Capital

Housing's Tech-Powered Affordability Solution Hidden In Plain Sight

Scores of new pioneering companies with talented and energized founders have started-up in the past dozen or so years in the home building technology space. They promise to fill a void -- at housing affordability's nexus of apples and oranges. One already does that: Clayton.

Housing affordability makes for classic apples and oranges mixups in conversation and in solutions-seeking.

Through a lens of who is buying or renting, the business of building and developing affordably means one thing.

Through a lens of an individual who has trouble paying, the affordability of housing's present and future stock has an altogether different meaning.

A timely and clear example of this apples and oranges challenge shows up in Calculated Risk analyst and host Bill McBride's "Part 2: Current State of the Housing Market; Overview for mid-April."

A year ago, the payment on a $500,000 house, with a 20% down payment and 5.41% 30-year mortgage rates, would be around $2,249 for principal and interest. The monthly payment for the same house, with house prices up 2% YoY and mortgage rates at 6.49%, would be $2,576 - an increase of 15%.

But if we compare to two years ago, there is huge difference in monthly payments. In May 2021, the payment on a $500,000 house, with a 20% down payment and 3.09% 30-year mortgage rates, would be around $1,706 for principal and interest. The monthly payment for the same house, with house prices up 22.5% over two years and mortgage rates at 6.49%, would be $3,095 - an increase of 81%." – Calculated Risk

Now, McBride's focus here is primarily on these data points as drivers of housing prices and valuations against a backdrop of "locked-in" mortgage holders, and therefore, indefinitely constrained supply.

What the analysis also does, however, is at least partially demarcate the wherewithal dividing line that filters "apples" from "oranges" in the housing affordability conversation.

"Apples" affordability – in this context -- includes those with wherewithal to make monthly payments of $3,095, "an increase of 81%" in a two-year period.

"Oranges" housing affordability – in the same context – includes many millions of households not even remotely involved in that housing market "demand" universe because a $3,000 monthly payment, rent or own, is an absurdity.

The apples and oranges challenge in housing affordability is also an opportunity.

If you take all of those with the wherewithal to make down payments and monthly payments and you add to that number many millions more working households who currently find themselves on ground-up market-rate housing's cutting room floor, the business, its impact on both local and larger regional economies, and would be different.

Scores of new companies, pioneering companies, extraordinarily talented and energized companies have started-up in the past dozen or so years in the home building technology space, promising to fill that void, to work at housing affordability's nexus of apples and oranges.

Many of them are in early, or medium-phase stages of their business model and operational development. In today's capital investment risk environment, many of them are in a race with time because they're up against a common predicament: they've got to scale to become profitable; and if they don't become profitable, they're runway to scale will be cut short.

One company – a strapping 67-year-old producer of homes – already stands at that nexus, where apples and oranges belong in the same consideration set: It is a Berkshire Hathaway company called Clayton Homes, whose ceo is 59-year-old Kevin Clayton.

In an industry recognition piece in 2019, we wrote:

It would be [Berkshire Hathaway chairman Warren] Buffett’s dream scenario for a family to pull up to a driveway in a car insured by Geico, to a home sold by a HomeServices of America real estate agent, financed through our mortgage units, built by Clayton with materials from Johns Manville and MiTek and Lubrizol and others, a Benjamin Moore and Acme Brick exterior, and Shaw carpeting indoors,” says Clayton, president and CEO of Clayton Homes. “That’s not a strategic master plan or any kind of imperative for us as Berkshire subsidiaries. Still, Mr. Buffett’s real passion is for America-produced products and services that families want and need over long periods of time.”

"Mr. Buffett is thinking 100 years out. He could not care less if a downturn happens in the next quarter or in the next five years.”

Clayton Homes has made a name for itself in a business at best, discounted, and more often dismissed, dissed, and derided for much of its six-decade history, as a builder and purveyor of double-wides and HUD code mobile homes on wheels and platforms. For much of Clayton’s six-decade history, its executive management has been intent on elevating both the manufactured housing business and its customers, raising safety, quality, durability, and energy performance of the homes, and the financial stature of people who buy them.

Now Clayton’s story has a new chapter. The narrative over the past few years could easily serve as a classic case study from the Buffett playbook on principles of company acquisition. In such a playbook, people, a future-proof operations model and trust figure more importantly in deals than physical plants, product outputs, or other hard assets, including home sites. Clayton’s everyday business philosophy, to “open doors to a better life,” presupposes a mind-meld of both vision and mission, where profit and opportunity cross paths with risk and challenge for other competitors in the field.

We also detailed some of the unique competences the Clayton organization has practiced and improved upon in its decades in the pivot point of housing affordability and affordable housing.

