Marketing & Sales

Process Of Elimination: How The Next Fed Rate Hike May Hit Buyers

Fed hikes and higher borrowing costs siphon both consumer households and commercial investor-lenders from the market. Within the past 2 weeks, underwriting for 1x1 existing home acquisitions for SFR went dark.

Single-family-rental "1x1" aggregators large and small – a force-factor in driving up house prices even before the pandemic, and at a historically fast-rate in the past 24 months – have seen spigots of capital close off in the past month or so as investors and lenders grow wary of intensifying risk of debt costs eclipsing present and future yields on the properties.

Briefly, here's what's happening.

From a high-level, the arithmetic consequence of the sudden about-face from easy money to its opposite – eliminating buyers based on lending criteria – is playing out in two parallel plotlines, one consumer households, and the other commercial residential property investors.

The ride-along with the mathematical elimination is its linkage to a psychological – confidence, sentiment, Animal Spirits – abstention effect not yet fully baked into the observations of the big players in the market.

When it comes to underwriting 1x1 resale home purchases – the home-buys that make up an SFR portfolio, the problem that arose between first and second quarter 2022 is this. While existing home prices continue to remain stratospherically high – at plateauing peak, but showing first signs of a fall – the recent ratcheting up of borrowing costs caused as the Federal Reserve has set on a front-loaded upward reset on its Funds rate has turned pro formas in the SFR trade upside down.

The cost of your debt now exceeds what you can generate in terms of profitable rental cash-flow on these resale acquisitions at this point," a reliable, senior-level residential real estate strategist tells us. "New capital flows for resale 1x1 acquisitions are essentially dead in the water."

Effectively, this takes out an up-to-now ravenous class of existing home buyers in many of the U.S.'s hottest markets. Already, a noteworthy drop in competitive bidding for properties has shown up in more and more markets, a sign that softening in prices will follow since fewer bidders will gain leverage.

Per Redfin last week:

Nationwide, 49.9% of home offers written by Redfin agents faced competition on a seasonally adjusted basis in June. That’s the lowest share since May 2020 and the first time the bidding-war rate has been below 50% since that same month, when the housing market was at a near standstill due to the onset of the coronavirus pandemic. June’s bidding-war rate compares with a revised rate of 65% one year earlier and 57.3% one month earlier, and marks the fifth-straight monthly decline.

With 1x1 resale acquisitions going missing-in-action in the markets they were concentrated in, the upshot will mean one fewer bidder/buyers for every four active for-sale existing homes hitting the market.

