Land

Homebuilding's Top 10 Trends In 2024: No. 8 Destination Limbo

"We're watching in-migration by market very closely. Along with lack of inventory in the resale market, the key has been in-migration has not slowed in many markets (Charlotte, Tampa, ATL TX, etc). That's the canary in the coal mine." -- A senior-level land strategist

Rate cuts in 2024 are on the table, but don't write them in ink. How does an affirmation of a plan for as many as three cuts in the Fed funds rate sway your land underwriting aggressiveness while three big questions linger on where younger adult households are likely to want to buy new homes?

- Return to the office vs. remote work trends

- Payroll expansion and tight labor vs. higher unemployment and layoffs

- The new geography of jobs vs. the new geography of housing affordability

With what amount of confidence will you bet that one side or the other of these three mega-trend counterforces assert themselves as clear winners? The more "ifs" that are around as land investment underwriting goes on, the more uncertainty around internal rates of return on land. When margins are under pressure already, vacuums of land and lot value uncertainty are likely to be an ongoing challenge for some, and an opportunity for those with money and patience.

When you ask the housing cycle-wizened "smart money" what they're paying attention to most as macroeconomic forces crisscross, reverse course, stall, or accelerate, an area that keeps coming up as a weather-eye-worthy pre-indicator of good and bad residential real estate bets is where domestic in- and out-migration trends end up.

One trusted advisor tells us that underwriting new land deals in the current environment is tricky, not just because lot prices are always sticky on the way down, but because of another X factor in valuations:

We're watching in-migration by market very closely," he says. "Along with lack of inventory in the resale market, the key has been in-migration has not slowed in many markets (Charlotte, Tampa, ATL TX, etc). That's the canary in the coal mine."

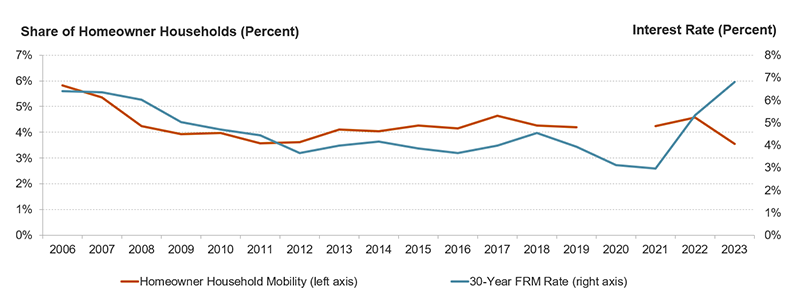

Local economics, of course, exists in a chicken-and-egg relationship with in-migration trends. However, housing affordability, a new analysis from Harvard's Joint Study for Housing Studies senior research analyst Riordan Frost suggests, has been playing a big role in muting national domestic migration trends since an early-Covid-era uptick in 2020-21.

The JCHS' Frost writes:

Given the current scale of the lock-in effect and the established negative relationship between this effect and homeowner residential mobility, further declines in mobility should be expected in the short term. This could have several broad economic effects. For one, lower mobility could result in inefficiencies in the labor market as households are less likely to relocate to more productive areas or areas in need of workers. The lock-in effect represents an additional moving cost, and research has shown that moving costs can lead to job misallocation and less job-seeking. This could also affect household utility as people will be less likely to move even as their family size or other needs (e.g. schools, health care) change. This could in turn increase traffic as people turn to commuting instead of moving, as one study theorized."

If the Fed's newly announced funds rate reductions go as planned in 2024, mobility trends might experience an uptick as the big lock-in-effect cohort starts to kick back into more typical life stage-driven behaviors like downsizing and moving into forever homes. JCHS analysis Frost concludes:

Increased housing supply could alleviate house prices and give households more options when they want to move, possibly outweighing the lock-in effect. In the absence of those changes, mobility is likely to stay low for homeowners as the lock-in effect, the housing shortage, and rising prices incentivize staying put."

So, the three funds rate cuts now under consideration for 2024 are a big "if" that ties to continued progress in the war on inflation, as well as how rapidly and deeply the overall economy starts to cool off as part of that effort.

Where the jury's still out is whether what has been hot local economies start to lose momentum and turn from in-migration magnets into out-migration hubs, especially if they're closely tied to industry sectors that slow down more dramatically.

Equally important, some of the "path of growth"-style outer circumference development and investment that has become a big focus of demand – more affordable and viable in a hybrid work or remote work backdrop – may also get a stress test for sustainable growth. If unemployment rates start to go up, and slack starts to form in the workforce, employers – most of whom are keen to bring staffers back into their offices, and would regain leverage in a weaker jobs economy – some of those farther out suburban areas that have gotten a pandemic boost may once again lose some luster.

In the swirl of tailwinds and headwinds in housing, it's our view that post-Covid domestic migration and mobility decisions and commitments have passed their peak and are trailing to a new norm.

And very likely we won't have a clear set of contours and sustainable patterns on that new norm until well after 2024. That's what we call Destination Limbo.

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.