Marketing & Sales

In 'Best Places To Retire in 2021,' U.S. News Keys In On Budget And Health

Three million "unplanned" retirees in the past year swell 55-plus demand, and further open opportunity for new communities that offer post-career living on a tighter budget.

The great-great-great grandchildren of 19th Century English lit rockstar Charles Dickens might deservedly curse the fact that one of the author's patented lines, "A Tale of Two ... " generates no copyright royalties nor residuals.

Describe any number of social, political, economic, health, cultural, environmental phenomena these days and the term "a tale of two ..." fits, almost as if by virtue of some involuntary muscle.

So it goes with retirement, which might seem an odd topic pick on a First-Friday-of-the-Month of the first week of the first month of the second half of 2021 – when focus, almost entirely among business planners and strategists of all stripes is on jobs, not retirement.

Strange are the days that retirement – particularly, pandemic-correlated or caused retirement – goes hand in hand with employment, unemployment, labor participation rates, etc. as a leading indicator of an economy's ability to stand on its own two feet without Uncle Sam's bounty.

It does.

New York Times economics staffers Nelson D. Schwartz and Coral Murphy Marcos report this morning on a less-appreciated but important consequence Covid-19's fast-forward shock-effect on lives and livelihoods: unpremeditated retirement.

In this brief excerpt, our thematic, "a tale of two ...," emerges loud and clear.

Mrs. Vega and the Pattens are three of the millions of Americans who have decided to retire since the pandemic began, part of a surge in early exits from the work force. The trend has broad implications for the labor market and is a sign of how the pandemic has transformed the economic landscape.

For a fortunate few, the decision was made possible by 401(k) accounts bulging from record stock values. That wealth, along with a surge in home values, has offered some the financial security to stop working well before Social Security and private pensions kick in.

But most of the early retirements are occurring among lower-income workers who were displaced by the pandemic and see little route back into the job market, according to Teresa Ghilarducci, a professor of economics and policy analysis at the New School for Social Research in New York City.

On the surface, for folks whose livelihoods focus on investing in, developing, designing, and building residential neighborhoods for the 55-plus set, natures nudge of an extra three million people from careers to retired mode instantaneously expanded the 55-plus target universe by that much.

The NYT piece concludes as much, at least from the perspective of its anecdotal case-example couple, whose quote would be music to the ears of homebuilders and developers in the 55-plus space:

The Pattens feel unnerved with the sudden change after 22 years of nonstop work, but they, too, are looking at the upside.

“We both know that, at our age, it was probably the best thing for us,” Mrs. Patten said. “We will get used to all of this time on our hands. Our plan is to volunteer, travel and look for a new place to live after 30 years on the old homestead.”

So, 55-plus magnet markets – such as the annual rankings by U.S. News of "The Best Places to Retire in 2021," and how each of those places achieved their spot in the standings, are worth extra focus, given that few of those inadvertent retirees will be likely to force their way back into full-time labor participation.

Here's the U.S. News top-10:

- Sarasota, FL

- Fort Myers, FL

- Port St. Lucie, FL

- Naples, FL

- Lancaster, PA

- Ocala, FL

- Ann Arbor, MI

- Asheville, NC

- Miami, FL

- Melbourne, FL

No real surprises here. It's "the why" that makes them worth the time to check out and apply to potentially undiscovered market gems for land acquisition and community development opportunity.

This year's 25 Best Places to Retire is dominated by Florida metro areas, largely due to affordable homes, low taxes and high ratings for happiness and desirability. Increases in Desirability and Job Market scores lifted Sarasota from No. 2 last year to overtake Fort Myers for the No. 1 spot for 2020-2021. And while Port. St. Lucie’s Housing Affordability score slightly decreased, increases in Desirability, Job Market and Health Care scores helped it jump two places to No. 3. Miami, FL also saw a decrease in Housing Affordability but still broke into the top 10 this year, jumping five places to No. 9 thanks to Desirability and Job Market score increases. The top 25 places to retire also includes three Texas communities, and two places each in Michigan, North Carolina and Tennessee.

“Moving to a new place for retirement can reduce your cost of living and improve your quality of life,” said Emily Brandon, U.S. News senior editor for retirement.

It's that simple. Except for the Dickens "a tale of two ..." factor.

And that's where there's both challenge and opportunity around the fact that massive, accelerated aging – not just into "active adult" hale and hearty years, but into barely active, old-old extended retirements – is a largely unmet housing solution-waiting-to-happen.

It's this "tale of two ... " dimension we'd like to spotlight, not because it's about a bleaker dimension of the issue, but because within big challenges like this, private sector brilliance and innovation tends to see and generate opportunity.

