Capital

As Spec Home Mojo Rises, More Builders Make A Go Of Evenflow

What's working is getting spec on the ground and bolstering marketing and sales competencies to keep an evenflow construction management process going.

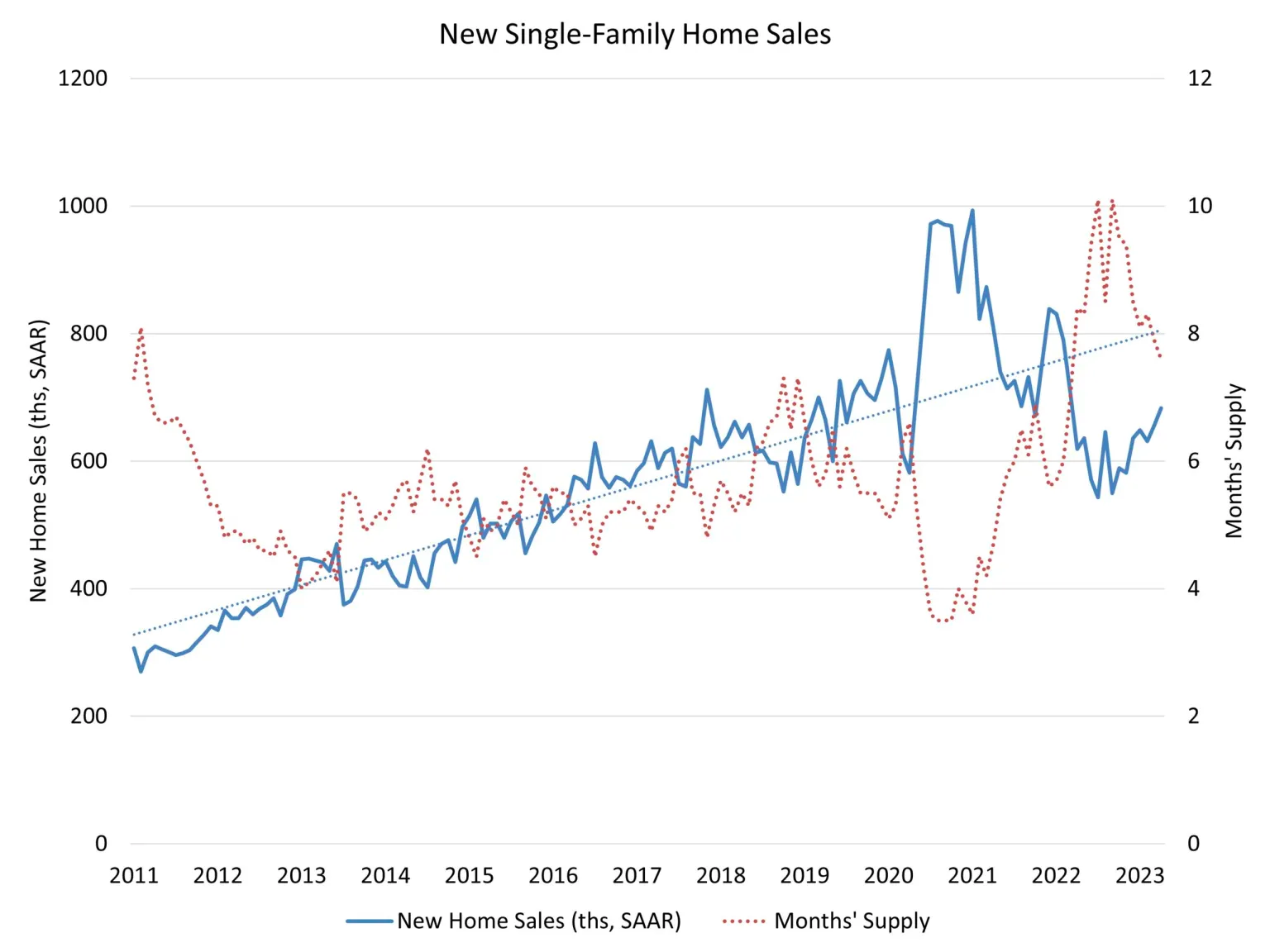

Another month, another strong sign of a little engine of new home sales recovery that could.

