Leadership

Homebuilding's Talent Compensation New Normal: Talent Over Dirt

Exclusive: The 2024 FTS Compensation Report reveals why people-first investments drive resilience in today’s land-light operational and capital investment models.

For decades, homebuilding strategies have been built on land, a finite resource that anchors both opportunity and risk.

However, a steepening trajectory of land-light and asset-light models reveals an undeniable truth: the strength of an organization’s people now outweighs the value of the dirt they develop.

The newly available 2024 FTS Compensation Report underscores the critical role that adaptability, agility, nimbleness, and resilience in talent play in driving success, particularly in a volatile yet opportunistic market.

[Here's the link to access the 2024 FTS National Homebuilding Compensation Report.]

FTS CEO Thomas Carpitella explains,

Builders should view the results of this year’s compensation report to understand better where skillset demands are trending. These compensation trends will follow suit as the industry continues to consolidate, driven by large-scale M&A and tightening land pipelines. Builders must know about the competitive landscape with their talent — what their competitors are likely paying and how to remain competitive regarding acquiring and retaining top talent in the industry.”

Land-Light and Asset-Light Models

Builders — modeling asset-light pioneer and paragon NVR — adopting these models, such as Lennar and Dream Finders, rely on partnerships and land options rather than extensive owned lot pipelines. This requires high-caliber professionals adept at navigating complex entitlement processes, maintaining deal flow, and mitigating risk.

Carpitella notes,

The large publics are only getting bigger; over time, they will continue to control the vast majority of talent within the homebuilding industry at its highest level. Remaining competitive from a talent perspective should be smaller builders' top priority.”

Construction Cycle Optimization:

- Faster build cycles and smoother volume management are key drivers of profitability. These require excellence in operations management and project execution, roles that will see some of the highest compensation increases in 2024.

Customer-Centric Design and Delivery:

- To meet evolving buyer expectations, builders need strategic sales and marketing leaders who understand the intersection of affordability and customization.

Structural Factors Driving Compensation Trends

Persistent Structural Demand

The underlying strength of demographic-driven demand remains a pillar for homebuilders. Millennials and Gen Z are increasingly forming households, ensuring robust demand despite economic headwinds.

- Constrained Supply: Regulatory, zoning, and permitting barriers, coupled with a chronic undersupply of available homes, have created a persistent imbalance that demands innovation and adaptability.

- Human Capital as a Differentiator:

Compensation growth reflects a strategic pivot toward prioritizing roles that directly contribute to operational excellence and value creation, including:

- Land acquisition and development professionals.

- Operations, estimating, construction, sales, and HR leaders.

- Creative and scalable experts in marketing, IT, and design.

Why Talent Matters More Than Ever

The FTS report's year-over-year comparisons illuminate the accelerating need for talent, especially in strategic roles related to land acquisition, operational excellence, and extracting customer-centric delivery. Maximum value from minimal land holdings demands a workforce that can innovate, adapt, and execute precisely.

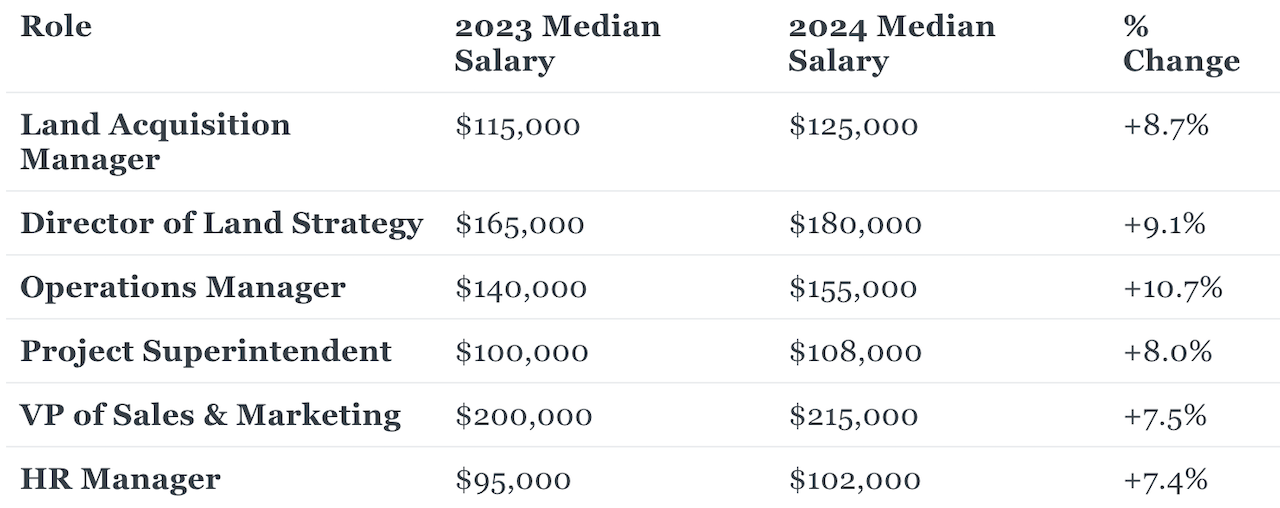

Compensation Trends: Year-Over-Year Insights

The 2024 report demonstrates significant increases in salaries across several high-priority roles. This reflects a strong demand for talent that can drive business value and underscores the competitive pressures to attract and retain the best people.

