Architecture

Homebuilding's Top 10 Trends In 2024: No. 3 Smaller Houses

Smaller home sizes don't – and can't – mean less value. It remains to be seen whether architects, engineers, and operators will succeed in creating iconic entry-level style homes whose form and function speak particularly to Millennial and Generation Z adult households.

The most crystal clear, unqualified praise I've recently heard about a homebuilder was a trusted advisor describing that operator's mastery at profitably serving its local market's entry-level, first-time buyers.

They practically out-LGI LGI," he said.

Enough said.

Favorably comparing a firm to the last 15 or so years' standard-setter in fusing a big bold strategy, a precisely-configured operational system, and a product offering into one of the industry's storybook successes can only mean the highest praise.

What's more, making that comparison becomes doubly meaningful in the last quarter of 2023, when this is the current state of things in housing.

- affordability at its worst since the 1980s

- mortgage interest rates high, and expected to remain higher-for-longer

- prices, well prices are like this:

'As we sit atop our year-ahead outlook perch, the evolution of the U.S. housing market has been Herculean or devastating depending on where you look,' [Morgan Stanley] strategists [Jay Bacow and James Egan] wrote. For one, home prices are yet again at a record high, up 6% since the end of last year, they said. At the same time, sales volume has fallen tremendously: Existing-home sales are down 21% in the first nine months of this year versus last year; new-home sales are up 5%, but total transaction volumes are at their lowest level in more than a decade, as of the first three quarters of this year, according to the note. Until then, affordability largely depends on mortgage rates.

What LGI and many other builder teams who conditioned their product, operational, and land investment systems to compete so capably for entry-level, first-time buyers was to reverse-engineer who they were and what they could produce – not on a price tag or ASP at all.

Rather, the starting place – the most compelling way to pull a family household from a rental into homeownership – was a monthly payment that stood alongside a month's rent and said, "good deal."

Many of the homebuilding companies that got their start during the Great Recession – not to mention ones that had weathered and thrived despite severe down cycles in the 1980s and 1990s – learned to execute as businesses that produced homes and created places exactly as LGI did. Their value-stream and build-cycle flowed back from monthly-payment wherewithal as the starting place and they built product lines, operational practices, and business systems that met the need, paid the bills, and made investors and lenders whole.

