Policy

A Tale Of Two Markets: Housing's Split Personality Challenges All

The Harvard Joint Center for Housing Studies annual analysis, "The State of The Nation's Housing 2021," releases today, diving deep in the data that tells housing's sharp divides.

Color-coded, the numbers tell a story of housing in America, sharply delineated, stratified, and divisible among haves who are gaining, and have-nots losing more with each passing day.

In its top layers, livability in all its wondrous dimensions – indoor-outdoor living and dining, human-scaled lighting, air exchange and room comfort, water purity, noise reduction, a yard, a walkable community – are the must-haves of well-being that, spurred by dirt-cheap mortgage interest rates, have galvanized both for-sale and for-rent single-family new home demand.

But below those layers, home each day means having to try to pick which bill one can't afford not to pay, or else.

The Harvard Joint Center for Housing Studies annual analysis, "The State of The Nation's Housing 2021," releases today, diving deep in the data that tells housing's tale of two markets.

Chart after chart after chart, each a data picture worth tens of thousands of words and countless accounts of human hardship and disparities in all their naked reality.

New York Times writers Conor Dougherty and Glenn Thrush write:

Like the broader economy, the housing market is split on divergent tracks, according to the annual State of the Nation’s Housing Report released on Wednesday by Harvard’s Joint Center for Housing Studies. While one group of households is rushing to buy homes with savings built during the pandemic, another is being locked out of ownership as prices march upward — and those who bore the brunt of pandemic job losses remain saddled with debt and in danger of losing their homes.

“Millions of households were financially unscathed coming out of the pandemic,” said Alexander Hermann, senior research analyst at the Joint Center for Housing Studies. “But the pandemic has left millions of others struggling to make their housing payments, especially lower-income households and people of color.”

Dougherty and Thrush focus most on an immediate, quickly moving-target matter that embraces the equally-urgent interests of mid-to-low end property owner landlords and managers versus their renter-residents, many of whom continue to be protected from eviction despite months of not paying their rent.

They write:

