Leadership

A Semi-Custom Production Hybrid Fit For Bumpier Times

In Houston-based Partners In Building's acquisition of Dallas-based custom-builder Paul Taylor Homes, we explore the nimble, operations-focus capability at scaling personalization for a value-driven buyer.

Partners In Building, the Houston-based brainchild former Ryland Homes and John Laing Homes executive Jim Lemming booted up in 1986, was an oddity from the start for someone with a production homebuilder's pedigree.

The News

Partners In Building, it was reported in Ralph Bivens' RealtyNewsReport, acquired Dallas-based custom homebuilding venture Paul Taylor Homes.

Here's details on the deal from the article:

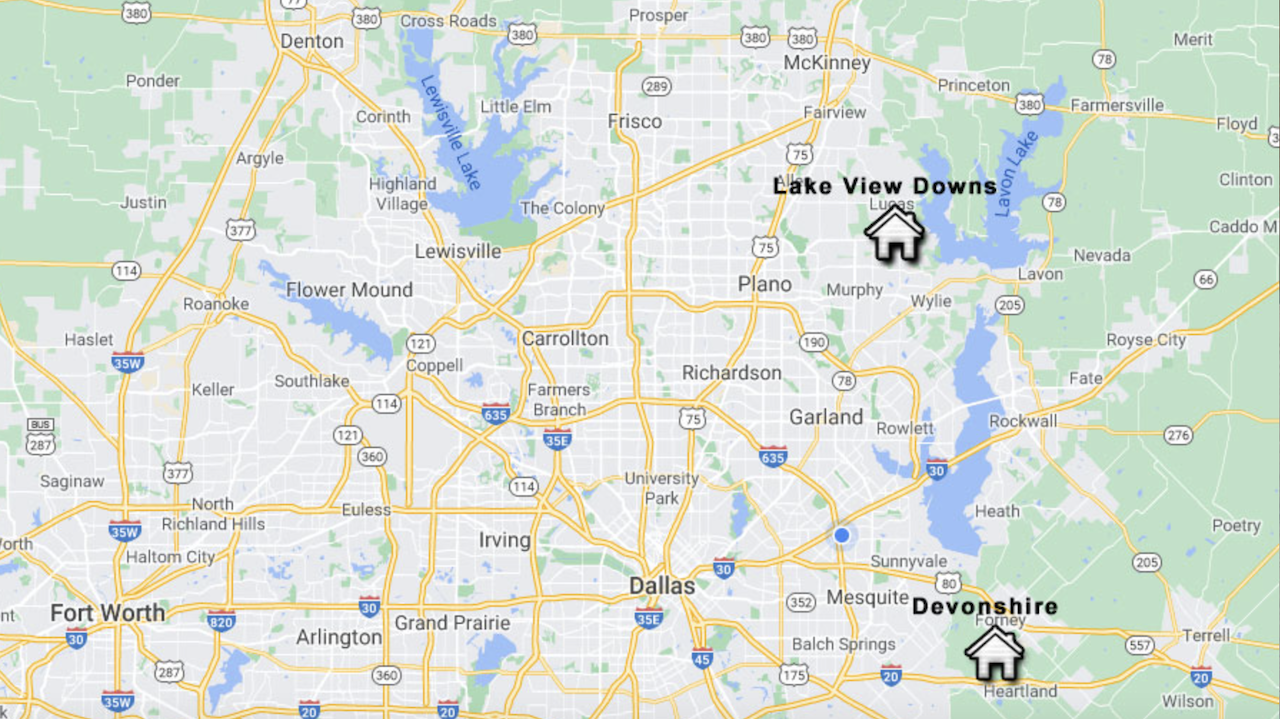

The acquisition of Paul Taylor Homes includes approximately 80 homes under contract and in various stages of construction, with an average sales price of approximately $800,000 each. The deal also includes more than 120 homesites, three model homes, the company’s portfolio of home designs, and its corporate office lease at 17950 Preston Rd. The combined company will operate as Partners In Building.

The current employees of Paul Taylor Homes, about 16 in total, have been offered positions at Partners In Building.

“The extremely talented and dedicated team at Paul Taylor Homes is one of its greatest assets, with many employees who have been with the company for over a decade,” said Chris Lemming, who has been named Dallas-Fort Worth Division President of Partners In Building. “We are very happy to continue working with this great team, which will provide us with an excellent platform to build on the success and reputation Paul Taylor Homes has established over the past four decades.”

The PIB platform, which builds and sells about 250 homes a year in Houston and Nashville, TN, bridging a select homebuyer "partner's" wish-list of home features and functionality with his or her pocketbook, stands out even more so now, as a mere coin toss could turn the character of demand for new homes from price-focused to value-driven.

This production-semi-custom hybrid, popularized in Texas with a Modern Hill Country elevation and interior floorplan styling that brought simpler elegant lines and a warmed mix of exterior cladding materials, allowed Partners In Building to attain a luxury experience they aspired to within reach of budgets below the custom home barriers to entry.

Here, we wrote:

With average selling prices of about three-quarters of a million dollars, the Partners in Building were looking to capture what aspirational buyers sought in homes that were selling at a higher price point, in the $1.2 million to $1.4 million custom home.

"We were looking to find out what buyers see particularly in those higher-end homes and bring it into our offerings," Lemming tells us. "This is how, in working with Mike Woodley (Woodley Architectural Group), we struck upon the idea of Hill Country Modern or Modern Hill Country. Woodley describes it as an agrarian style, warm but contemporary."

