Policy

As Prices Outpace Incomes Everywhere, Opportunity Dims

Wages haven't kept up. Dirt cheap interest rates are under pressure. Not enough homes -- it's evident to everyone -- is not a strategy for economic dynamism.

The 35th U.S. President John F. Kennedy was quoted in at least two of his campaign speeches prior to the 1960 general election:

In the Chinese language, the word "crisis" is composed of two characters, one representing danger and the other, opportunity."

Merriam-Webster defines opportunity as "a favorable juncture of circumstances," and JFK – rightly or wrongly interpreting the Chinese structure of the term Weiji -- read into it a meaning Americans get, and often embrace as true. That "favorable juncture" Webster refers to, as often as not, has peril, pain, adversity, struggle as an essential part of its make-up.

Which brings to mind housing opportunity.

National Association of Home Builders assistant vp for Survey Research Rose Quint writes:

Soaring building material costs, high demand and low inventory have added tens of thousands of dollars to the price of a new home and caused housing affordability to fall to its lowest level in nearly a decade during the second quarter of 2021.

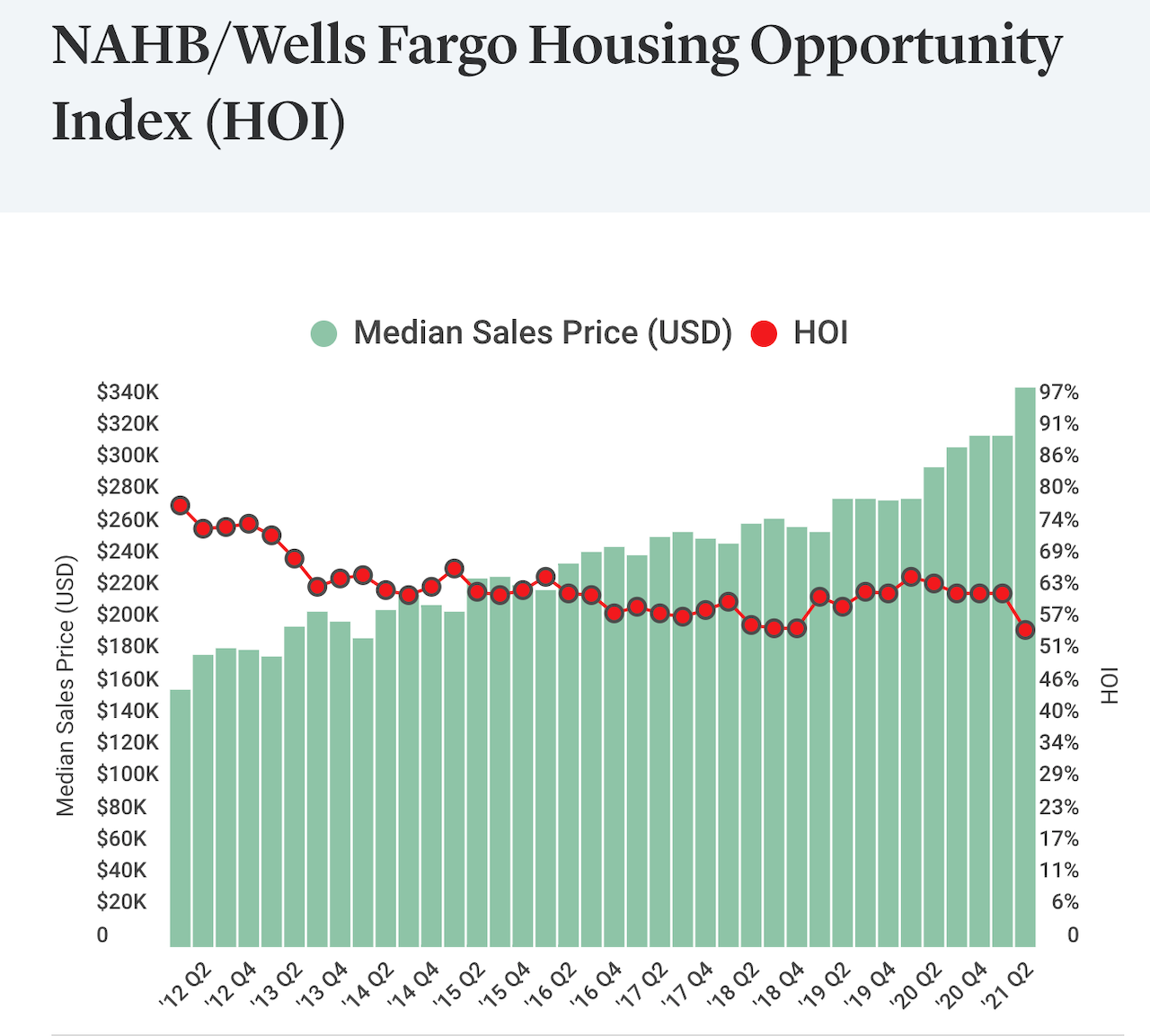

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI), 56.6 percent of new and existing homes sold between the beginning of April and end of June were affordable to families earning the U.S. median income of $79,900. This is down sharply from the 63.1 percent of homes sold in the first quarter of 2021 and the lowest affordability level since the beginning of the revised series in the first quarter of 2012."

Taking as a baseline assumption that an American household can afford to pay up to 28% of gross wages for housing, the NAHB indexes housing affordability – originally developed by a former director of research Gopal Ahluwalia – in the "juncture of circumstances" known as income and housing cost. The methodology is explained in depth here.

The NAHB/Wells Fargo Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria."

NAHB researcher Quint notes that one force factor leading into the "juncture," pricing qualifies big-time as a danger zone, or a call-to-action connoted in the Chinese term Weiji.

The HOI shows that the national median home price surged to a record $350,000 in the second quarter, up $30,000 from the first quarter. This is the largest quarterly price hike in the history of this series. Meanwhile, average mortgage rates increased by 13 basis points in the second quarter to 3.09 percent from the rate of 2.96 percent in the first quarter."

The Wells Fargo/NAHB HOI data chart a different story for each market, leading to rankings of Pittsburgh as the No. 1 most-affordable large market metro, and Cumberland-Md.-W.Va., as most-affordable among smaller markets.

West Coast cities in the states of California and Oregon stack the deck among the nation's 10 least affordable markets.

The issue is is there a limit to how much crisis, adversity, frustration, peril, struggle, and pain people can withstand – with respect to this juncture of income and housing prices – before their resolve, their Dream, their motivations begin to wither and turn, instead, to apathy, to despair?