Land

Comfort Zoned In: Remapping Paths-Of-Growth To A WFH Future

The lot plot thickens as data reveals homebuyers' bets that a work-from-home hybrid is the future they're buying into. That means trading off commute convenience for more space.

Job center-centricity -- a seemingly timeless force that unleveled playing fields everywhere, and helped create developer, builder, and investor empires – may be ceding power to a new, more hybridized future of place.

Wrapped into the questions of the moment for geography, for homing, for land speculation and community planning are timeless human values.

- Safety, security, well-being – for oneself and loved-ones

- Time itself

- A means of livelihood

Almost everything else had already been in play in glacially slow-motion, only to be sped up in the vortex of the pandemic, which is and will be a continuing factor in life as we know it.

In the pandemic's slipstream, working site and community planning models that tie job centers to rooftops in algorithms of value, have gone temporarily dark as predictive for the next set of years.

Nearer-term forces that model work-from-home and work-in-the-office or workplace hybrids are now fully "in" in real estate planning, evaluation, investment, and development dynamics.

Wall Street Journal real estate reporter Nicole Friedman puts this spin on a consumer trend scoop that infers a pivot in land valuation, acquisition strategies, and development.

"For Home Buyers, Length of Commute Drops in Importance, New Data Shows"

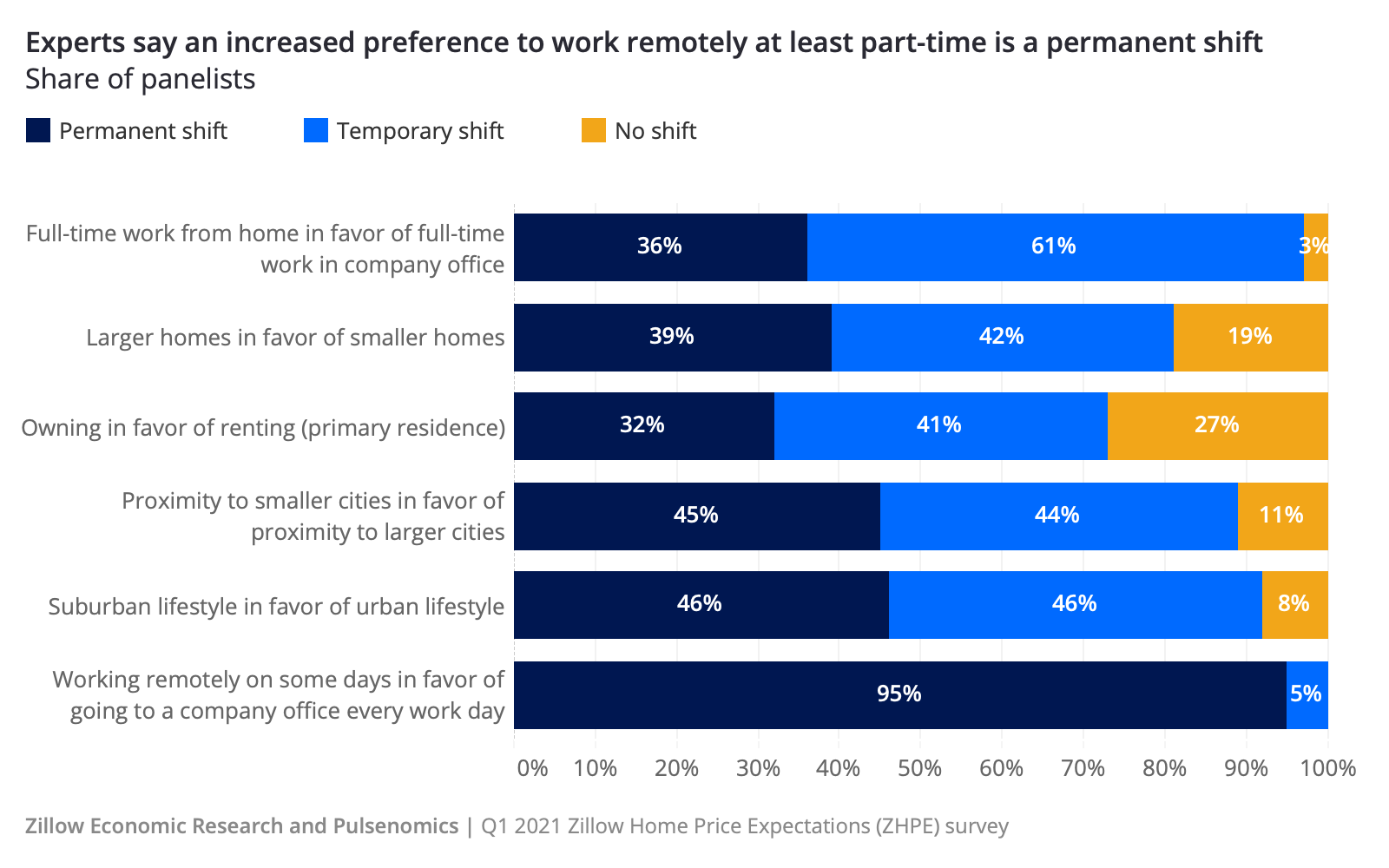

Friedman focuses on Zillow research that evidences a shift in consumer behavior – a greater willingness to trade off a longer commute for a more spacious, more rural feeling home, with the big hedge that the homebuyer's livelihood will be split in time spent in the office versus at home.

Looking at behavioral transaction data in Boston, for instance, Friedman notes:

In the two-year period ended in May 2021, home values in neighborhoods with a 70-minute commute rose 30.2%, strongly outpacing a 9.2% price gain for 20-minute-commute areas and a price decline of 2.5% for neighborhoods within 10 minutes of a job center.

Neighborhoods with commutes to job centers of 50 minutes or longer also posted the strongest price growth in the two-year period ended in May 2021 in New York City, San Francisco, Los Angeles, Washington, D.C., and Seattle, according to the Zillow analysis.

In all of these higher-cost metro areas, neighborhoods with longer commutes had lower median home prices than neighborhoods close to job centers.

The data very specifically reflect a widening conviction among at least a select band of employees that they're going to continue to have the option of working from home at least part of their weekly job schedule.

That's, of course, conditioned on how productivity, career advancement, compensation, and talent acquisition and retention dynamics net out in the long aftermath of Covid's initial disruption. Permanent or not, homebuyer behavior reflects that employees believe they've got an upper hand of leverage on that issue, especially when across sectors, talent and skilled labor constraints run top of mind on the part of many employer organizations.

This adds up to added risk for players bent on adding to their vacant developed lot pipelines to gain visibility into both volume and margins into and beyond 2023 and 2024.

The "lumpy" factor in forecasts will work as a determinant of who wins and who loses over the next 24 to 36 months, even as fundamental demand runs hot. It's how these farther-out rings and paths of growth pencil – or not – that remain cloaked in uncertainty.