Capital

Early-Movers D.R. Horton And Pretium Signal It's Their Time To Strike

The $1.5 billion agreement between Pretium and D.R. Horton reflects conviction of each of the participants around two plausibilities, or perhaps, likelihoods. That doesn't mean they're bound to turn out as expected.

Two top-echelon players decided they've got enough insight into where residential real estate's headed, and the ability to control their destiny come what may, to become early-movers.

For neither $51.8 billion investment manager Pretium Partners nor $33 billion homebuilding leader D.R. Horton – which closed just shy of 83,000 home sales in 2022 – is the reported $1.5 billion agreement for Horton to sell 4,000 new homes into Pretium's single-family rental portfolio a strategic surprise, or a new tack.

Rather, the $1.5 billion agreement between Pretium and D.R. Horton reflects conviction of each of the participants around two plausibilities, or perhaps, likelihoods. That doesn't mean they're bound to turn out as expected.

- One – on Pretium's part, is that the delta between rising borrowing costs and weakening rents has past its greatest distance, which may signal the "cause for pause" in single-family-rental transactions may be ready to relent, with a signal that investment and deployment may resume.

- Two – on D.R. Horton's part, the bulk deal reflects its strategic leaders' capability to scale its BTR product and production platform profitability, even as per unit costs may undergo ongoing pressures in a post-easy money lending and investment environment.

Bloomberg first reported the story late last week, and the Wall Street Journal tapped its own sources for added insight into the agreement.

Investment firm Pretium Partners is paying more than $1.5 billion for thousands of homes, say people familiar with the matter, a move that could signal investors’ re-entry to the housing market after higher interest rates drove them away.

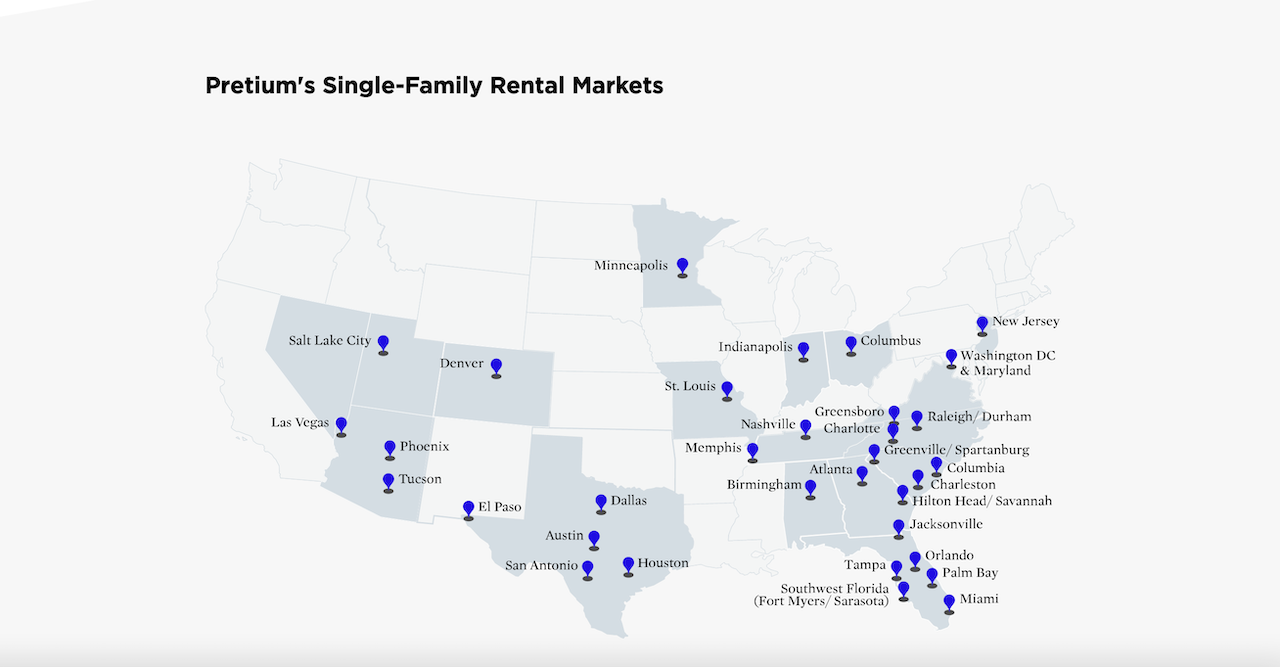

The New York-based Pretium has agreed to pay D.R. Horton, the largest U.S. home builder by volume, for more than 4,000 homes scattered across the Southeast and Southwest, these people said. Pretium oversees a portfolio of about 100,000 rental homes and has been one of the largest buyers of American houses in recent years. – Will Parker, Wall Street Journal

While the headline speaks to a blockbuster deal, in context, the plan would amount to about 4.5% of D.R. Horton's revenue on home sales, and about 4.8% of its single-family volume last year. That's material. But it's not game-changing.

The timing of the deal suggests a big strike at a moment its market-mover partners consider opportune. D.R. Horton's long-term play is to leverage BTR as a way to monetize its land and vertical investment investments, and to do that when and where it's both competitively advantageous and profitable. Further, with BTR as a deeper local scale option, it can itself leverage increased marketshare with greater profit margins by smoothing its starts in a market in both for-sale and for-rent communities.

In an April 20, 2023 Q2 2023 quarterly meeting with investment analysts, Paul Romanowski, D.R. Horton executive VP and co-chief operating officer noted:

We have seen good pace on our ability to rent up both our apartments and single-family for rent. We have seen stability in rent rates. They've been increasing quite a bit over the prior 12 months, and we've seen stability there. On the purchase side, we still see activity in the market. We have certainly some units that we pushed out and sold consistent this quarter really would last in terms of number of units. And although we have seen the number of buyers back off some and a little bit of tightening in credit in terms of their ability to get to these financed, but we still see pretty solid demand for the communities that we have out to market." – Seeking Alpha

Likewise, Pretium strategists – who've declared a long-term commitment to its residential real estate power-play in single-family rental – see high-volume builders as a core channel to scale their residential rental portfolios, and now as a time to pounce on an opportunity to add 4,000 at an estimated per-door cost of $375,000 because both the investment and the pro forma operational model can begin to make sense, barring a dramatic reversal of current improving trends.

They believe that within 'the falling knife' context of a correction and its causes, that scenario may have changed, and now investors are once again finding ways to accretively finance these BTR transactions," an executive with knowledge of these deals tells us. "Rent deterioration has flattened, and in single-family – while rent growth has slowed – it has begun to stabilize, and show signs of improvement. So, if the cost of leverage starts easing, and rents improve, cap rates can rise again."

Both partners have work cut out for them on operations and financials they are in control of, and both are exposed to risk. For Horton, the big lift will be in driving down its input costs on for-rent production to well-below a retail home's cost model. For Pretium, the risk is more of a mistiming in both borrowing cost trends, and rent trends. However, both Pretium and D.R. Horton have the depth of capital and the cycle-timing track record to make their early-mover investments pay off.

This type of partnership gives builders a mechanism to monetize what they produce, and we'll see more of them," says our strategic investment executive source. "The big SFR companies have a lot of capital – and now that the cause for a pause may be easing – we're going to see these types of partnerships happen more and more frequently."

MORE IN Capital

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.

Engineering The Path To Better, Faster Growth Amid 2025's Stall

Local resistance, rising fees, and long entitlement windows are locking up growth. This analysis shows how smart financial planning unlocks new possibilities.