Products

The Great Lumber Lag Of 2021: Here's Why High Prices Stick

A master-class in price stickiness applies not just to dimensional lumber, but to a number of materials and product categories with complex distribution channels.

Sticky, yes, but how sticky?

So full of hand-offs is the chain of action that assembles 18,000 separate SKUs into a 2,000 square foot home – all that selling and buying and selling – it's no wonder prices end-users pay and their original input cost bear little relationship to one another.

National Association of Home Builders director of Tax and Trade Policy Analysis David Logan offers a master-class in price stickiness, applying clinical insight to the current state of lumber prices.

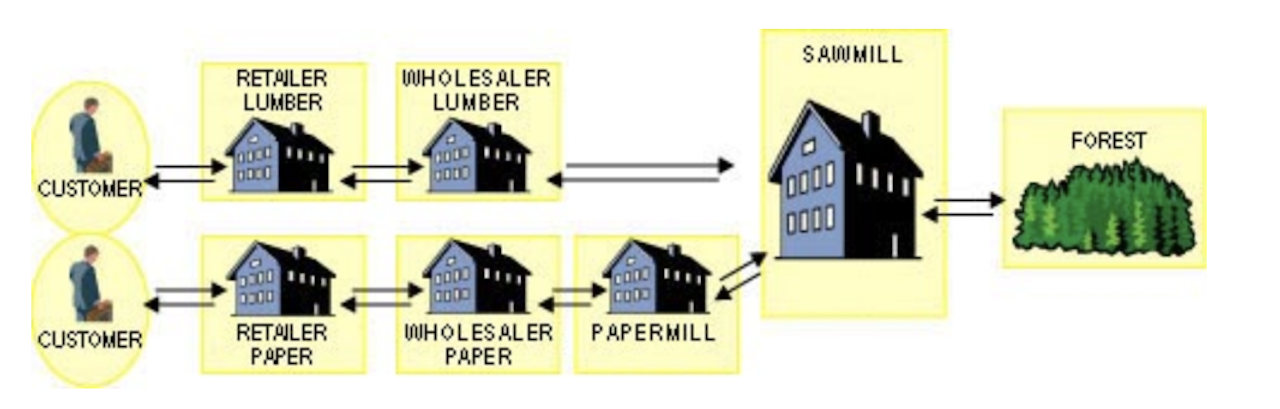

To know how and when horizons may start to brighten on the lumber pricing front, and to recognize more precisely what leverage builders may begin to gain in lumber pricing dynamics, Logan deconstructs the lumber value chain.