Another point on the scoreboard for believers; another goose egg for those who continue to sense headwinds, disruptions, and displacement haven't yet fully taken their toll, but will sooner or later.

Be that as it may, what's working is working on the new-home sales front. And, while historically-scarce listed-for-sale existing home inventory – especially in the lower price tiers of the price spectrum – have served as a super-catalyst, sweeping undeterred home shoppers into the new-home funnel, that doesn't entirely explain what's working, and where both the risk and opportunity lie for homebuilders looking to jump on the extraordinary and unusual imbalance of buyer options.

We'll get to that in just a second. First, the latest data print as Robert Dietz, chief economist of the National Association of Home Builders, contextualizes it:

Stabilizing mortgage rates and a lack of resale inventory provided a boost for new home sales in April, even as builders continue to wrestle with rising costs stemming from shortages of transformers and other building materials and a persistent lack of construction workers.

Sales of newly built, single-family homes in April increased 4.1% to a 683,000 seasonally adjusted annual rate from a downwardly revised reading in March, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. This is the highest level since March 2022. However, sales are down in 2023 thus far by 9.7%. Sales may weaken in the months ahead given the rise for interest rates at the end of May."

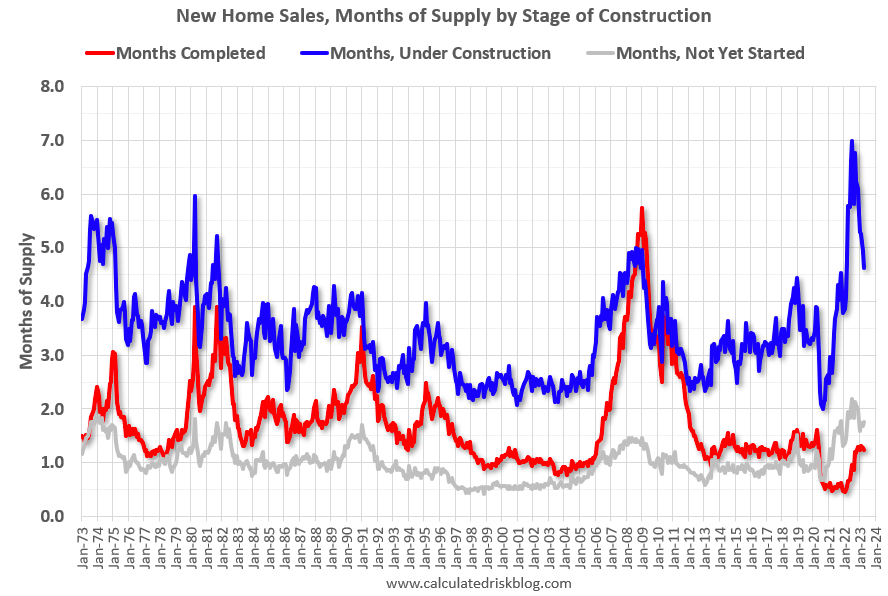

Digging deeper in below the broad strokes, Calculated Risk's Bill McBride captures a set of revealing macro new home construction dynamics, helping to illustrate where the action is and isn't from a sector-wide "even-flow" standpoint of new-starts tied to new-home closings:

Here's the Calculated Risk chart:

There are 1.23 months of completed supply (red line). This is close to the normal level.

The inventory of new homes under construction is at 4.6 months (blue line). This has been declining but is still an unusually large number of homes under construction due to supply chain constraints.

And about 1.8 months of potential inventory have not been started (grey line) - about double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

Going back to the "what's working" point, McBride's observation about the "blue line" of new homes under construction declining calls out the relative success builders are having in selling through their under-construction inventory.

So, here's the other side of the coin – apart from very scarce resale inventory – as to what's working for home builders:

Amid volatility and a backdrop of rising mortgage interest rates, homebuilders learned in 2022 that ready-to-own homes – or ones with a final construction completion date within 30 to 45 days – gained a dramatic advantage among home buyers.

- These homes took the guesswork out of interest rate locks, and gave buyers confidence in a solid settlement date for financial planning and securing a mortgage

- In a tricky economic environment, a completed or near-complete home also removes mental friction, particularly from first-time buyers. They get to see the property of their dreams in real life and real-time, removing any likelihood of an order cancellation.

