Land

Land Valuation And The New Geography Of Catastrophe

The future of housing and the future of home weave into the near-and-present peril around property and its value in a climate that is closing in.

One of the areas we keep close tabs on is how weather and climate affect property as this could have some surprising downstream effects. From homes being destroyed to the impacts of construction material, demand surge to long-term ramifications on loans and home prices in the area. Natural hazards have a way of upending life as we know it." – Maiclaire Bolton Smith, CoreLogic senior leader of research and content strategy

It's Climate Week. Where are the solutions and where is the opportunity in this for The Builder's Daily audiences? Both solutions and opportunity will come with a cost, first in accountability.

Climate, taken simply, is an area's weather, typically averaged over a three-decade period.

More rigorously, it is the mean and variability of meteorological variables over a time spanning from months to millions of years.

Importantly, climate and "area" connect by definition. Logic follows, area and property directly connect here, as do property, home, and people. People – individuals, societies, civilizations – and their homes and their climate interweave for all of human time, and species and their fates bear a helical relationship with climate across geologic time.

For purposes of The Builder's Daily however, the tie between property as an economic value and as real estate's essential raw material resource and climate is land speculation, planning, acquisition, and development's No. 1 challenge for the foreseeable future.

That's the case, whether current property value behavior, transaction, valuation, planning, or development reflect that or not.

In a podcast conversation, CoreLogic's Bolton Smith engages the company's chief of science and analytics David Smith, in exploring the economics, finance, and risk analysis in an evolving collision between climate and the built-environment. Says Smith:

When we, as CoreLogic estimate the losses from an event, what we’re estimating primarily are the costs to repair and rebuild afterwards. So from whatever damage that event has caused, our loss estimates are focused primarily on residential and commercial properties. And when we say commercial, we’re talking about things like industrial facilities, in addition to things like office buildings and shops and hotels and so on. And in this, we include all the costs, not only to repair, rebuild those properties, but also what it costs to replace or repair their contents, and also associated costs of their downtime. So things like business interruption for commercial properties, things like additional living expenses on the residential side. We also often break the loss estimates down, for example, by that residential versus commercial, we may look at geography by state, metro area, and so on."

Three questions will drive real estate values, strategies, investments, and dynamics.

- Are people prepared for what can happen to their property vis a vis today's climate conditions?

- Can they prepare, by reckoning with risks and pricing them into measures they take to increase resilience?

- Will they?

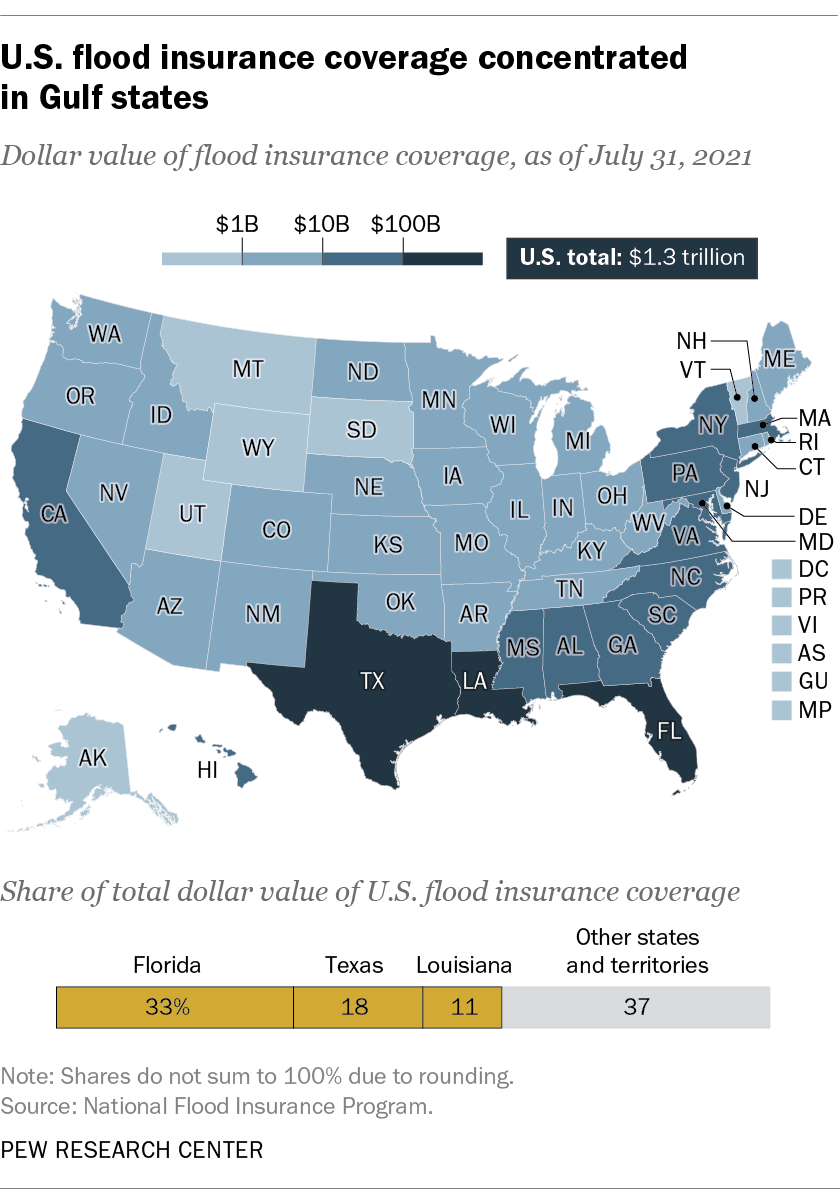

New Pew Research analysis from senior writer Drew DeSilver looks through four lenses at how household-level fitness matches up to climate and natural hazard conditions.

This analysis examines the prevalence of four specific tools to endure extreme weather in the United States: flood insurance, air conditioning, portable generators and home insulation. (As we’ll see, some of these tools may have their own climate impacts.)"

Access to and use of the "tools" DeSilver explores as measures of preparedness vary by region, financial means, enforceable rules and laws, and attitudes.

So, the answer to the questions "are people prepared, can they do so, and will they do so?" are:

- Partly

- Not everybody can

- Even a greater number are unlikely to

For land acquisition, planning, development, and investment valuation and economics purposes, human nature's tendency to underestimate risk will be a meaningful issue to tackle.

In hindsight, many risks seem obvious. And when we do take the time to evaluate potential risks, there is often not much that is profound about them. Yet so many of us fall prey to unforeseen risks, believing that they came out of nowhere or that they could not have been anticipated. While this may be true in some cases, most of the time risk blindness occurs due to the way our brains are wired."

Reasons offered here as to why people misread potential peril are that reward obscures risk, sunk costs often cause people to double-down, and the "future-averse" belief that because something hasn't happened it means that it can't be tested and better understood.

The choice business leaders and their real estate and land strategy and tactics specialists need to make is on whether to continue on a future-averse pathway that fails to attach accountability to participating in markets that clearly under-appreciate risk or not.

Companies ignore a longer tail of accountability at their peril, and so do the people who lead those firms.

Join the conversation

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.