Leadership

Deal Makers, Start Your Engines: A Fast, Furious M&A Pace Ahead

The mergers and acquisitions environment is poised for a burst of activity, with Builder Advisor Group's Tony Avila predicting 10 to 12 major deals by year-end.

When things are going great, that's the time to sell.”

Tony Avila, CEO of Builder Advisor Group, has been instrumental in shaping the M&A landscape for homebuilders across the United States. Avila’s insight underscores a critical truth for private homebuilders contemplating their future: the best time to take chips off the table is often when business is booming, not when the pressures to sell become pronounced.

As the U.S. homebuilding industry enters the final quarter of 2024, this principle is more relevant than ever. The mergers and acquisitions (M&A) environment is poised for a burst of activity, with Avila predicting 10 to 12 major deals by year-end.

It's one of the reasons we're so excited Tony Avila is an important part of our Focus On Excellence leaders summit and workshop, October 28-30, at the Hyatt Regency Lost Pines Resort in Austin.

This M&A surge is driven by a confluence of market forces, a powerful strategic pivot among public builders, and the ongoing challenges faced by private operators.

Public builders – the biggest bloc of strategic M&A acquirers, buoyed by their strategic advantages and access to capital, are aggressively pursuing acquisitions to strengthen their market positions and deepen their local scale. Avila, who has been closely involved in many of these transactions, highlights the breadth of activity:

We’ve got buyers lined up in Texas, Florida, the Gulf Coast, Virginia, and the Carolinas. And that’s just the beginning—deals are being lined up in the Mountain West, the Mid-Atlantic, and beyond.”

After an energized, high impact M&A deal flow out of the gate in 2024, and 11 reported deals completed through July of this year, acquisitions in all of their respective phases – from tire-kicking, to NDAs, to LOIs, to definitive agreements – have gained extra measures of motivation, both among buyers and sellers in the post-pandemic, end-of-easy-money environment that took shape beginning in 2023.

M&A dynamics in the homebuilding practically hold a mirror to supply and demand forces in market rate residential real estate writ large.

- Structural demand (i.e. strategic acquirers) is intense and has both domestic and global bidders, loaded for bear with capital.

- Strategic supply (i.e. well-located, best-practice, operationally excellent, and locally-trusted homebuilding operator sellers) is relatively scarce.

- The catalyst for motivation on both the buy- and the sell-side is access to plentiful capital to secure near- and longer-term growth within high-activity markets that promise a transparent horizon of economic and domestic migration growth.

This analysis delves into the dynamics at play, drawing on Avila's expertise, to offer a comprehensive view of a homebuilding M&A landscape expected to shift into high gear, maybe as early this week or next.

Public Builders Tighten Their Grip

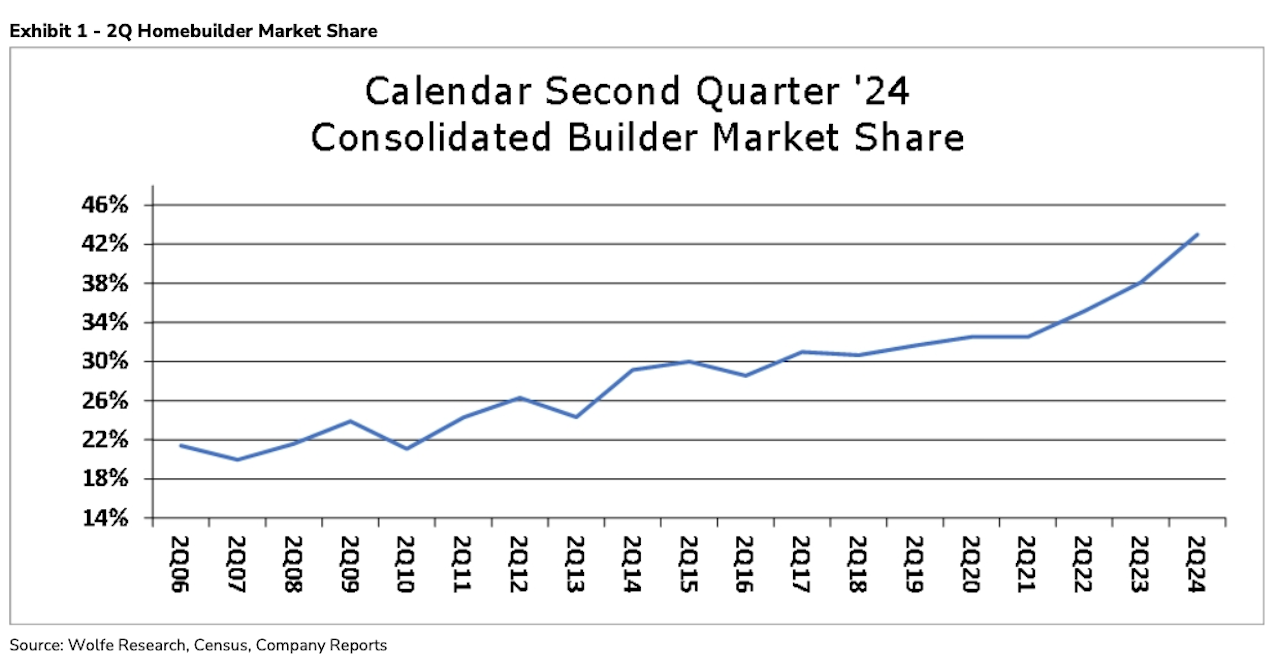

The current M&A environment cannot be fully understood without considering the broader market context, particularly the strategic positioning of public homebuilders. According to a recently published Wolfe Research report, New Home Sales (NHS) now account for 14.3% of total home sales, marking a significant +190 basis point (bps) increase compared to the previous year. This shift has been a boon for homebuilders, who have seen a 7.2% increase in NHS despite a nearly 9% decline in the resale market.