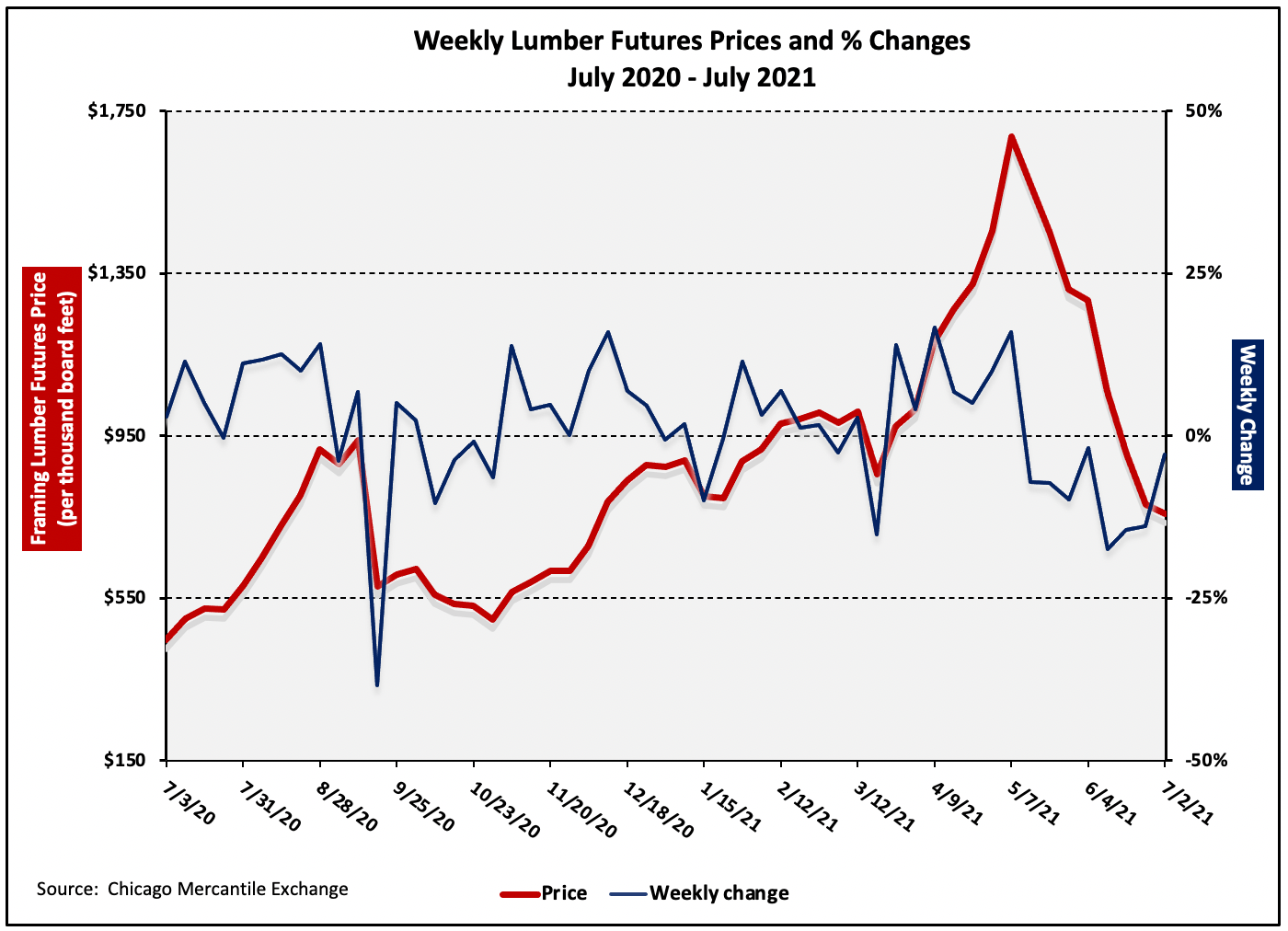

Logan's lesson in lumber econ 101 begins with recognition of a builder pain point, the gap between what they're reading about lumber futures price declines and what they're still paying for their lumber packages on job sites.

Here, Logan notes, is the rub behind why "street" prices lag – dramatically – what's happening on the futures market grabbing all the headlines.

To maintain margins, retailers and wholesalers do their best to buy low and sell high. At the very least, they try to avoid buying high and selling low, which happens to be the biggest risk in an environment of rapidly falling prices. For example, had a lumberyard quoted a client at prevailing prices two weeks ago, it would be taking a 25 percent loss relative to current pricing. Thus, a supplier that quotes clients at current market prices will consistently lose money when prices are falling.

Suppliers’ inventories will also tend to be tighter during periods of falling prices. Whatever inventory the business has on hand was expensive relative to current prices. This gives wholesalers and retailers incentive to run through that inventory while they can still get close to what they paid for it—and doing so without souring relationships with customers. And for reasons stated above, they will be “trigger shy” to buy more lumber than they are contractually obligated to provide to customers for fear of ending up with a load of inventory on which they will take a loss.

The lag, of course, always works to the detriment of builder end-users. While price declines make their way like molasses into "street" costs, it's the opposite when typical demand-supply unevenness creates upward pressure on input costs. On the way up, there's very little lag-time.

It should come as no surprise that, given the complexity of forces at play – complete with capital costs, taxation, legal fees, insurance coverage, and headcounts – at all five "stages" of dimensional lumber's value chain, Games Theory might figure into understanding how it all works.

Logan gives a shout-out to the more-serious-than-it-might-appear "Wood Supply Game," for all that free-time people in the supply chain have these days.

Business managers and employees can play the publicly available “Wood Supply Game” developed by Forest to Customer (FORAC). The “game” allows players to manage one or more stages of the supply chain and demonstrates how output, inventory stock level, and ordering decisions affect the flow of goods. The game also showcases the importance of information sharing among businesses at different stages. A detailed explanation of how to set up, administer, and play the online game can be found here.