Capital

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.

In a move that crystallizes both a structural and situational pivot in the residential development economy, Five Point Holdings’ acquisition of a controlling stake in Hearthstone signals more than just a major real estate investment merger.

It serves as another signpost – like Lennar's spinoff of Millrose earlier this year – pointing to where homebuilding strategy is headed — toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.

Announced June 20, Five Point will own 75% of a newly formed entity called Hearthstone Residential Holdings, LLC, into which substantially all Hearthstone’s assets and operations will transfer. Hearthstone founder and CEO Mark Porath and affiliated entities will retain the remaining 25% and continue to lead the management team.

Here's a provided statement from Mark Porath, Founder and Chief Executive Officer of Hearthstone:

Partnering with Five Point is a strategic step forward for Hearthstone. This venture will allow us to scale our platform and broaden our impact while aligning with an industry leader that shares our long-term vision. We’re entering this partnership to leverage the respective strengths of both companies, and my continued ownership stake reflects my confidence in the future of the business. Our builder clients will experience continuity in service—with the added advantage of expanded resources, enhanced capital solutions, and increased capacity to support their growth strategies."

The deal — valued at $56.25 million, according to SEC filings — comes as the residential development and construction sector is fundamentally reorganizing. It's a shift away from land-heavy, capital-intensive, risk-laden development models and toward more fluid structures. These structures prioritize cash flow, return on invested capital, and off-balance-sheet land control, placing a premium on what builders do best: build, sell, and serve customers.

The Why Behind the Deal

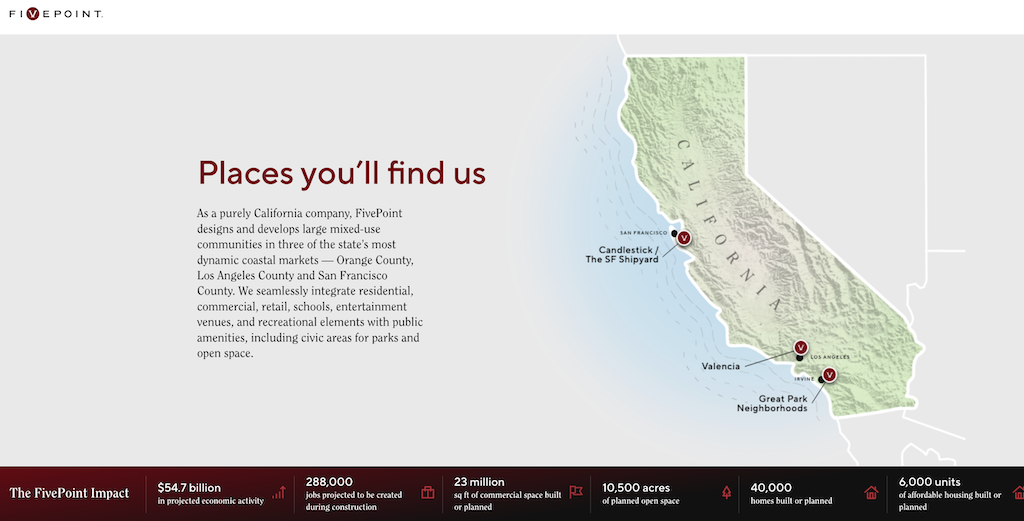

Hearthstone has operated as a capital partner to public and private builders for three decades, managing over $2.6 billion in assets and underwriting more than 173,000 homes and lots through lot option programs, joint ventures, and advisory services. Five Point, meanwhile, controls tens of thousands of entitled lots in three of California’s highest-barrier-to-entry markets: Irvine, Los Angeles, and San Francisco.

The rationale for the joint venture is rooted in the moment: builders and capital partners alike are navigating a protracted VUCA landscape—volatility, uncertainty, complexity, and ambiguity. High interest rates, construction cost inflation, and insurance risk convergence have made the old ways of tying up land capital for five, ten, or fifteen years untenable.

Enter the land bank.

In this model, land is held or acquired by a capital partner—such as Hearthstone or Millrose (Lennar’s spin-off land bank)—who then offers builders finished lots on an option basis. This allows the builder to conserve cash, keep land risk off the balance sheet, and focus their enterprise on vertical operations and revenue recognition.

The acquisition will create new revenue streams for Five Point while connecting us to a broader network of capital providers and strengthening our relationships with builder partners,” Five Point CEO Dan Hedigan says in the press statement. “Together, we’re positioned to scale Hearthstone’s land banking business, while further supporting Five Point’s asset-light growth strategy.”

Why It Matters Now

There’s no mistaking the environment homebuilders now face.

- Finished lot availability remains bottlenecked by slow-moving entitlement and local resistance.

- Land carrying costs are prohibitively high due to elevated interest rates and capital scarcity.

- Homebuyers are pinched by affordability, creating little margin for mispriced products or speculative building.

