Capital

Price-Fixated: How To Make Now A Leadership Teachable Moment

All eyes are on costs, supply constraint, and the strain between producers and their vendors. That's a risk; here's an alternative view of the moment's challenge.

Supply-chain lumber and building materials shock, lot-pipeline stress, labor-capacity constraint, regulatory burden, and an overriding sense that the deluge of consumer demand is – at its core – an overturned hour-glass, whose sand-flow has been accelerated by Fed interest-rate machination ... it all funnels down to a single obsession:

Price.

Here, CoreLogic principal economist Molly Boesel characterizes the quantitative benchmark in a classic use-case example of headline risk:

Home Price Gains Were at a 15-Year High in March

Boesel's high-level data recap oozes a flat-affect as she speaks to a historical demand surge and an increasingly hysterical response among producers responding to it.

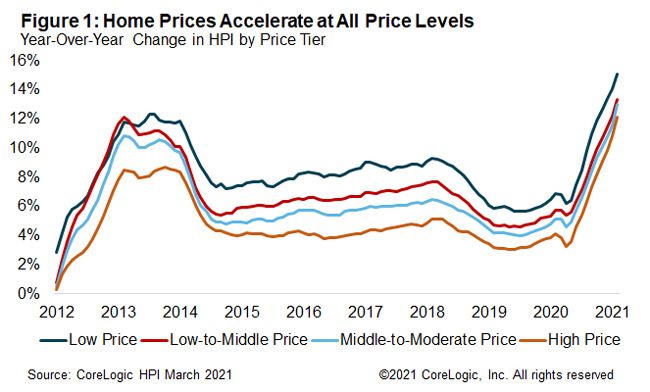

National home prices increased 11.3% year over year in March 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The March 2021 HPI gain was up from the March 2020 gain of 4.6% and was the highest year-over-year gain since March 2006. Low mortgage rates and low for-sale inventory drove the increase in home prices. A pick-up in construction and an increase in for-sale listings as more homeowners get vaccinated may help moderate surging home price growth.

A sudden mountain-melt of consumer recovery now converges with latter-pandemic motivated moves, interest-rate opportunity, fear-of-missing-out, and you-only-live-once Animal Spirits.

The leader's dilemma is this: Obsess about price, or what?

The moment – not unlike the unwritten playbook leaders needed to draw on early last Spring as the first spasms of crisis and panic shivered through the real estate and construction landscape when Covid arrived – calls for epic leadership.

- Presence – eat, sleep, breathe, and above all, listen and learn from the team members and associates with boots on the ground.

- Reframe effectiveness and performance benchmarks to transform what success looks, feels, and becomes when powerlessness and agency go through turbulence, lack of visibility, and uncertainty.

- It's never about "us" – except when "us" includes "them" to the core. Trust is the ultimate capital, and needs to move up the hierarchy of focus in more minds.

Where does that leave price fixation, bubble talk, complaints about input costs?

You tell us.