Leadership

A Spectre Of Back-Charges Challenges Builder Performance

Who will pay for all the variations to original purchase order agreements and deliveries amidst supply chain chaos? Where field challenges roll up to business risks.

Back-charges are practically a four-letter vulgarity among homebuilders and their building products and materials partners.

Today, as a result of a traffic pile-up of unforeseen, unmanageable, and, as-yet, not-fully-recognized direct and indirect construction cycle costs tied to chokeholds in the supply chain – back-charges are the talk of the town. They've emerged as a new strain between builders and their suppliers, and as a genuine 4th quarter and possibly full-year budget- and margin buster.

For instance, some builders have begun spending $3,000 to $5,000 extra per new home now to move past a weather-tight rough-frame phase inspection without having windows installed because of backordered products. Those extra costs owe to field decisions being made under tremendous pressure from corporate offices to deliver completions; they are mounting fast, across multiple categories.

The tally for the gamut of variance to original purchase orders – according to construction finance executives we spoke with – is far from fully reflected in Q4 and full-year re-projections. Big profit margins, which appeared to be a slam-dunk in light of buyers' willingness to pay more and more for new homes, now look as if they'll be squeezed razor thin by these unforeseen direct and indirect costs.

What Are Back-Charges?

Back-charges occur when a homebuilder pays for a workaround to a construction critical path item today that they will have to pay more to undo later. Specifically, they're billings incurred for work a builder does that should have – by agreement – been done by a contractor, but wasn't.

We'll amplify below more on how these "stealth billings" happen, their impact on per-home costs, and the stresses they're putting on builder-vendor relationships and on builders' business and financial models for 2021.

The big question pressing every meaningful vested and invested part of construction's massively disrupted value chain is "who will pay the back-charges?"

Nobody wants to foot these extra bills. Somebody will have to. Who will it be?

The likely answer is "the builders." If it's the builders who will shoulder the costs of these "field purchase orders", as they're known, however, say goodbye to the level of pre-tax earnings and margins builders pro forma-ed into calendar 2021 financials based on prices they were able to pass along to willing homebuyer customers.

They will underperform those margins, and they don't yet even have the data yet to reckon with how big the miss will be. Public homebuilding companies are trying now to manage expectations for lowered volume and revenue guidance, but few hints of impact to overall earnings are showing up in the latter-year re-forecasts.

That may have to change, especially if the answer to the question, "who will pay?" turns out to be the homebuilders.

Lesser-of-Evils Measures

Back-charges are a financial Hobson's Choice for homebuilders, who're mostly scrambling now to close and deliver new homes under construction by year-end to meet investor-, lender, vendor, and homebuying customer deadlines. To progress a home from rough-frame to drywall, an inspection typically requires a weather-tight stage. In normal times, that means windows are installed.

These are not normal times. As a fall-back, construction managers have begun to salvage their schedules by resorting to a tactic with known and unknown costly consequences: A plug fix to keep the construction cycle moving in hopes that missing parts and pieces can be added in time to deliver a finished home.

This takes us back to the dark ages of scheduling," says supply chain guru Ken Pinto, a TBD Dream Team member, and author of the Supply Chain MasterClass. "You call the dry wall team, and see when they can come, and don't call the next crew until they're done. Then you call the paint team, and you don't schedule the next crew until they're done. That's the worst way to manage through a construction cycle for efficiency and quality. It's what we've come to."

Back-charges, it should be said, are a symptom.

Root causes here are the COVID-19 pandemic and its global siege of the extensive hive of mining, materials, manufacturing and production, distribution, transport, and installation, as well as a late-Winter Texas freeze that temporarily broke and shutdown the nation's petrochemical supply sources for long enough to wreak havoc on a year or more of downstream resin and plastics-based building materials and supplies.

No one to blame for those root causes. The problems come with the series of responses, reactions, and ongoing relationship dynamics of the chain of buyers and sellers up and down building's supply channel as the symptom – back-charges – forces costs to the whole value chain that can be financially very painful.

In the Spring it was lumber. In the Fall, it's windows, which it's widely reported that are on a 24- to 27-week delivery schedule due to supply chain disruptions that trace back to the petrochemical industry meltdown and its aftershocks, as well as problems in aluminum, glass and other material supplies that go into window manufacturing.