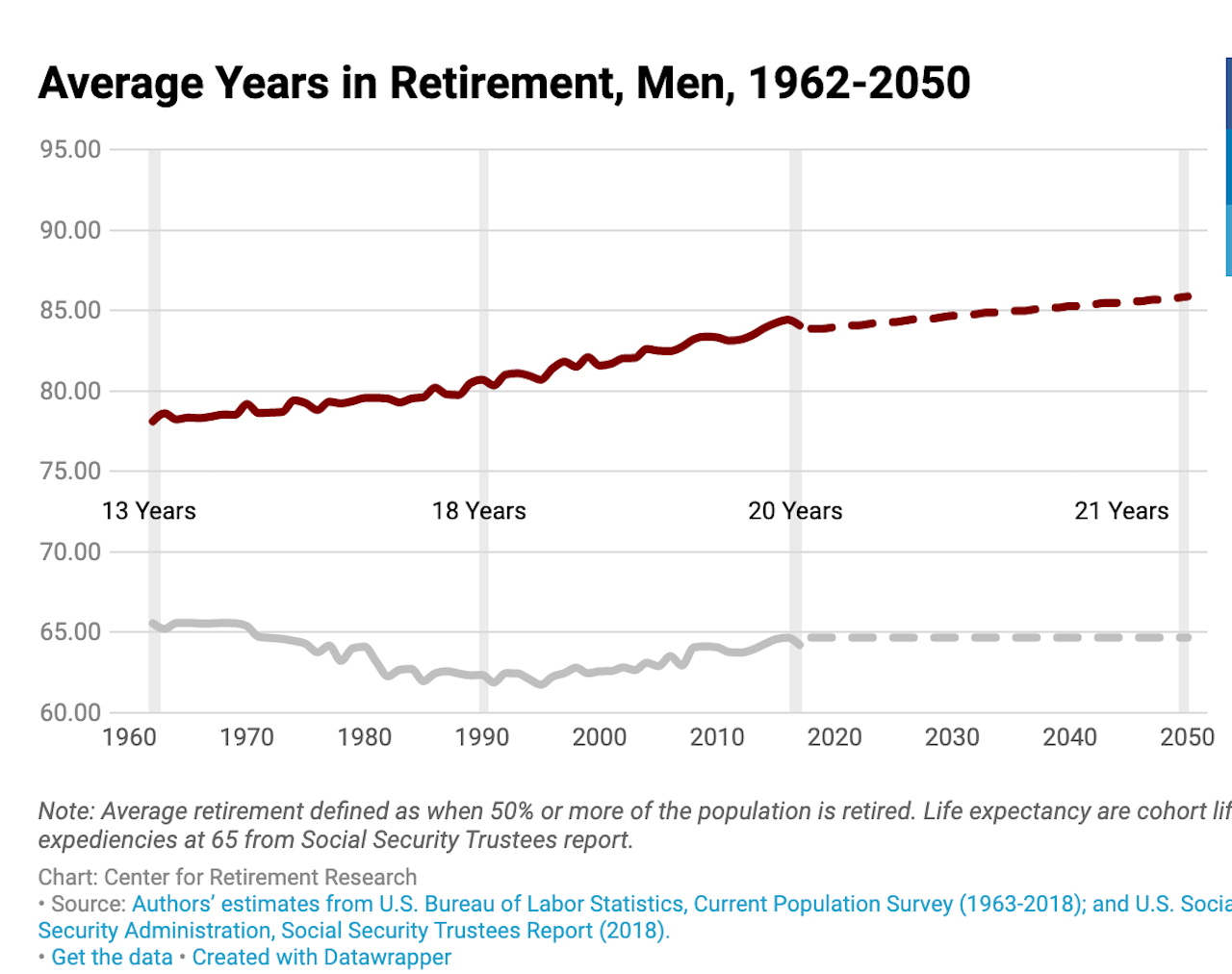

Have a look at Boston College-based Center for Retirement Research data, like its estimates of average years in the retirement span for males here, based on actuarial life-expectancy data, and the CRR's analysis, "How Have Older Workers Fared During the COVID-19 Recession?:"

Essential reading, as well is the Center for Retirement Research's National Retirement Risk Index, updated this past January. Also, check out Pew Research's "How Employees Handle Their Retirement Savings During Work Transitions," which uses data from the University of Michigan’s Health and Retirement Study to look at how people in respective occupational and earnings segments respond differently to earlier-than-expected retirement.

Characterization of the opportunity for housing – not now, but someday – as a solution jumps out in this "a tale of two ... " conclusions among Pew Research's key findings:

Pew’s analysis shows that decisions about retirement savings can vary with income, debt, race, and account balance size, among other factors. Certain policies or employer practices may be helpful when workers and retirees draw down their retirement savings, because they may lack information when they do so; perhaps they have not previously owned an IRA and hence may be less aware of IRA rollover options and fee structures. More financial education delivered at the point of decision-making about topics such as fees and plan and IRA options that preserve assets in retirement may be helpful. When feasible, it should be easy—even the default option—to keep assets in a low-cost retirement account whether that account is an employer plan or an IRA with low-fee investment options.

Financial education, literacy, and planning – basics of housing's ladder to adoption, aspiration, and attainment – go with the turf of expanding market opportunity for the senior housing segment.

Join the conversation

MORE IN Marketing & Sales

Why Homebuilders Should Stop Ignoring the Move-In Moment

Buyers don’t just want a new home — they want a seamless handoff into it. Concierge services may be the zero-cost amenity that becomes a new industry standard.

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.