Public builders, in particular, have capitalized on this environment. Wolfe Research notes that in Q2 2024, public builders gained a substantial +490 bps of market share year-over-year, bringing their total to 43.0% of NHS nationwide — the strongest gain since 2007. This surge reflects the strategic use of their access to fixed and lower-rate debt, longer-term capital, and competitive advantages such as mortgage rate buydowns and adaptable product offerings. In an affordability-constrained market, public builders have positioned themselves to outcompete private builders, who are increasingly hampered by limited access to capital and rising land costs.

M&A Motivators

In a recent conversation, Tony Avila shared his perspectives on the motivations driving both buyers and sellers in the current M&A landscape. Avila emphasized that the best time to sell is often when a business is performing well — a sentiment reflected in the flurry of activity he’s witnessing. For many private builders, the decision to sell now is driven by a combination of factors: the scarcity of capital, the intensifying competition for land, and the rising costs associated with land acquisition and development.

Public builders, buoyed by their strategic advantages, are actively seeking acquisitions to strengthen their market positions. Avila highlighted ongoing deals across key markets, including Texas, Florida, the Gulf Coast, and the Carolinas. These deals involve a mix of public and private buyers, as well as international interest from Asia and Canada. The breadth and depth of these transactions and bidders underscores the robust demand for strategic acquisitions, even as U.S.-based public builders aim to solidify their market share ahead of anticipated growth in 2025 and beyond.

The largest number of buyers I’ve ever seen are actively investing in the sector, including international players from Japan, China, and Korea," Avila says. This influx of capital, both domestic and international, is fueling the aggressive M&A activity that is expected to continue into 2025.

The Public vs. Private Builder Dynamic

The growing market share of public builders is part of a larger trend that has seen the Top 10 homebuilders steadily increase their dominance over the past few decades. Data from the National Association of Home Builders (NAHB) reveals that while the Top 10 builders' market share slipped slightly in 2023—from 43.5% to 42.2%—this decline was primarily due to the recovery of private builders who were able to complete and deliver more homes following the supply chain and labor disruptions of the Covid pandemic.

However, the slight decline in market share does not indicate a weakening of the Top 10 builders' position. On the contrary, these public builders have intensified their efforts to box out private operators, leveraging their superior access to capital and strategic flexibility. The Federal Reserve’s tightening of monetary policy has further exacerbated the challenges for private builders, who now face higher borrowing costs and increasing pressure from land sellers. In this context, the ongoing M&A activity reflects public builders’ strategic intent to capture even greater market share, often at the expense of their smaller, private competitors.

Japan's Growing Presence

Adding another layer to the M&A landscape is the growing interest from international investors, particularly from Japan. Avila noted that a Japanese firm has recently invested in Builder Advisor Group’s debt fund, marking its first foray into the U.S. housing market. This investment reflects a broader trend of foreign capital seeking opportunities in the American housing sector, driven by the strong demand for housing, particularly among millennials, and the relative affordability of U.S. real estate compared to other global markets.

Japanese investment, focused on debt rather than equity, is seen as offering a favorable risk-adjusted return. This interest from international players adds momentum to the already heated M&A market, as public builders continue to seek strategic acquisitions to bolster their positions in key markets.

Deals and Their Implications

Recent M&A activity offers a glimpse into the strategies being employed by both buyers and sellers. For instance, public builders have targeted private builders with valuable land assets or strong local market positions, allowing them to quickly expand their market presence in high-growth metro areas. These acquisitions are not just about immediate gains but are part of a longer-term strategy to dominate local markets and outmaneuver competitors.

The Wolfe Research report highlights that public builders like D.R. Horton and Lennar have been particularly aggressive in gaining market share, with D.R. Horton’s market share increasing by +140 bps on a trailing twelve-month basis. Such strategic moves are indicative of the broader trend towards consolidation in the industry, as large public builders seek to maintain their growth trajectories – and grow margins – in an increasingly competitive market.

Take-Aways for 2024 and Beyond

As we approach the end of 2024, the U.S. homebuilding industry is experiencing one of its most dynamic periods in recent history. The combination of strong M&A activity, aggressive market share strategies by public builders, and growing international investment suggests that the landscape will continue to evolve rapidly. For private builders, the challenges of competing in this environment may push more to consider selling, especially as public builders leverage their strategic advantages to consolidate their positions.

Looking ahead to 2025, the trends identified in this analysis point to continued consolidation in the industry. Public builders, with their access to capital and strategic flexibility, are likely to continue driving M&A activity, shaping the future of the homebuilding market. Tony Avila observes,

Builders’ margins are starting to tick up, and absorption pace is starting to tick up slightly... I would expect in six months to see margins and absorption pace for closings up slightly."

He attributes this to the recent downward inflection in interest rates, noting:

the cost of mortgage rate buydowns is coming down a little bit, and definitely construction costs overall have been easing," factors that are expected to contribute to improved profit margins for builders.

This optimism from Avila not only underscores the current momentum in the market but also suggests that the challenges of the early summer are beginning to recede, paving the way for a robust finish to the year.

On the mergers and acquisitions front, right now it is Katie, bar the door. There are a lot of buyers, a lot of deals coming."

With this backdrop, the homebuilding industry is poised for a period of intense activity and strategic realignment, with significant implications for 2025 and beyond.

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.