- Further, as existing home stock has remained scarce, new-construction spec homes have emerged at attainable price points and monthly payments levels, effectively filling a void created by the lack of availability of lower-priced resales.

- What is more, even as supply chain chokeholds finally begin to relax, evenflow production of spec inventory homes allows for operational controls and efficiencies that make for better margins and faster inventory turns.

- Lastly, a stock of spec homes also gives a builder optionality in light of on-going interest among institutional investor buyers seeking new single-family rental properties.

For all these reasons, large, well-capitalized homebuilders have mostly dialed in an increase of spec home starts to keep pace with buyers’ mindsets. Smaller homebuilding firms need this kind of optionality as well, especially given a better-than-expected Spring 2023 selling season, with absorption rates and pricing exceeding plan.

At the same time, fallout from the failure this Spring of three very large regional banks has caused many of the U.S. regional and local banks to pull-back on commercial lending and credits as regulators comb their deposit and loan reserve risks for potential trouble. This has put stress on local and regional privately held homebuilders in their efforts to secure project financing and acquisition, development, and construction loans that would allow them to add fuel to feed into their production machines.

Alternatives to traditional lenders, private equity, friends and family, country club, and family office money have been around for decades, and homebuilders have structured win-win opportunities with these channels through multiple cycles. The tech and data era has also spawned a number of entrants that have similar private capital structures and terms to other non-bank debt and equity facilities, with some added advantages of integrating directly into a homebuilder's build-cycle operational cadences – seeing to it that payables, receivables, and cash management can occur smoothly while the bandwidth and focus of the firm is on the construction itself as well as customer focus, new land opportunities, and other core priorities.

SNAP.BUILD is one such alternative to more traditional bank and private equity channels, particularly suited to bridge lending and capital services for local and regional private homebuilding companies that subsist in real-time cash management fashion.

We have a builder in the Metro-Atlanta market that we established a relationship with in 2019," says Brad David, executive VP of development and construction at Snap.Build. "This particular builder builds a mix of for sale and build-to-rent product. Through the use of our lending platform and the built-in efficiencies that it provides, they have been able to scale their business from single-digit closings in 2019 to 247 units in 2022. They are projecting over 400 closed units in 2023."

David notes that because Snap.Build is a private lender and does not have the same restrictions as traditional lenders in the homebuilding space – i.e. spec to pre-sale ratios – the solution can allow builders to build more units quickly and efficiently. As it turns out, this doesn't solely depend on having more ready access to capital, but also the operational capability of engaging trade crews on a "preferred builder" basis necessary for velocity on the start-to-completion build-cycle.

Our ability to be nimble and match the speed of our builders through our fully automated draw management platform gives builders of all sizes a competitive advantage on the spec starts front, David says. He explains: "In a traditional residential construction loan, one of the real hindrances to growth is an antiquated processes around draw management and deploying capital. Our platform allows builders to build as fast as they want, because we have alleviated the cumbersome draw request process. We pay vendors, subs, and suppliers on behalf of our builders on a weekly basis. Builders are able to negotiate more competitive terms with vendors and suppliers as well as attract the best sub-contractors because of the ability to pay faster and more consistently than their competitors."

Net, net, in light of the tilted playing field favoring new home construction, and a decidedly stronger interest among would-be homebuyers for a ready-to-own, or firm-closing-date home, what's working is getting spec on the ground and bolstering the marketing and sales competencies to keep an even-flow management process going.

Despite the current volatility in the market, builders can’t sell from an empty wagon as the saying goes," says Snap.Build's Brad David. "Builders have to have inventory on the ground ready to sell and be occupied. We understand that need and understand the speculative environment. We give our builders the runway that they need to produce much-needed inventory and grow their businesses."

Snap.Build provides builders with funding for residential construction projects. Snap.Build offers a non-recourse loan structure, competitive rates, and efficient loan closing.

MORE IN Capital

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.

Engineering The Path To Better, Faster Growth Amid 2025's Stall

Local resistance, rising fees, and long entitlement windows are locking up growth. This analysis shows how smart financial planning unlocks new possibilities.

Lennar’s Q2 Results Redefine Homebuilding Power Play

As housing demand softens and builder confidence fades, Lennar’s asset-light strategy, pricing flexibility, and volume-first execution offer a roadmap—and a warning—for the rest of the industry.