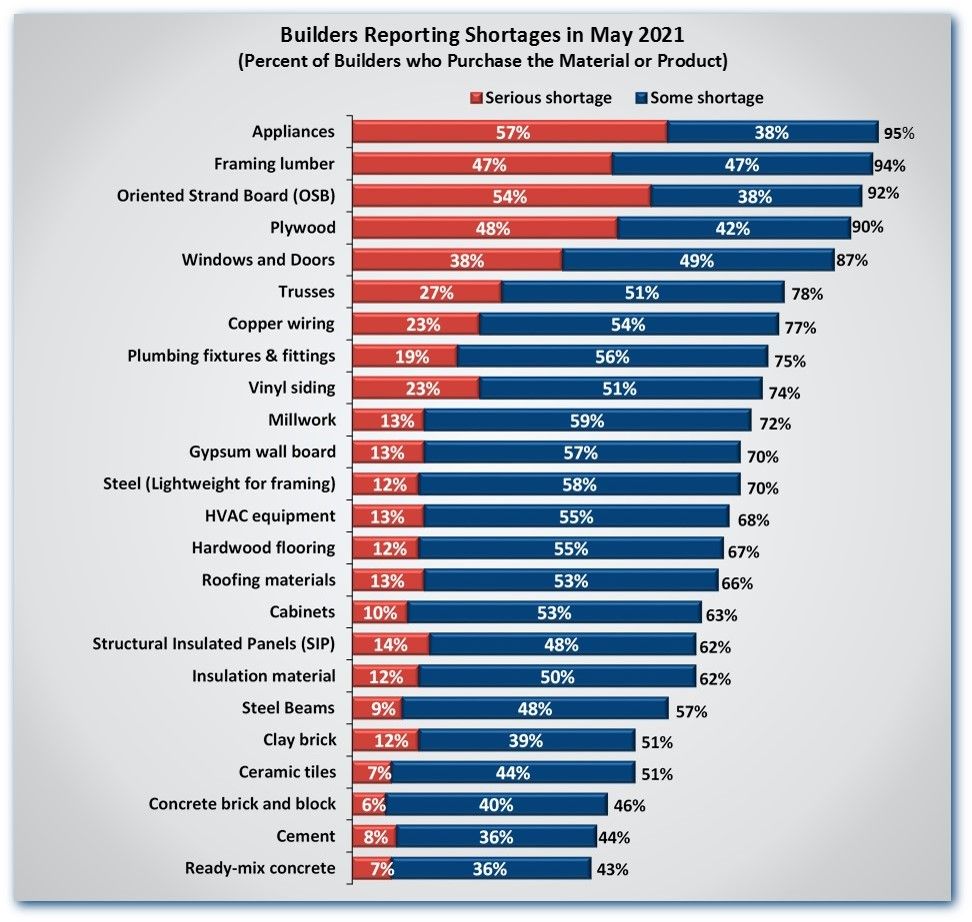

For similarities, Covid- and natural hazard-related hits to supply and a sustained upward spike in demand collided. The well-known result was shortages, delays, and price increases that boggled the mind and broke the bank.

That's where most of the similarities end, and the important differences between Spring 2021 "lumbergate" and Q4 "windows wall of worry" begin.

It's not that windows are exceptional for being in dire short supply. Almost every category of product or material in the construction supply has challenges. It's that – seasonally – windows matter more urgently now because of where they fit into the rough-framing and pre-drywall construction cycle, and what little recourse builders have to navigate past windows as a critical path item.

In the winter and Spring, lumber and wood products prices skyrocketed, mills increased capacity, and prices began to come back to earth.

Windows – a made-to-order item in the building supply chain, different from other products and materials that manufacturers and distributors produce and inventory based on macro demand projections – are a different matter.

Word among construction executives is that to push rough-framed homes past their construction phase barrier – minus windows – construction managers are resorting to plugging window openings with plywood in order to pass a pre-drywall "dry-box" inspection.

In such instances, there are two areas of extra cost impact. One is in the carpentry, plywood, caulking, etc. to weather-proof the enclosure. The other is – once the windows do show up – a host of direct expenses it takes to cut through and repair drywall, repairs to exterior cladding, new paint etc.

Those costs – for direct material inputs – add up to from $3,000 to $5,000 per home; that doesn't include indirect carrying costs, schedule impacts, and other internal soft costs related to the stalled completion. With 600 or 700 homes in construction, needing to be complete by year-end, those kinds of added costs have the potential to spiral rapidly for a high volume builder

The C-suite has begun calling purchasing and construction managers to account for all of the FPOs, and asking them for the order of magnitude of extra expense," says an executive familiar with disruptions at the field level. "There are so many alterations to budget occurring while the priority from corporate has been to go to any measure to complete the homes. So, now, as these extra billings start to bubble up from the field, the question is who's on the hook for them."

The reflexive instinct adds tension to builder-vendor relationships, as the letter of many contracts would force the failure to deliver products as agreed back on the supplier to bear the brunt of the back-charges.

Few doubt that that burning bridges with one of a very finite few manufacturer suppliers of a product line such as windows is a smart thing to do right now.

Manufacturers are refusing 'surge orders' from builders that want to order and inventory extra supplies of items like windows," says our construction finance source. "What's more, if you shift over to another manufacturer in the belief that you're going to do better on the schedule, there's no guarantee that new supplier will come through with what they've promised."

Bottom line: The supply chain disruption runs up and down the entire building lifecycle, and it will take the entire system time to navigate through ongoing delays.

The leadership issues to consider boil down to the business value of trust, both with team member associates at the field construction and purchasing level, and with manufacturer-vendor-suppliers.

All builders know the business upside of being a 'preferred builder of choice,' and now is the critical time for this to play out," says Pinto. "Suppliers depend on fast-pay to keep their businesses resilient. We know that desperation doesn't produce great houses, and the important point to focus on is how to keep trust in tact so that we can continue to produce great houses."

The other big pressure point of VPOs falls on the relationship between field construction managers and purchasing managers and their corporate higher-ups.

These folks are already at wit's end dealing with all of the day-to-day pressures and going to the lengths they're going to complete their projects," says our construction finance source. "If they start getting heat for these EPOs, you can bet they're just going to quit."

Join the conversation

MORE IN Leadership

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.