the market share of SFBFR homes is small, it has been trending higher. As more households seek lower density neighborhoods and single-family residences, but some may do so from the perspective of renting, the SFBFR market will likely expand in the quarters ahead as the economy recovers from the virus crisis.

The two questions are these:

- Can the public and large private homebuilding – and even some of the private equity land players like Golden Tree and Walton – get in the same game with land valuation rules that have changed so dramatically?

- Will the REIT gross and net yield assumptions prove out in the real world, especially as new challenges – such as those arising at the community level among voters and officials who oppose single-family-rental communities – emerge and the structural demand for these offerings settles into an enduring pattern?

** Correction: An earlier version of this story incorrectly reported that the Arizona land auction was a sealed-bid process. That misstates the actual facts, which are that July 21 event was a "live action," in which public homebuilding company bidders hung in "until the end." TBD regrets the error.

Join the conversation

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.