Leadership

Chain Reaction: How Will Builders Respond To Input Pressures?

Back-half margin compression looks likely as homebuilders absorb input cost spikes and hit selling price push-back.

The building materials and products supply chain guru frowns, worry deeply furrowing his brow.

"Have the homebuilding executives started saying it yet,?" he wonders. "Their margins," he says, as he does the mental math of adding the spate of materials costs increases to their direct input expenses. "They're not going to be able to hold their per-unit gross margins unless they can pass it all along to their homebuyer customers."

There are two issues here: What is happening is one. What builders do is the other, more intriguing and materially important issue with respect to the 2021-22-and-2023 plotline for the for-sale market-rate housing business.

The second issue, while more critical, is open to question. And that's a positive. We'll explain.

But first, the first matter: what is happening.

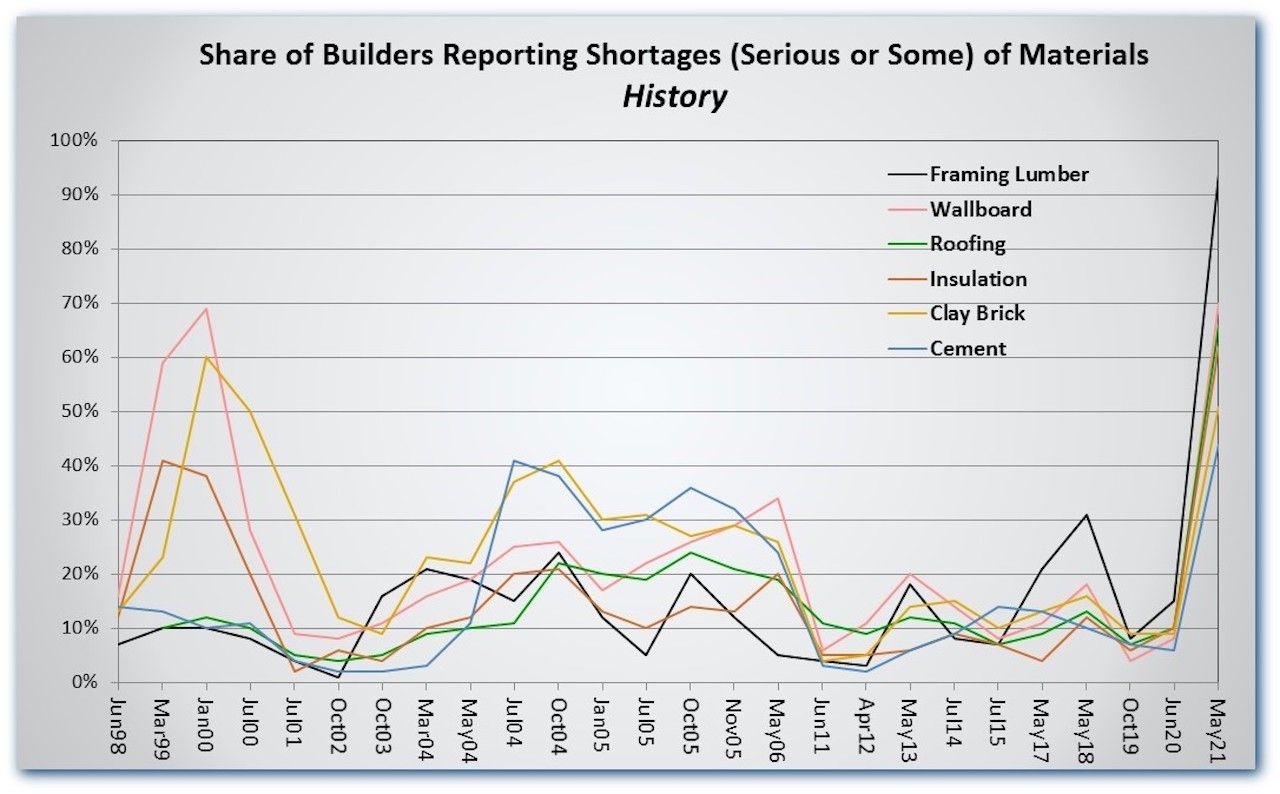

Record Numbers of Builders Report Material Shortages

- No news here, really, but as Paul Emrath, National Association of Home Builders vp for Survey and Housing Policy Research, notes, at least nine out of 10 builders report shortages of appliances, framing lumber, OSB, and plywood, and practically as many can't get adequate supplies of windows and doors.

- Short supplies of more than two dozen varieties of materials and products – mostly a function of COVID-19-caused supply disruptions – have created historically adverse conditions for input cost visibility and management.

Now, let's take a look at the second matter at hand: builders' reactions to these record-setting adverse circumstances. That leaders today may actually take stock and reckon with how individual enterprise reactions to supply-demand spasms can roll up to more sweeping adverse consequence is a glimmer of encouragement.

Here's why.

As the supply chain's paroxysms play out enterprises with the deepest pockets and nimblest capital resource capabilities will look to lock in their access to scarcer, more expensive goods and services in the channel, and block out others.

They'll pay what it takes, and they'll hoard. It's a natural, reflexive behavior, and Bloomberg's Tracy Alloway and Adrian Kennedy write about hoarding's impact on economics and expectations here.

Last year, the world became intimately acquainted with the idea and practice of hoarding toilet paper. Grocery shelves were suddenly cleared as people rushed to build up their own personal supplies of the white stuff. While the supply of bathroom tissue hadn’t suddenly changed, a sharp jump in demand for it created the appearance of a shortage.

Now, Bank of America economist Ethan Harris points out that the toilet paper-esque strategy of hoarding has gone global, in the sense that more and more companies are buying essential materials, components and other inputs, in order to manage potential future supply shocks and deal with resurgent demand.

“The clogging up of global supply chains could ease over time as specific shocks fade, but the fundamental problem is one of strong demand and low inventory. New technology such as tracking systems has enabled businesses to operate with very low inventories. That is great in good times, but it makes the system highly vulnerable to disruption. Even worse, faced with shortages companies are starting to double order to ensure that they are high in the queue. This is the business sector equivalent of emptying the grocery store in front of a hurricane or hoarding gas or toilet paper at the first hint of shortage.”

What this means – and it is going on as we speak in a lumber and building products and materials supply channel where "every-man-for-himself" has begun to stress and strain relationships at every turn – is the prospect of inflation eroding the basis of trust.

Alternatively, given the fact that many companies in residential construction's complicated ecosystem have spent the past decade or more evolving "core values" statements rooted in engendering and sustaining trust, one might imagine the possibility of a behavioral pivot.

It's not what happens to you, but how you react to it.

React, respond, or initiate?

That’s pretty much all that’s on offer.

What will you do next?

The first gives us visceral satisfaction and emotional release, and it almost always leads to bad outcomes.

Responding is smarter. It requires each of us to think hard about the action and emotion we seek to create after something is put on our desk.

And the third? Initiating is ever easier and leveraged than ever before, which, surprisingly, also makes it more difficult to move up on our agenda.

The economics of housing – including its cycles of boom and bust – are behavioral economics. It's a people business. Whether it's the supply chain, or the chain of value in a building lifecycle of investment, land development, design, distribution, construction, and marketing and sales, hand-offs from person to person happen, increasing or subtracting value.

Builders can choose. Per-unit gross margins are a choice, not necessarily a chain reaction of others' choices.