Land

Signorelli Builds Boldly Where Others Shy Away From Risk

From Valley Ranch to Austin Point, the Signorelli Company CEO turns constraints into catalysts, shaping the next era of Texas community development.

Danny Signorelli doesn’t back off a problem. He hunts them.

We look for opportunity where there’s challenge,” Signorelli says. "Sometimes, those surface-level problems turn a lot of folks away. But if you power through them, there’s success hiding in plain sight."

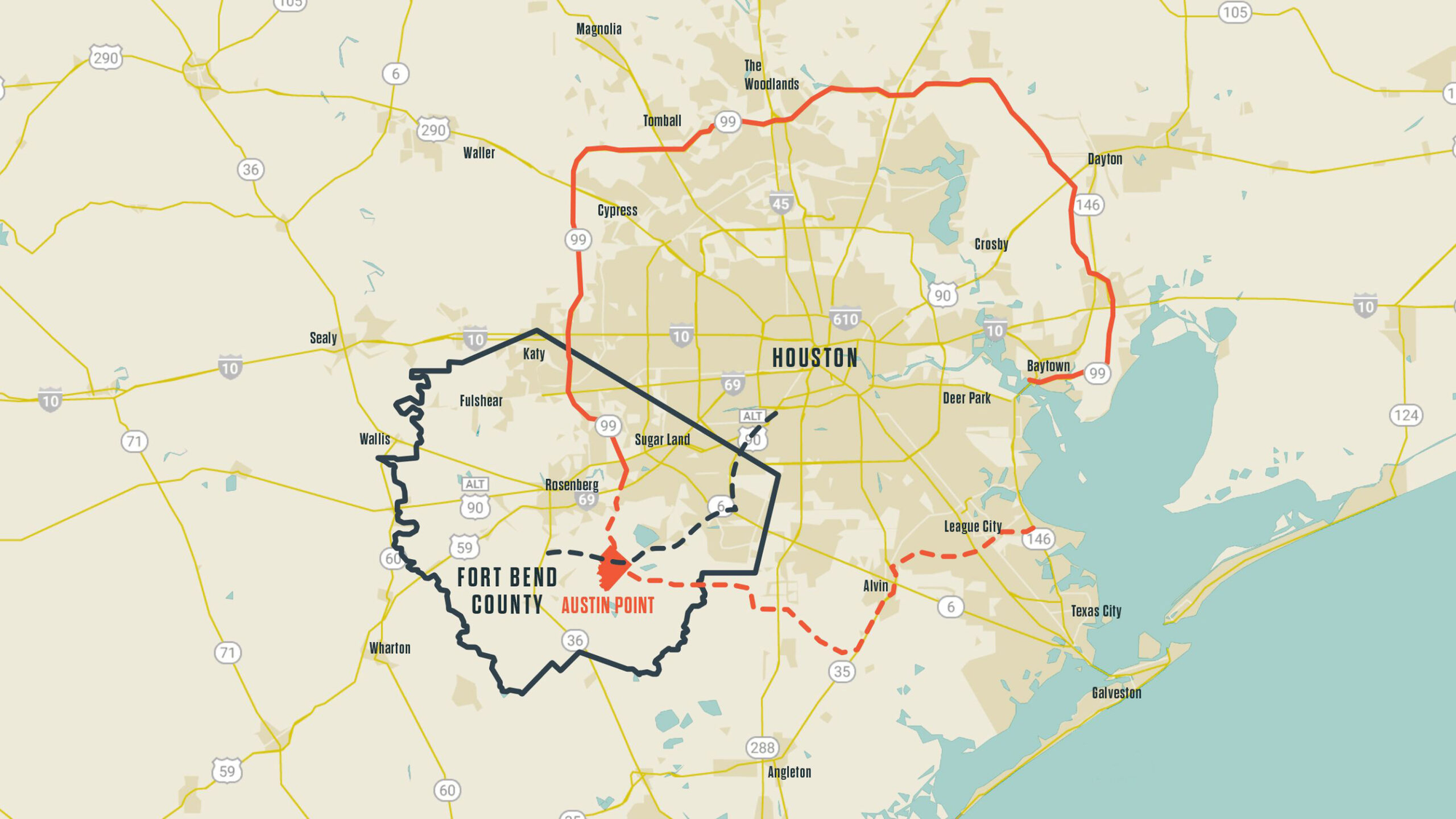

That philosophy is the backbone of Austin Point, a 4,700-acre master-planned community rising from the farmland of Fort Bend County, Texas. As CEO of The Signorelli Company, Signorelli is now spearheading one of the largest private land development initiatives in the state’s recent history—a vision built not on short-term market timing, but on the long arc of demographic inevitability, infrastructure foresight, and deep-rooted optimism about Texas.

Where Others See Barriers, He Sees Openings

The story of Austin Point, which begins sales this summer, is shaped by the same DNA that drove Signorelli's breakout success with Valley Ranch two decades ago. That North Houston-area project, now home to the region’s busiest outdoor shopping center, emerged from a dry precinct where alcohol sales were banned.