The result? Builders need speed, precision, and predictability. And that’s only possible if they have access to land on terms that de-risk the development cycle.

Five Point’s acquisition accelerates a new balance of power: developers and capital partners integrating their capabilities to supply land and capital on terms builders can live with. Instead of fighting market cycles or betting on future appreciation, this model is about delivering lots that serve today’s product needs, at today’s pace, and under today’s capital constraints.

It also positions Five Point as more than a developer of some of California's most strategically located tracts of land. Ironically, Five Point's history and its spin-off out of Lennar last decade presage the current shift to asset-light, balance-sheet-light strategies at an earlier stage. From SEC materials in 2017.

In 2009, our company was formed as a limited liability company (under the name “Newhall Holding Company, LLC”) to acquire ownership of Newhall Land & Farming Company. Our management company was originally formed in 2009 as a joint venture between our Chairman and Chief Executive Officer, Emile Haddad, and Lennar Corporation to manage the properties owned by Newhall Land & Farming Company and to pursue similar development opportunities. Our management team was an integral part of the team in charge of developing and implementing land strategies on the west coast for Lennar prior to the formation of our management company. Key members of our management team have led the acquisition, entitlement, planning and development of all three of our communities since their inception. Our management team also has long-standing relationships with our principal equityholders, including Lennar."

With Hearthstone under its umbrella, Five Point becomes a high-leverage capital allocator with immediate reach into the pipelines of dozens of homebuilding enterprises—public and private—looking to land-bank or JV their way through turbulence. Expect similar alliances from organizations like Forestar.

From Millrose to Hearthstone, Landbanks Take Center Stage

Lennar’s Millrose spin-off earlier this year was an early indicator of this strategic pivot. The publicly traded builder—known for leading industry operational shifts—uses Millrose not only to de-risk its own lot pipeline but also to offer lot inventory to builders outside the Lennar organization.

Millrose’s purpose mirrors Hearthstone’s under Five Point: provide off-balance-sheet access to lots that are ready (or nearly ready) for vertical construction, while preserving optionality and aligning payment schedules to the moment of need.

These arrangements give builders room to breathe, manage debt ratios, and preserve working capital while giving landholders recurring income and capital gain upside.

For Five Point, the deal allows its massive entitled land base to evolve into a revenue-generating, capital-flowing engine, serving not just the builders within its planned communities, but the broader industry in need of just-in-time lots.

For Hearthstone, the alliance injects new firepower and institutional scale into its national platform, allowing it to serve more builders in more markets while retaining the same disciplined execution that’s made it a go-to capital partner for over 30 years.

What It Signals for Builder Strategy

For homebuilding enterprise leaders, the message is clear: the best capital strategy is no longer about owning the most land. It’s about having reliable, transparent, flexible access to the right land, at the right time, with the right customer and product strategy in place.

This means homebuilding operational excellence is no longer tied to how much land you hold—it’s about how well you execute across every touchpoint of the vertical business: designing the right product, engineering cost-efficient construction processes, selling with speed and margin, and creating delighted customers.

The companies best positioned for this future are those building tightly integrated partnerships across the land, capital, and operational stack.

A Final Word: Scale, Trust, and Precision

This Five Point–Hearthstone move has implications far beyond California.

It’s a bellwether of how the industry will increasingly organize: specialist platforms teaming up to concentrate on what they do best. For Five Point, it’s community-scale entitlement and infrastructure delivery. For Hearthstone, it’s capital deployment, risk management, and builder relationships. Together, they present a fully equipped platform for the next generation of land-light builders who need everything but the land on their balance sheet.

For builders—especially those without massive balance sheets or entitlement shops—this model represents freedom from carrying land risk, overextending capital, and chasing lot supply in all directions. It’s a future defined not by speculation but by precision, trust, and speed.

As the market continues to fluctuate and capital becomes even more selective, partnerships like Five Point–Hearthstone will set the template for how tomorrow’s homes get built: with greater clarity, lower risk, and a sharper focus on what matters.

MORE IN Capital

Toll Brothers Exits Apartments, Sharpens Playing To Strengths

The $347 million sale of Toll Brothers’ Apartment Living platform to Kennedy Wilson transfers $5.2 billion in assets under management and a national development team. For Toll, it’s less about retreat than an embrace of its cultural pedigree of focus, discipline, and luxury market leadership.

Stanley Martin Grows Southeast Footprint With Windsor Homes

The North Carolina builder brings 2,100 lots and 270 homes into Stanley Martin’s fold, extending its reach across the Triad and coastal markets. For Daiwa House, the deal is another step in building regional “mini Daiwa Houses” as durable U.S. platforms.

Impact Fees And The Missing Math That Puts Deals At Risk

Builders and developers are recalibrating every line item in the deal stack—but often overlook the 2nd-largest cost: jurisdictional fees. Carter Froelich unpacks how better modeling and collaboration on impact fees, hook-ups, and builder credits can expand land residual value.