Policy

Homebuilders Get Caught In The Appraisal Gap Vortex

The lag time between market pricing, comparables, and fair appraisals -- already an issue prior to the pandemic -- puts more potential buyers at risk of failure as they try to qualify for loans in hot markets.

Whac-a-mole, an arcade game whose apocryphal origin story dates to the pre-Pac-Man era mid-1970s, is on a lot of people's minds these days.

Today's constantly emerging array of mini- and not-so-mini disruptions and crises challenge builders' skills at dispatching them with decisiveness and alacrity, with an immediate pivot to the next, and then the next, and then the next emergent critical path issue.

Some of the issues sequence with one another, as in a domino effect. Others occur at oblique angles, and still others appear to be unrelated to the rest – although it could be argued that the pandemic may play at least some role in them all.

One that does trace directly to the particular, pandemic-caused stresses, dysfunction, anxiety, bad-blood, price flux, and overall cost impact under the broad heading of supply chain challenges – a Mole builders must try to whack – has reared its head.

The appraisal gap, which CoreLogic chief appraiser Shawn Telford writes about here, was a thing prior to the pandemic, but now – as a consequence of supply disruptions and input price inflationary pressure – it's a phenomenon.

For builders, the gap represents a structural risk of shrinking their buyer pool, which puts both margins and sales volumes at peril.

Here's how Telford characterizes the appraisal chasm.

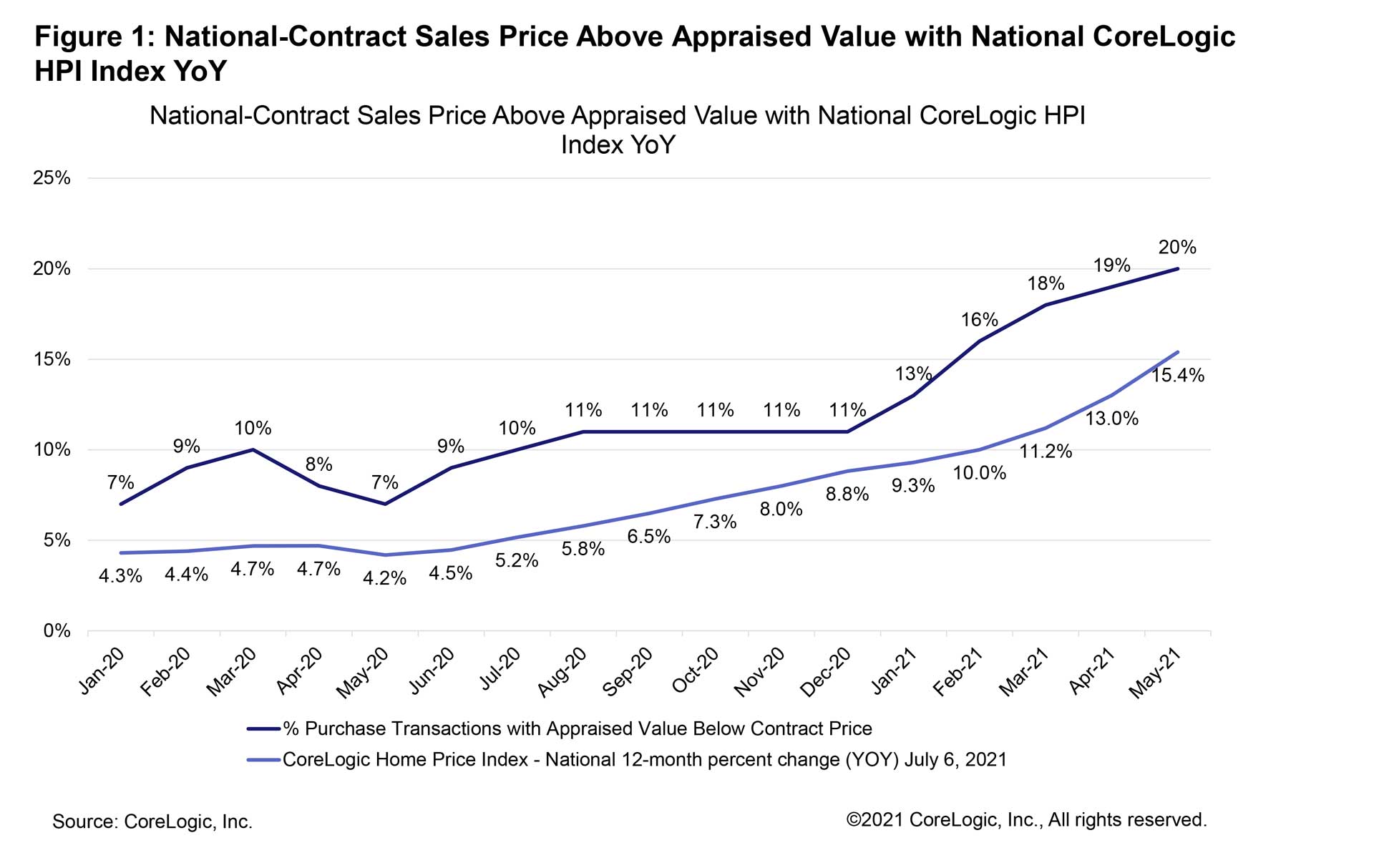

Beginning in January 2020, nationally, 7% of purchase transactions had a contract price above the appraisal, but by May 2021, the frequency had increased to 19% of purchase transactions. As expected, the frequency of a contract price being below the appraised value decreased from 69% in January 2020 to 52% one year later. The frequency of the appraised value matching the contract sales price remained relatively flat, moving from 24% to 29%.

Homebuyers can be negatively impacted when the contract sales price is above the appraised value as lenders use the lower of two values to calculate the loan-to-value (LTV) ratio. This scenario can require borrowers to bring more cash to closing to “close the gap,” or they may need to pay for mortgage insurance as their LTV is higher than planned. In the worst-case scenario, the sale falls through as the anticipated financing doesn’t work out.

During the same period, the CoreLogic Home Price Index (HPI) began a steady climb, moving from 4% annual growth in January 2020 to 15% through May 2021.

At highest risk in this squeeze are homes builders have designed, planned, and value engineered to fall within price ranges where buyers can qualify for Federal Housing Administration, Fannie Mae, and Freddie Mac-backed mortgages, which cap loan amounts and set loan-to-value limitations.

It's a Whac-a-mole challenge where one slam of the mallot won't likely make the problem go away.

Join the conversation

MORE IN Policy

California Breaks CEQA Barrier To Reignite Housing Production

Championed aggressively by Gov. Gavin Newsom, the historic environmental law reform unlocks the potential for infill housing—and could become a model for other high-barrier states.

Governor’s Veto Derails Connecticut Upzoning Push

State leaders aim to regroup for a fall special session after a housing bill faces resistance from local zoning defenders.

Can California Clear A Better Path To Housing Stability?

Berkeley’s 8-year “step-up” project exposes the true cost of building even the simplest housing. A test case in transition: When red tape meets a desperate need for shelter.