Land

As Lot Prices Soar, Risk Rises For Homebuilders' Margins, Sales

It's musical chairs time in residential land acquisition and development, with more contestants in the game, surging unmet need for shelter, and a lot to gain for the winners.

Two problems for a homebuilding firm in today's sizzling seller's market.

One is delivering up already-sold homes on time and on budget, and actually being able to take on new orders for the business backlog.

The other is that – in today's sizzling seller's market – if builders are going to be sellers, then first they've got to be buyers. Balance sheets for builders, like any other going concern, typically consist of "what comes in" and "what goes out." Builder's may get to be beneficiaries of a seller's market for the "what comes in" side of their balance sheets. However, for the "what-goes-out" side, they're the ones buying in a seller's market, and they're taking a beating that makes projecting profitability a menacing challenge.

Public – and public official – perception tends to focus almost exclusively on homebuilders as sellers. It's easy for the lay person to forget that all those pieces and parts that go into making a home and a community have to be purchased and assembled on a piece of purchased property in order to be sold to a homebuyer.

It's even easier for that lay person to fail to recognize a reality that, like would-be homebuyers in today's frenetic rush to purchase, the more would-be buyers there are, the more a tight supply pressures selling prices higher, and higher, and higher.

Builders large and small, developers, land bankers, institutional capital portfolio investors in the U.S. and abroad, foreign-based strategic buyers – everybody wants in on the U.S. new residential construction and real estate game now. It's too enticing not to want in. More people, more households, more employment in a still-expanding economy, together with not enough homes sets up as a very solid speculative bet that sellers will do well for the foreseeable future.

But only if they can also be clever, exceptional buyers of the raw inputs they have to pay for – land, materials, capital, people.

Here's just a piece – and a critically important one at that – of that problem in today's market. National Association of Home Builders assistant vp for Housing Policy Research Natalia Siniavskaia, Ph.D., writes:

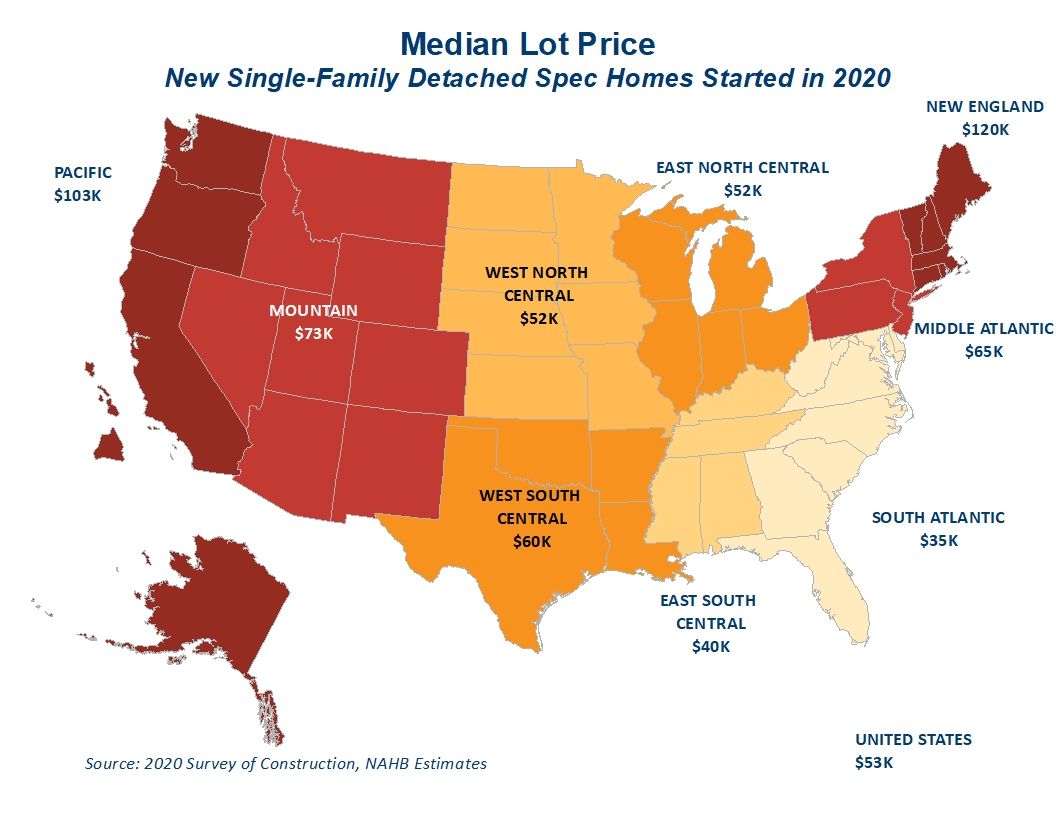

Lot values for single-family detached homes started in 2020 surged 18%, according to NAHB’s analysis of the Census Bureau’s Survey of Construction (SOC) data. As a result, the median lot price reached a new record high of $53,000. Though an 18% jump in lot values is unprecedented, it is consistent with other significant building material price hikes and undeniable supply challenges that have been constraining the pandemic-fueled housing boom.

Siniavskaia notes that after adjusting for inflation, the current median price for a homesite is edging toward 2005-2006 levels, a time economists, analysts, experts, and their uncles and mother-in-laws remember as a housing bubble.

As a percentage of what builders get when they're sellers in today's market, lot values clock in at about 14.6% of median new-home prices of about $362,000.

To be fair, as the NAHB's Siniavskaia observes, half the building lots sold in the U.S. price in at below the $53,000 median, and half the new-homes sold in the U.S. carry price-tags lower than $362k.

The intensifying business risk issue for builders is – assuming that the spell of soaring building materials prices runs its course and, Covid Delta variants permitting, supply chains and building trade capability stabilize in the coming months – calculating the forward rate of change in lot prices.

The heft and sway of sheer demographic growth notwithstanding, the need for more shelter versus the level of effort, difficulty, and cost of producing it will be a defining business challenge for residential real estate in the 2020s.

The good news is that land bankers – those who can benefit as both buyers and sellers of precious homesites – have been raising their game as value-providers who smooth-out the upward spikes in lot costs and availability.

An X-factor in the current push-pull environment that's elevating – escalating – lot internal-rate-of-return models remains the structural strength of the economy through a turbulent fiscal and monetary policy period ahead.

People and companies who pay tend to overpay when there are more buyers around and less to sell. When it comes to land, the price of overpaying gets very high very quickly.

Join the conversation

MORE IN Land

As More Would-Be Buyers Opt To Wait, BTR Demand Heats Up

As consumer households hesitate to purchase until signs of clarity emerge on the pricing, interest rate, economic and political backdrop, etc., the industry could witness a shift from owning to renting, a change worth watching.

Misawa's 51% Buy Of Visionary Homes: A Theme And Variations

The combination is Misawa's second U.S. market inroad, having completed a similar deal to take a majority interest in North Texas operator Impression Homes in December 2018.

The Elephant In The Land Acq Room: Underwriting For Inflation

We need to underwrite where we would operate today on present conditions, which hopefully is a floor under our speculative ceiling.