Key Comparisons

- Division Presidents (revenues above $50M):

2023: $235,000–$290,000 → 2024: $246,000–$325,000

Increase: 4.7% to 12.1% - Vice Presidents of Construction (revenues above $50M):

2023: $181,000–$215,000 → 2024: $192,000–$210,000

Increase: 6.1% to 4.7% - Across-the-Board Average Increase for All Roles: 6.5% year-over-year.

FTS CEO Thomas Carpitella frames this data within the broader competitive landscape:

Builders must understand where skillset demands are trending. Remaining competitive from a talent perspective should be smaller builders’ top priority, especially as public builders continue to dominate market share."

Key Insights:

- Land Roles: Salaries for land acquisition and strategy roles saw the steepest increases, reflecting the need for expertise in entitlement and market analysis amid limited land supply.

- Operations: Rising compensation in operations underscores the value of streamlining build cycles and enhancing construction quality.

- Sales & Marketing: Increasing pay for sales and marketing leadership highlights the strategic importance of engaging buyers and addressing affordability concerns.

As FTS Director Liz Perkins observes,

We’re proud to unveil the second edition of our Homebuilding Compensation Report, thoughtfully designed to support builders during their critical annual planning season. The year-over-year trends, including significant compensation growth for land and operations professionals, reveal how builders are aligning resources with strategic priorities.”

High-Level Approach to the 2024 FTS Compensation Study

The 2024 FTS Compensation Report represents a thorough and credible benchmark for the homebuilding industry, offering actionable insights into compensation trends across various roles and organizational levels. Designed to support strategic decision-making, the report provides essential data for builders, hiring managers, and professionals seeking to navigate a rapidly changing market with clarity.

Methodology and Sample Size

The 2024 study drew on responses from over 10,000 homebuilding professionals across the U.S., with a robust 18% response rate contributing to approximately 1,800 detailed data points. The dataset spans a wide array of roles within public, private, regional, and national homebuilding organizations. A rigorous data cleaning process ensured accuracy, with bi-weekly reviews conducted by industry specialists to validate trends and align job roles with standardized categories.

The result is a reliable and detailed resource for compensation planning, offering key insights into base salaries, bonus percentages, and year-over-year growth. With its expanded scope and precision, the report stands as a trusted tool for understanding how compensation strategies align with evolving priorities and organizational structures.

The Four Virtues of High-Performance Organizations

The 2024 report positions four critical virtues — adaptability, agility, nimbleness, and resilience — as essential for organizational success in today’s environment. These traits, embodied by top talent, allow builders to navigate both near-term challenges and long-term opportunities.

Adaptability

- Builders must adapt to shifting economic conditions, including fluctuating interest rates and land scarcity. This requires professionals who can assess risk and pivot strategies in real time.

Agility

- Agile teams are indispensable for managing demand spikes, supply chain disruptions, and regulatory changes. Incentive-driven compensation structures can reward this capability.

Nimbleness

- With public builders dominating market share, smaller firms must act decisively in land deals and operational adjustments. Hiring nimble decision-makers is key to competing effectively.

Resilience

- Resilient organizations invest in training and retention, fostering a workforce that can sustain high performance through economic cycles.

Key Takeaways for Homebuilding Leaders

Leverage Trusted Compensation Data: Reliable benchmarks are indispensable for competitive hiring. As Perkins highlights,

We hold ourselves to the highest standards of data integrity, rigorously cleaning and monitoring responses throughout the year.”

Prioritize People Over Land: Building talent pipelines should rank alongside land investments in strategic importance. Teams skilled in evenflow construction cycles and customer engagement will drive value far beyond what land alone can deliver.

Anticipate Consolidation Trends: Carpitella notes that industry consolidation is shaping compensation trends. Smaller builders must proactively adapt to avoid talent losses to larger public builders.

Plan for 2025 and Beyond: Lower interest rates and demographic demand suggest growth opportunities, but only well-compensated, high-performing teams will be positioned to seize them.

People Are the New Bedrock

As homebuilders prepare for 2025, the 2024 FTS Compensation Report serves as both a diagnostic tool and a strategic guide. It reveals not only what’s happening but why it matters: talent, not land, is the bedrock of modern homebuilding success. By investing in their people, organizations can ensure resilience and agility in a rapidly changing environment, setting the stage for sustained growth and value creation. Homebuilding leaders must embrace the reality that their organizations’ success in 2024 and beyond depends as much on their ability to invest in people as it does on their land strategies. As Liz Perkins reflects:

We’re already exploring enhancements for next year, such as deeper segmentation by builder type and size. Our mission is to support builders with actionable insights that help them plan for the future with confidence."

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.