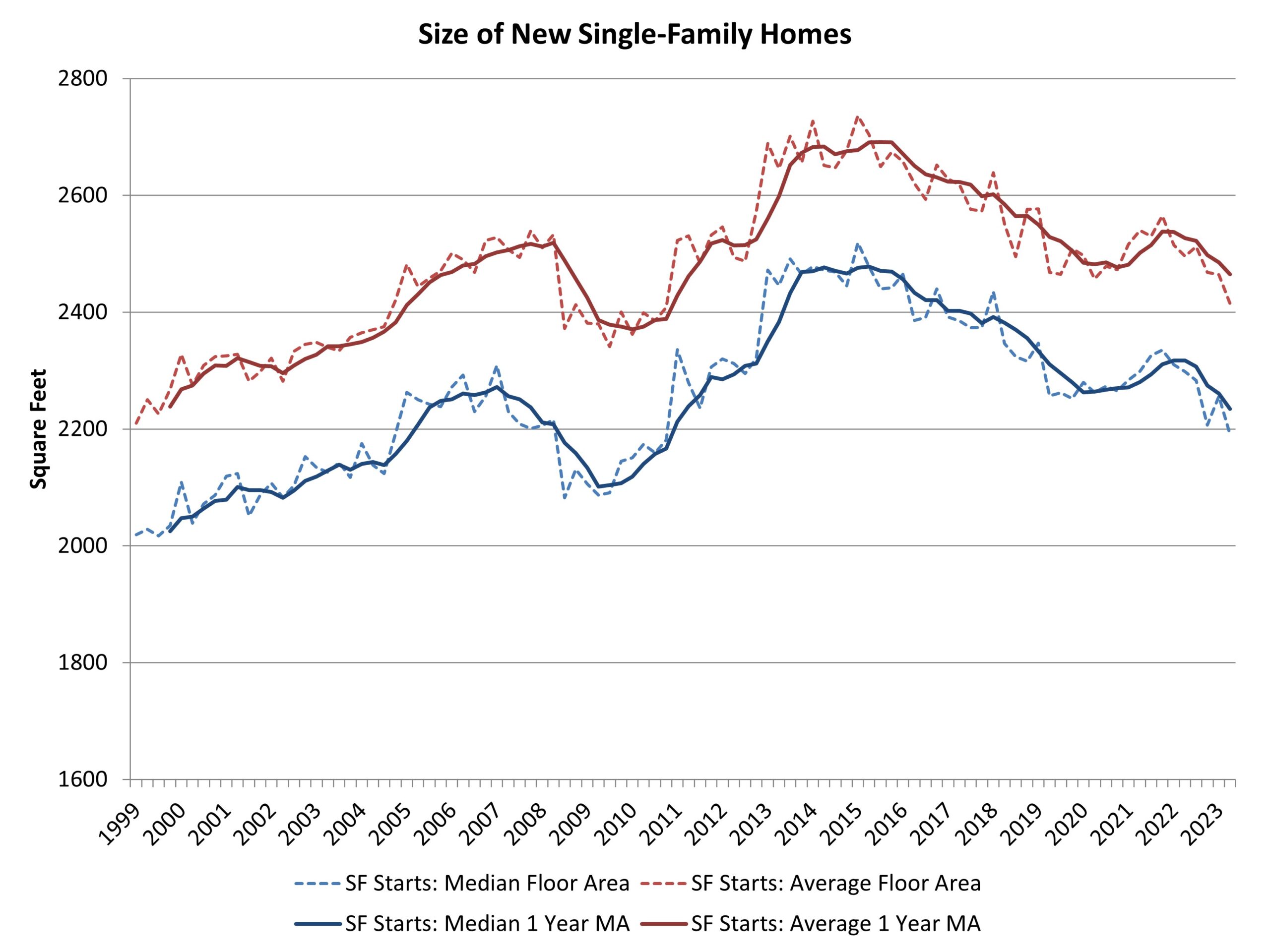

Now, in August, National Association of Home Builders chief economist Robert Dietz tapped into second quarter 2023 data from the Census Quarterly Starts and Completions by Purpose and Design, reaching this set of conclusions:

Median single-family square floor area declined to 2,191 square feet, the lowest reading since the end of 2010. Average (mean) square footage for new single-family homes fell to 2,415 square feet.

Since Great Recession lows (and on a one-year moving average basis), the average size of a new single-family home is now 3% higher at 2,465 square feet, while the median size is 6% higher at 2,234 square feet.

Home size rose from 2009 to 2015 as entry-level new construction lost market share. Home size declined between 2016 and 2020 as more starter homes were developed. After a brief increase during the post-covid building boom, home size is trending lower and will likely do so as housing affordability remains constrained."

Smaller home sizes don't – and can't – mean less value. It remains to be seen whether architects, engineers, and operators will succeed in creating iconic entry-level style homes whose form and function speak particularly to Millennial and Generation Z adult households. Opportunity awaits.

The critical takeaways here are, of course, more than about reducing square footage and capturing additional time and materials costs with fewer SKUs, and a streamlined start-to-completion cycle:

- Outlier operators invariably win at finding both a monthly payments trigger and an emotional (why now?) catalyst to cause absorption rate pull, and they engineer their processes, systems, and business investments to do it profitably.

- To date, the biggest challenges operators have faced have been mathematical, not psychological. Pricing buyers in with mortgage buydowns and other incentives has effectively kept the machines running, pulling sufficient volume through overheads. A bigger challenge may still come if a broader economic downturn starts weakening a strong employment backdrop and eroding demand by hitting household incomes.

- Value engineering, in its latter application, involves a holistic business adaptiveness that carries across an enterprise's entire relationship ecosystem. The upshot is a product in a location a mostly young adult household will both aspire to live in and can afford to own, and a value-creation business that makes money for its owners, investors, and lenders.

Houses, for a while going forward, will be smaller, no doubt. Will they be ones a later generation may remember as iconic?

MORE IN Architecture

Design-Estimating Disconnects Cost Builders Time And Margin

Former builder-operators Brandon Pearson and Marcus Gonzalez share what’s broken—and how connected teams can win now and in 2030.

How Missing Middle Housing Wins Approval And Works

Architect and planner Dan Parolek coined the term “missing middle housing.” His firm’s projects prove that thoughtful design, political navigation, and local momentum can overcome entrenched zoning resistance.

Faster Builds, Better Margins: The ROI On Right-The-1st-Time Velocity

Inside the digital transformation of homebuilding: How integrated teams, shared data, and AI are turning velocity into a high-stakes profit advantage.