Lemming says the use of stone, wood, glass and metal in felicitous combination, "clean lines but not a stark modernist look," met with an immediate favorable result.

For PIB, Dallas – the nation's No. 1 market in housing starts – stands as a market the company expects one-day could become the firms leading metro for sales volume, and an opportunity to further scale its semi-custom-production platform.

What It Means for Homebuilders

An ability to bring nimbleness and capability to bear on a semi-customized array of floorplans and finishes – spanning in a home purchaser's experience, the personalization he or she aspires to with the actual home they can attain – and, further, the canny value chain management among trades and suppliers to deliver on start-to-completion schedules may be a business model whose moment has come.

Also – as is becoming clear from the growth of Orange County, CA-based Thomas James Homes, another fast-scaling production semi-custom hybrid whose focus is inner-ring residential tear-down and infill on-your-lot projects, technology, zoning and building code data, and an operational template with reliably-low variability – being able to fly below the radar of custom home extravagance but above the fray and risk of new path-of-growth entry-level oriented high-volume development and building has emerged as a product, location, and pricing position fit to weather turbulence ahead.

Are Partners In Building and Thomas James Homes — which last year introduced Colorado to its active markets model, now serving zip codes in Southern and Northern California and the Pacific Northwest, as well as Denver, and is now gearing up a Phoenix-area launch – on to something, especially as market turbulence?

You bet. As Thomas James Homes' co-founder and ceo Tommy Beadel told us:

Within the 775-plus zip codes our operations serve, there are 3.82 million homes 80-years-old or older," Beadel told us when we spoke mid-year last year. "That's unlocking the value of land that, with redevelopment, becomes more valuable."

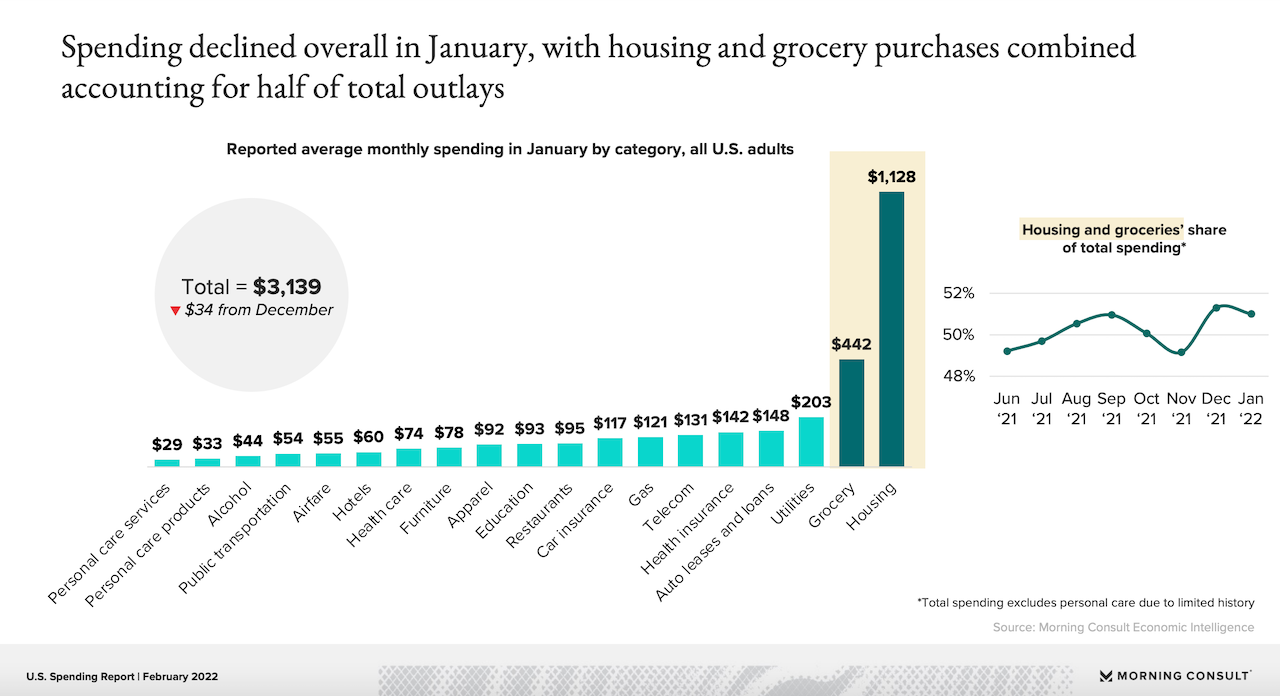

As a tide of more price-sensitive buyers gets buffeted and blasted downstream of both input cost inflation among builders and the impact on mortgage interest rates of the Federal Reserve's balance sheet reduction and its plans to tighten its own reins on access to easy money, discretionary buyers whose wherewithal can withstand the price shocks and borrowing impacts figure to be the focus of a product mix shift ahead.

Not only are value-focused homebuyers able to tap into greater financial flexibility and depth, they're also apt to bear with longer start-to-completion construction cycles, since they view their new home purchase the sum of their "bucket list" of preferences in features and functionality.

Why It Matters

While the fundamental generational cohort factors that drove a strong mix-shift emphasis toward the first-time buying, entry-level pricing younger adult household are still in play, the impact of inflation, the prospect of interest rate rises, a slow structural shift in work-of-the-future livelihoods and earnings, and now, geopolitical violence and disruption changes the outlook.

This new outlook means builders and their partners need to ready themselves for a new path of resilience, to steel their business models and investments for big bumps ahead. That means a focus on value over price in their offerings.

Join the conversation

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.