Leadership

A Wall Of Worry: Homeowners' Insurance Options As Risk Rises

What's coming clear is that the business of homeownership, the business of running a business, and the business of running a state are no mean feat to align and harmonize when it comes to natural disaster risk.

America's vaunted pandemic era market winners -- domestic migration magnets, new housing activity hotbeds, and leading gainers on the price appreciation front – share at least two important traits in common.

Most of them are in demand. And most of them are at risk.

You know the ones we're talking about. Florida, Alabama, and the coastal Southeast; Texas up through New Mexico and Arizona, Colorado, California and the Pacific Northwest. Picture a horseshoe shape from the north on either coast, heading around across the entire U.S. south, and then up the other coast. That's the in-demand/at-risk nexus.

A Core Logic analysis recently connected these dots:

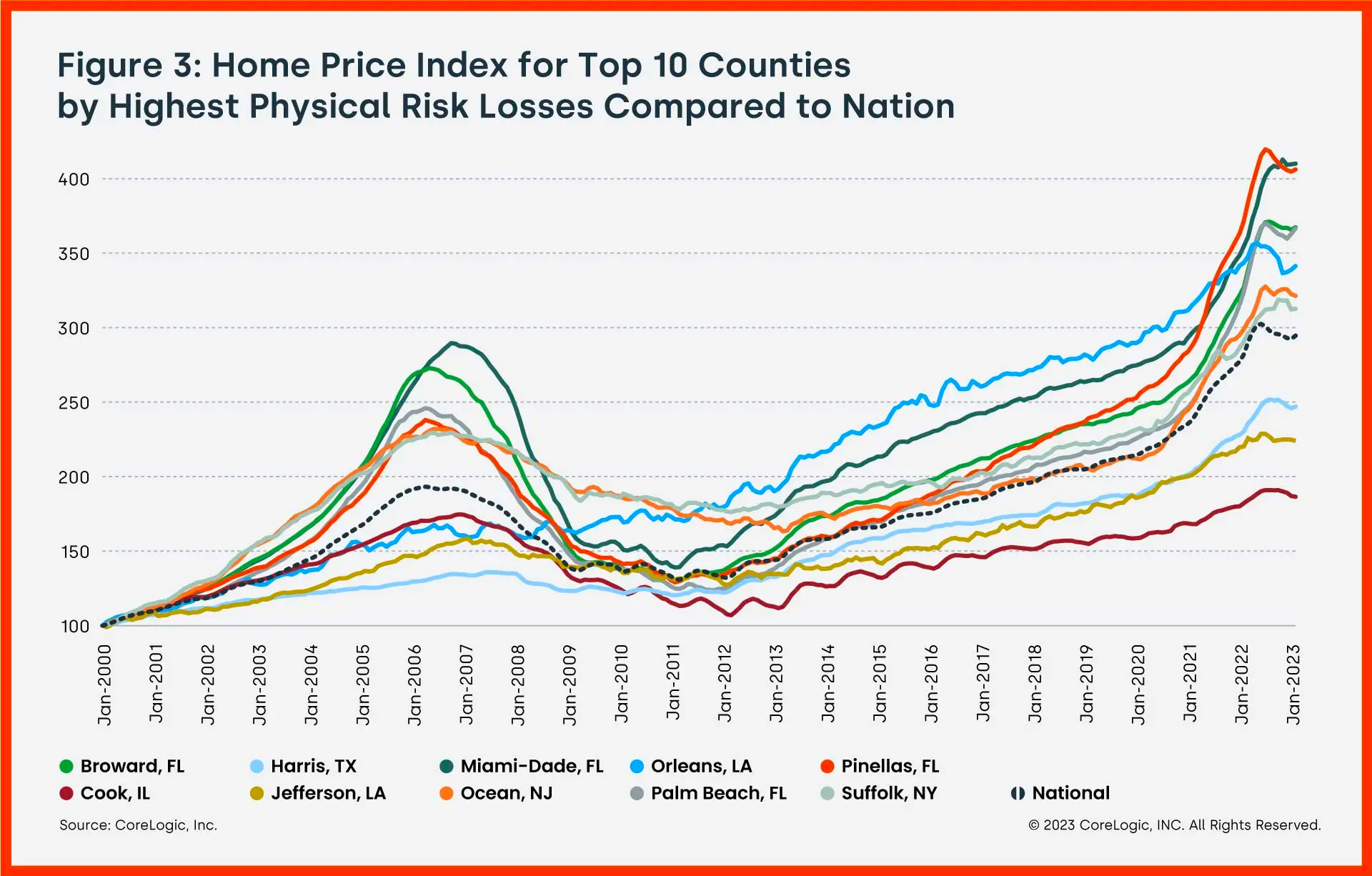

Interestingly, many of the high-risk counties ... experienced significant price growth in recent years. Though home price growth varied across the top 10 counties, seven of these locations are appreciating faster than the national average...