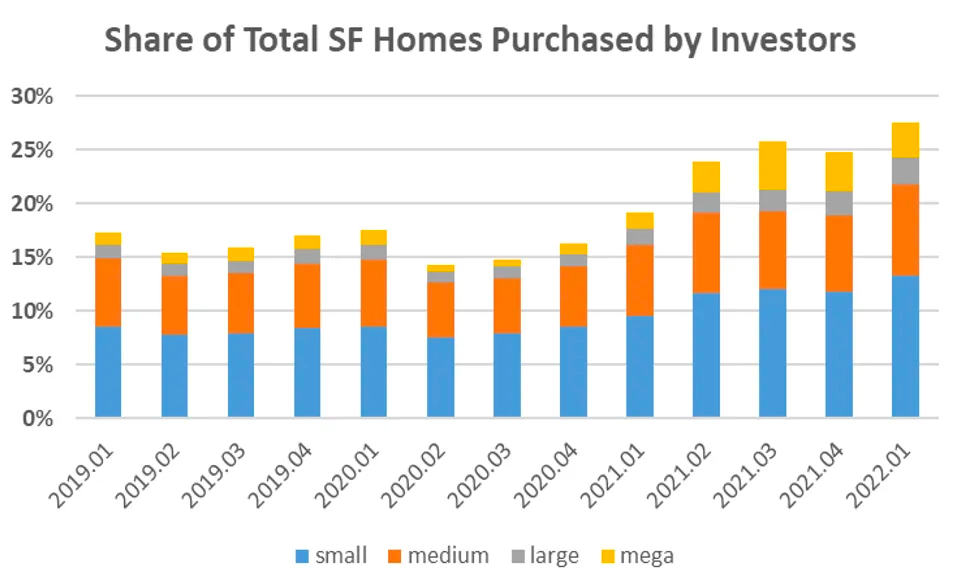

In its quarterly report on “investor” home buying activity, CoreLogic reported that SF homes purchased by “investors – defined as entities (individual or corporate) who retained at least three properties simultaneously within the last 10 years – increased to a record high of 27.6% in the first quarter of 2022, up from 24.8% in the fourth quarter of 2021 and 19.2% from the first quarter of 2021. – Calculated Risk

Here's the upshot of this sudden dynamics shift in many of residential real estate's most active markets for homebuilders and their partners.

If home resale price and pace get disrupted, it means as well that there are overall fewer bidders as well for new homes, since an up-until-now super-constraint on active for-sale existing homes cools down.

All eyes now focus on how well – at what price point, in what time-frames, and with what amount of incentives – builders can continue to convert pronounced interest into hard sales.

We called "owner-occupiers" who hunted for a new home to buy an "endangered species" last November. For months they had to line up – even fight – for the privilege of purchasing the most expensive consumer durable of a lifetime. They got priced out, crowded out, and squeezed out, and had to keep at it if they wanted to succeed.

Now, it's them, the primary-residence homebuyers – the ones with the motivation, wherewithal, and gumption to close in the weeks and months ahead, and the ones who'll value their property as a place to live – who'll set the floor and restore certainty to a market grasping for both.

At least until such time as the Federal Reserve relents on its plans to raise its Funds rate anchor and offload mortgage backed securities, a skinnier, value-focused and/or lifestage-driven demand

Until that stream of determined buyers – and its make-up of discretionary vs. life-stage or financial-reasons-oriented household participants sort out -- declares itself as undeterred in a price environment that may well feature a "falling knife" cascade of lower prices begetting lower prices, a demand baseline and the certainty and clarity it would support may be elusive.

It's primary-residence buyers homebuilders have placed a strong stock of confidence in to weather financial and economic turbulence in the months ahead. Last week, with Q3 earnings to report, Tri Pointe Homes executives described a primary homebuyer as resolute but needing a gentle hand of support through a choppier market environment:

Guiding customers to the finish line is core to the company’s confidence. Demand remains strong but the buy cycle is “elongated.” As a result, management described themselves as transforming “from order takers to financial therapists.” Tri Pointe’s customers want to buy, but the rapid run-up in mortgage rates has left them in shock. Constant talk of a recession layers on more hesitancy. These buyers have become market timers given worries about the volatility in the housing market. TPI as the confident therapist has to reassure and reveal possibilities (similar to the work ahead for realtors working in this tough market). – Seeking Alpha, Ahan Analytics

In the meantime, uncertainty and a lack of clarity are peeling off "non primary" market participants whose investments were more transactional in nature, where either buying-and-flipping or buying-and-converting to a rental cash-flow producing property made for a sure-bet win on both valuations and/or a pro forma

Multiple bids on residential real estate property assets, from one existing home to 5,000 newly built ones, became a whole new ballgame in May of 2020.

Somewhere between the start of the first quarter and the end of the second quarter of 2022, that ballgame – complete with asterisks to note all the ways it was exceptional from prior contests, and very likely future ones – unceremoniously ended.

This week, as the Federal Reserve's FOMC – the governing body that sets the anchor levels off of which mortgage rates reset – will continue to do a number on the total universe of householders who can buy.

As Tri Pointe's Doug Bauer's remarks from last Thursday's earnings call intimate, it's going to have to homebuilders' teams working their magic on those who continue to be able to buy to cause them to want to do it sooner than later.

Join the conversation

MORE IN Marketing & Sales

Why Homebuilders Should Stop Ignoring the Move-In Moment

Buyers don’t just want a new home — they want a seamless handoff into it. Concierge services may be the zero-cost amenity that becomes a new industry standard.

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.