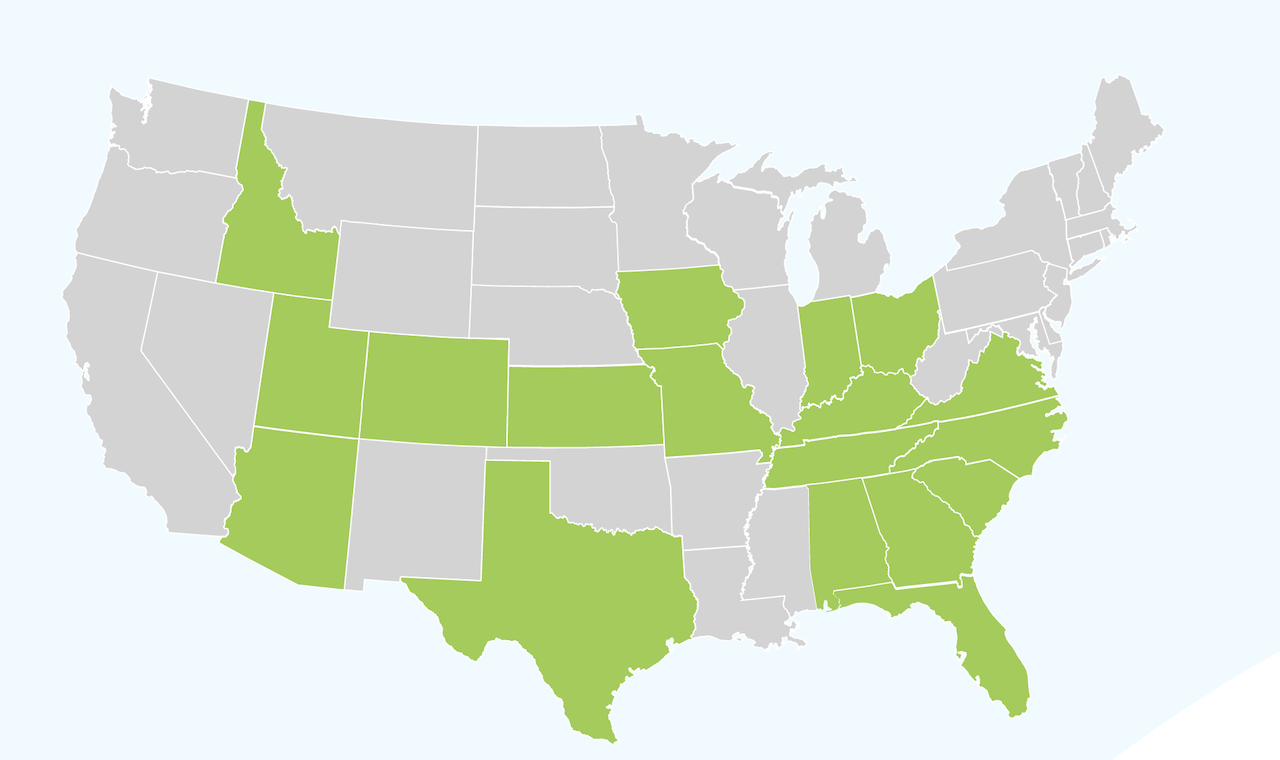

A national infrastructure of 40-or-so manufacturing plants—whose output sells through 350 retail outlets—a distribution network of 1,200 independent retailers, and an owned mortgage finance company, as well as home insurance, includes a vertically integrated building supply chain that produces and distributes 42% of the rough and finished components and products that go into the company’s homes. Clayton is in about every segment of housing that one can imagine: modular homes, tiny homes, manufactured housing, college dormitories, military barracks, and apartments. And now, it also features a robust, top 20–ranked single-family, site-built portfolio with operations flanking its heartland-focused manufactured home businesses in what land sellers might classify as B, C, and D lot markets and submarkets.

This week, Clayton introduced its Clayton Home Building Group web platform, which for the first time gives a public face to the organization's full-stack approach to its values of attainable homeownership, innovation and social responsibility. Clayton Home Building Group built more than 62,000 single family residential homes in 2022, and is comprised of three interrelated business units, Clayton Manufacturing, Clayton Properties Group® and Clayton Supply®.

A statement from Keith Holdbrooks, Chief Executive Officer of Clayton Home Building Group:

We are thrilled to launch our first website dedicated to showcasing Clayton Home Building Group's extraordinary team members and the homes they build. With housing demand at an all-time high and affordability at an all-time low, our three unique but connected business units are dedicated to finding innovative ways to build high quality, attainable homes. ClaytonHomeBuildingGroup.com allows us to tell this story and connect with our customers and partners."

Thoroughly road-tested Clayton Home Building Group skillsets include:

- A thick national distribution network

- The biggest homebuyer customer knowledge base in the U.S.

- Advanced local, county, regional, and national policy and building code competency

- Deep vertical integration across building enclosures, interior finishes, and furnishings – and rich blended insight into offsite and site-built value creation

- Residential real estate and development

- A business culture steeped in customer and team member experience as business drivers.

We noted in our analysis in 2019:

While size and volume count, more disruptive forces are at work:

First, five years ago, who would have imagined that a player out of the manufactured home arena would have emerged among the industry’s site-build, high-volume builders?

Second, Clayton’s geographical empire consists primarily of heartland second- and third-tier housing markets that have been less prone to accelerated price increases over the past five years. They are also possibly more resistant to the market slowdown taking hold in home building’s expensive, mostly coastal markets.

Third, the lion’s share of Clayton’s customer-segmentation exposure is to entry-level buyers, where both the pent-up demand, current supply of inventory, and pace of absorptions continue to run strong, short, and hot.

Fourth, the Berkshire unit—one of a half-dozen Berkshire Hathaway companies positioned in the building supply, construction, and real estate technology space—has been working to close the construction technology gap between manufactured home building and higher-spec site-building to even better serve the $150,000-and-below market for homeownership.

Customer Experience Focus

Clayton gets it. A customer who can pay not much north of $600 or $700 a month—versus an average U.S. monthly mortgage payment of $1,030, and an average of $1,500 a month or more on a newly built home—is a tough customer. Still, that customer is practically the center of the universe in the minds of Clayton’s strategic leadership.

In nine out of 10 conversations, housing affordability and affordable housing are an apples and oranges comparison. For the people at Clayton, the magnitude of that challenge is a day-in-and-day-out opportunity.

MORE IN Capital

Timing Demand: Why Investors Choose To Buy Apartments Vs. Building

A construction slowdown today is setting up an undersupply tomorrow. Opportunistic, patient investors are already pivoting to seize future market growth catalysts.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.