Florida metro areas are among the fastest-appreciating U.S. housing markets, recording some of the highest year-over-year growth in March, as measured by the CoreLogic Home Price Index. Miami, which has the largest estimated loss from hurricanes and storm surges, is one the hottest markets in the nation. That metro experienced nearly five times the U.S. home price appreciation rate, posting a 15% annual increase in March 2023 compared with the national growth rate of about 3%." – Core Logic

A graphic from Core Logic's analysis emphasizes the in-demand and at-risk correlation.

Risk is risk. People are people. And people notoriously under-appreciate risk, especially when it comes to natural hazards and their homes.

Now, this week comes a new measure of that growing risk, and of the ongoing unavoidability of exposure to it.

New York Times staffers Christopher Flavelle, Jill Cowan, and Ivan Penn report:

This month, the largest homeowner insurance company in California, State Farm, announced that it would stop selling coverage to homeowners. That’s not just in wildfire zones, but everywhere in the state.

Insurance companies, tired of losing money, are raising rates, restricting coverage or pulling out of some areas altogether — making it more expensive for people to live in their homes.

“Risk has a price,” said Roy Wright, the former official in charge of insurance at the Federal Emergency Management Agency, and now head of the Insurance Institute for Business and Home Safety, a research group. “We’re just now seeing it.” – New York Times

The reason State Farm Insurance executives give for its plan to halt writing new homeowners' policies in California owes to a vice-grip of increasing wildfire risk and soaring replacement costs for reconstruction.

A Wall Street Journal article Saturday quotes this statement:

[State Farm] made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market." – Wall Street Journal

What it means for current homeowners covered by State Farm is that their current policies will remain in effect; new home purchasers, however, won't have what was formerly the largest player of its kind in the State of California as a home insurance option.

Insurance is getting more challenging in the areas where housing is booming. You have hurricanes in Florida, hail in Texas, wildfires in California – and it seems to have intensified in the last five years," says Alan Umaly, President, Westwood Insurance Agency. "So it’s not a surprise to see companies taking more severe action and further restricting capacity."

For new- and about-to-be-new homeowners, Westwood Insurance Agency creates a settlement safety valve of coverage for upwards of 100,000 new-home closing annually – with locked-in premium and policy coverage terms – by tapping a national footprint of more than 40 insurance company partners that can best match buyers' pocketbooks and coverage levels.

I remain confident that insurance markets will be available for new construction homes," Umaly says. "Insurance companies can use builder-sourced homeowners insurance to balance their exposures with good risks. That’s good news for our builder partners. At Westwood Insurance Agency, our advantage is that we’re a national, independent agency representing both admitted and non-admitted insurance markets. It’s about giving options to your home buyers, and that’s more important now than ever.”

What's coming clear is that the business of homeownership, the business of running a business, and the business of running a state are no mean feat to align and harmonize when it comes to natural disaster risk. The respective balance sheets just don't balance out with each other.

A Wall Street Journal editorial frames the challenge as one of state-regulatory overreach, undercutting the ability of private markets to adapt on their own to respective risks and opportunities, ultimately benefiting more consumer households.

Reinsurers are also limiting exposure and raising prices in California because of wildfires. Surging construction costs don’t help. The average cost of building a new home in California excluding land is $1.35 million. Blame the state’s burdensome building codes, permitting red tape, and high energy and labor costs. As the Chubb CEO said two years ago, “we cannot charge an adequate price for the risk.”

Mr. [California state Insurance Commissioner Ricardo] Lara is responding by lashing out at insurers. While “insurance companies prioritize their short-term financial goals, the long-term goal of the Department of Insurance is protecting consumers,” a California Department of Insurance spokesperson said in response to State Farm’s announcement.

Insurers aren’t prioritizing short-term profits. They are protecting their customers, investors and creditors. Mr. Lara isn’t helping Californians by driving away insurers, which will reduce competition and force more customers into a state-established insurer of last resort (backed by insurers) that provides skimpier and more expensive coverage."

The reality, however, is that risk is growing, and who will pay for that intensified exposure – whether it's everybody, or only the affected ones, or the companies' profits, or the state's taxpayer coffers – is the ever more frequent question that arises.

Who will foot the bill, especially as a majority of ground-up single- and multifamily construction, development, investment, .... and demand takes place in geographies that face ever greater natural hazard risk?

The New York Times piece notes:

The best way for policymakers to help keep insurance affordable is to reduce the risk people face, said Carolyn Kousky, associate vice president for economics and policy at the Environmental Defense Fund. For example, officials could impose tougher building standards in vulnerable areas.

Government-mandated programs, like the flood insurance plan, or Citizens in Florida and Louisiana, were meant to be a backstop to the private market. But as climate shocks get worse, she said, “we’re now at the point where that’s starting to crack.”

Almost no one relished the idea of stricter building codes. Where does that leave insurers and reinsurers and their business outlook?

Risk is risk, and growing rates of risk create their own problems when it comes to insuring policy-holders against them. It's a mathematical and business change.

Never mind that other term.

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.