Land

As Builders' Credit Market Shrinks, A Stopgap Capital Source Opens

"The capital becomes available for builders to move projects along that they might otherwise have to let languish because they can't tap cash to progress it into their pipeline." - Tony Avila, CEO-founder Builder Advisor Group

About the last thing private builders need right now ... more new causes for delays finishing new homes, delivering their backlogs across the goal line and clearing inventory.

For many, bank-debt balances – already swollen due to the four-to-eight weeks extra supply chain whack-a-mole has added to their construction cycles – have little give left in them.

In that context, Builder Advisor Group, which has offered a full-stack of real estate capital services totalling more than $20 billion to homebuilders and residential since its founding in 1996 and an additional $2 billion in debt and equity capital through its Encore Housing Opportunity Fund since 2009, has raised a $300 million real estate income fund designed to provide homebuilders a stopgap to help them withstand balance sheet stress and shock for the immediate stretch of difficulty and dislocation ahead.

What we're seeing is that lenders have been pulling back from their acquisition, development, and construction deals as the market has turned soft," says Tony Avila, founder and CEO of Builder Advisor Group. "Likewise, even land bankers and private equity capital sources have gotten far more conservative. At the same time, builders' balances have grown dramatically because elongated cycle times are chewing up their operating capital. Our new debt fund creates an opportunity to fill a niche need, and replace capital that others are not providing right now."

In late-September, National Association of Home Builders chief economist Robert Dietz noted:

Outstanding builder loan balances are rising as development debt is being held longer as new homes remain in inventory longer."

Whether they like it or not, however, builders likely are getting sucked into more supply chain pain ahead – if not immediately, probably eventually.

- A national rail strike looms just around the corner within the next couple of weeks

- Growing protests over Covid curbs in China threaten to further disrupt global economic value chains across many industries.

- An ongoing energy crisis – owing to Russia's attack on Ukraine, now heading into its second year – poses risks of impact on transportation availability and costs.

These disruptive forces impact essential materials and products supply and their costs. Then there's their domino-effect impact on an already-tight market of frontline skilled trades people.

Homebuilders have grown used to this. And up until this point, they've adjusted to every chokehold as it arose with a workaround. Homes took longer from start-to-completion, but customers were willing both to pay and wait.

The center – thanks in large part to homebuilding operator teams' characteristic adaptiveness and resilience -- held.

What homebuilders are striking up on now amounts to a squeeze on project and operating capital at a moment they can ill afford to run short. As new orders – and cash deposits – suddenly turn from a rushing river of revenue to a trickle, and as order cancellations grow, which means homes have to be resold into a market where demand has softened, completing homes, getting them closed, and booking that revenue has both greater urgency and higher risk.

Now, many experienced operators and their partners appreciate this as a "now" challenge, not a structural problem. Once the Fed finally signals it will let-up on the aggressiveness of its Funds rate increases, and once the Animal Spirits "falling knife" tip begins to show signs it will hit the ground, homebuyers will reactivate, and new market momentum won't be far off from that point.

The issue of the moment is access to that extra capital for staying power – extra capital typical channels have begun to show their own signs of hesitancy as business conditions have deteriorated.

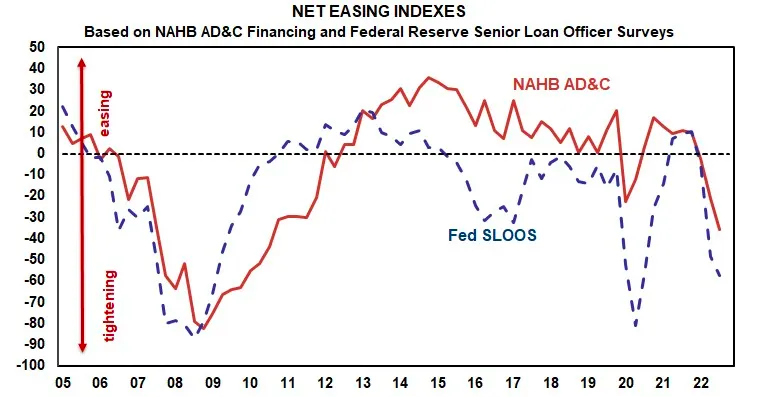

Earlier this month, from Paul Emrath, NAHB vp for Survey and Housing Policy Research:

In the first quarter of the year, the NAHB net easing index stood at -2.3 before declining to -21.0 in the second quarter and -36.0 in the third. Similarly, the Fed net easing index was -4.7 in the first quarter of 2022, but subsequently fell to -48.4 in the second quarter and -57.6 in the third. In short, the tightening of credit conditions for builders and developers is becoming more widespread."

Emrath notes that the worsening credit conditions add up to a root cause for growing weakness in builder confidence, given that their staying power options are shrinking at precisely the time they need them.

The new debt fund, Avila says, typically would offer capital with a 3-year term, at loan-to-value ratios ranging from 50 LTV to 80 LTV, at rates that float between prime-plus-5% to prime-plus-10%, with loan amounts ranging from $10 million to upwards of $50 million. The capital a builder receives – with BAG as first lien-holder -- in this case supplants mezzanine debt and equity, Avila explains, noting that the securitization of this form of financing has become known as "Dequity."

The capital becomes available for builders to move projects along that they might otherwise have to let languish because they can't tap cash to progress it into their pipeline," Avila says. "It extends their ability to own and control lots they'll need to keep feeding their machines of revenue and growth."

To date, Avila says, about 35 homebuilding operators have begun tapping into the loan fund, which he projects, will tide them over at least until the new-home market starts showing new signs of a come back. From a high level perspective, Avila and his team see a more dovish Federal Reserve stance on further rate hikes, and although word is that rates will likely stay elevated for some time in an attempt to quash drivers of inflation and expectations of inflation, market sentiment could rebound as soon as mid-year 2023.

At some point, historically, consumers start getting over the sticker shock of the higher rates and begin to take them more in stride as they move on through their life-stages and financial commitments," says Avila. "We think by mid-year next year, the market will pick back up."

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.