We had to change the liquor laws to unlock retail. Most people avoided the area. But we saw a false economic barrier and figured out how to remove it," he says. "That was the turning point."

Austin Point presented a different constraint: its location, which was hemmed in by the Brazos River and lacked direct connectivity. Once again, Signorelli leaned into the problem.

This time, it wasn’t liquor laws—it was mobility. The solution was Fort Bend Parkway and the Grand Parkway extension. We partnered with the county and the state to help move those forward."

Fort Bend County's 'Main and Main'

Once a hard-to-reach patch of farmland, Austin Point is poised to become Fort Bend County’s next urban core.

The project will ultimately support 14,000 homes and 17 million square feet of commercial space. Phase One alone includes 421 single-family homes, the 1824 social hub, and more than 25 acres of parks and trails.

We’re not building yesterday’s MPC," Signorelli says. "This isn’t about cookie-cutter subdivisions. Austin Point will look and feel different. It’s a walkable, hybrid community—green space, entertainment, jobs, and homes across price points."

And it couldn’t come at a more uncertain moment. In early 2025, many large builders are pulling back from land, wary of elevated rates, rising costs, and shaky consumer sentiment. But Signorelli sees that very uncertainty as a sign to go bigger.

You can’t build 10,000 homes looking at short-term cycles. We don’t make investment decisions based on a quarter or two. We’re betting on Texas—on Fort Bend County’s demographics, diversity, and long-term growth," he says.

Builder Partnerships and Product Diversity

The project’s first phase drew enthusiastic interest from more than 20 homebuilders. Ultimately, nine signed on, including Perry Homes, Westin, David Weekley, Ashton Woods, Drees, and CastleRock.

This is the first subdivision in my 30-year career where we took lots to the builder market and every single one said yes," Signorelli says. "We’ve got price points from the $300s to over $800,000, alley-loaded homes and front-loaded estates, all tied together by parks and green space."

This product mix is no accident. Signorelli has long advocated for housing diversity to match life-stage and income diversity.

We want a seat for every person that wants to live in Fort Bend County. And we want you to walk out your door and feel like your neighborhood belongs to you."

Commercial Innovation and Live-Work Synergy

Austin Point’s scale also enables an ambitious commercial vision. The innovation district will target employers across healthcare, tech, life sciences, and education.

Most people spend more time at work than with their families," Signorelli says. "If we can shorten the commute, or better yet bring the workplace to the neighborhood, we unlock quality of life. That’s the future."

He’s betting that businesses will want in. With $1 billion in public infrastructure improvements surrounding the site and shovel-ready commercial parcels, the timing may prove right.

Our tenants love Valley Ranch because it works," he says. "The same formula—intentional mix, long-term ownership, reinvestment—applies here."

A Lesson in Long-Term Ownership

What sets The Signorelli Company apart is its model. Unlike developers who exit once land is entitled, Signorelli holds and operates its communities long-term.

This is our capital. We’re not beholden to short IRR targets. We think in ROE over decades," he says. "We own the retail, build the multifamily, manage the land. That patience lets us make smarter decisions."

That approach enabled Valley Ranch to evolve into a regional destination, with 12 million annual visitors and another 800,000 square feet of retail coming. Austin Point is designed to scale similarly.

From Valley Ranch to Austin Point

The connective thread between Signorelli’s early work in Valley Ranch in New Caney, TX, and his latest in Fort Bend is vision turned reality through persistence.

I like to think big, but even I didn’t imagine Valley Ranch becoming what it is. Austin Point is Valley Ranch on steroids," he says.

That mindset was influenced by one of Texas development’s most revered figures.

We feel like we’re following in the footsteps of leaders like [Johnson Development founder] Larry Johnson," Signorelli says. "He understood that a master-planned community wasn’t just about rooftops—it was about jobs, schools, and long-term value for everyone."

In 25 years, Signorelli hopes to see 12 million square feet of commercial development, thousands of homes, schools, parks, and "a place that fuels regional progress."

We may be long gone by then, but the decisions we’re making today are building something that lasts," he says. "That’s what legacy means."

MORE IN Land

Jody Kahn: What Builders Say Now About New Home Demand

Amid slumping buyer urgency and looming policy uncertainty, John Burns Research & Consulting research guru Kahn summarizes builder sentiment trends and pain points from fresh field data.

Texas Land, Texas Spirit: A Wake-up Call For Better Neighborhoods

Scott Finfer calls for a reinvention of how communities are built—away from formulaic lot counts and toward ecosystems rooted in landscape, design, and daily experience. His essay challenges developers to deliver neighborhoods that endure and reflect the best of the Texas spirit.

BTI’s Long-Game: Big Land Bets Amid Homebuilder Tactics Shifts

CIO Justin Onorato explains why developer BTI sees resilience in Florida, Texas, and Colorado markets, and how population dynamics shape its long-view strategy.