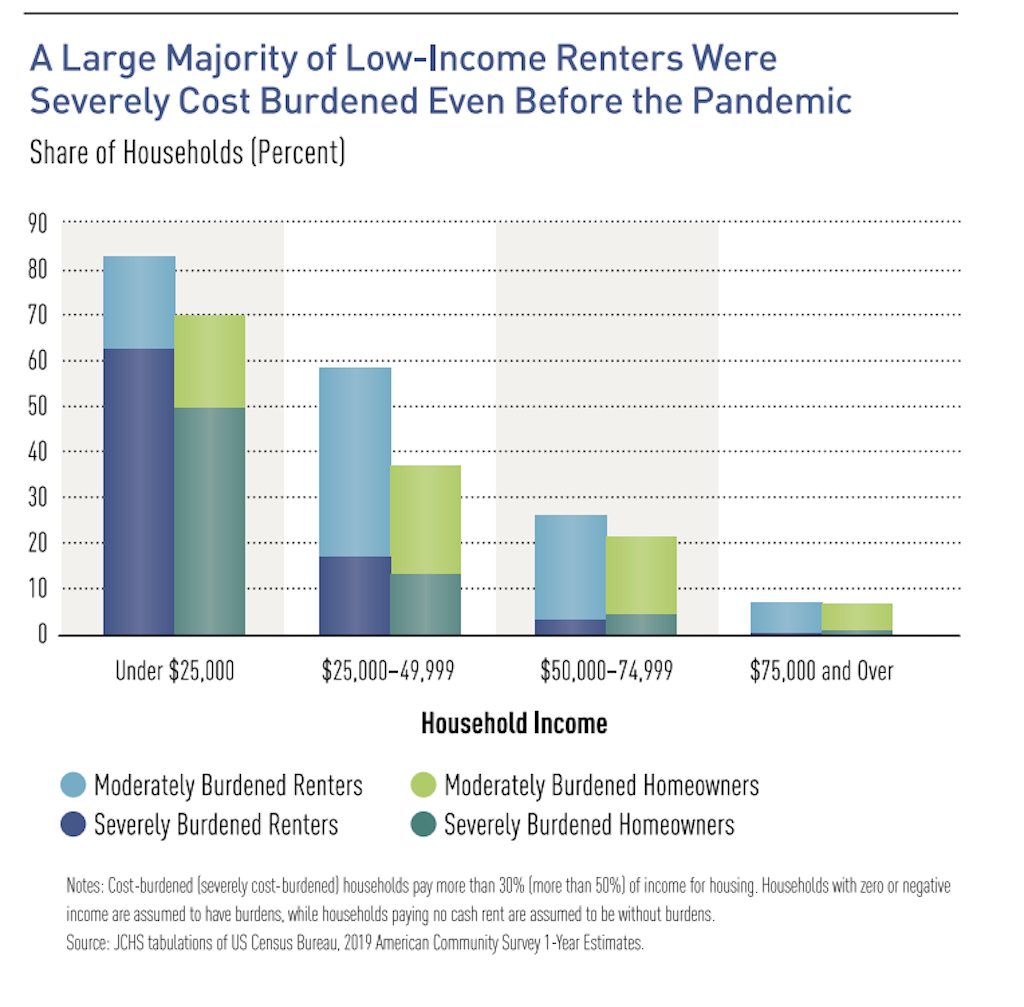

The moratorium was never much more than a stopgap that has done nothing to address a worsening nationwide housing affordability crisis caused by gentrification, the wealth gap and a chronic shortage of housing for the working class and poor. Even before the pandemic, one in four rental households was paying more than half its pretax income on rent, while homelessness was on the rise. Since then, more than half of renter households lost income, and 17 percent were behind on rent earlier this year, according to the Harvard report.

The reasons this parallel-realities gap challenges not just those whose focus is low-income and supportive housing but the entire market-rate ecosystem track directly to the taproot of the American Dream, economic mobility that comes of a fair shot at opportunity and hard work.

That can't happen when a chasm – widening by step-change measures year after year, and table upon table – pertains not just to fair, healthy, decent shelter, but, rather, to the capacity to cope.

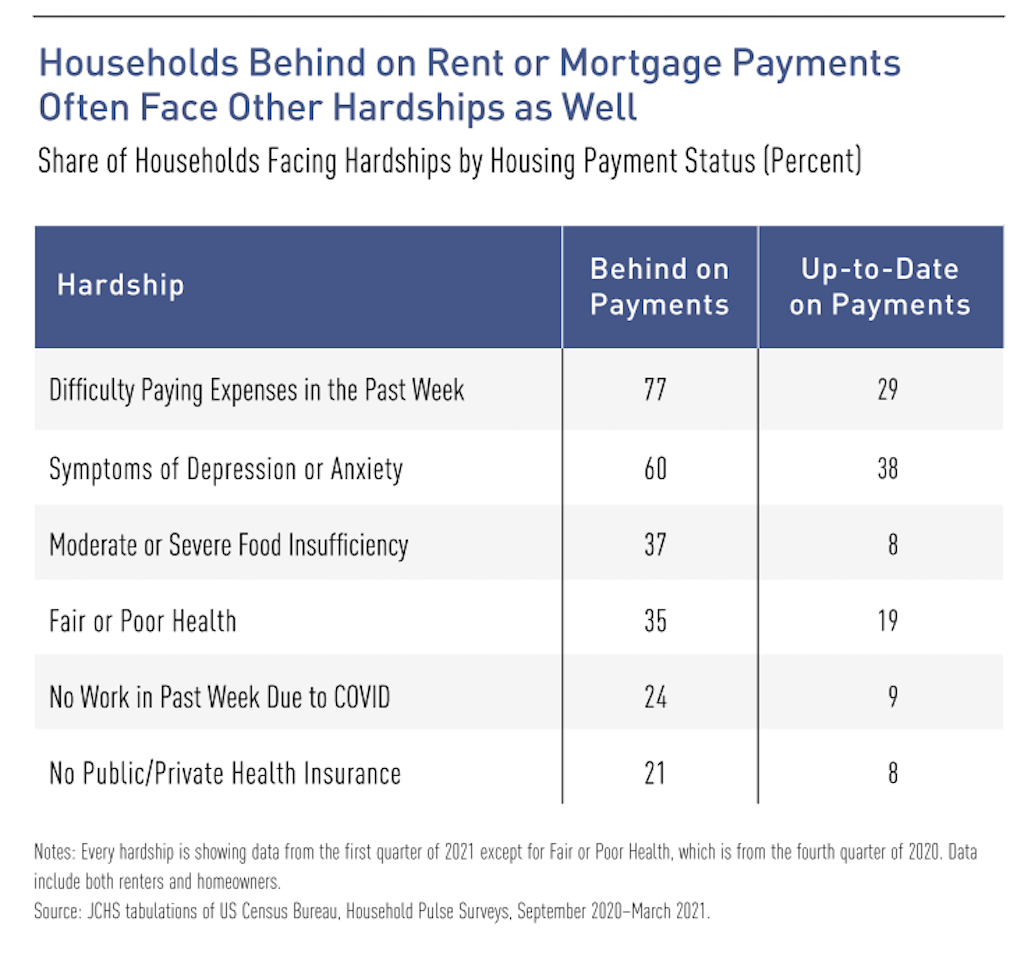

The pandemic has highlighted how vital affordable, good-quality, and well-connected housing is to health and well-being. Indeed, the Household Pulse Surveys in the first quarter of this year show a clear relationship between the stress of being behind on housing payments and the incidence of other hardships. For example, more than three-quarters of households that were unable to cover their rents or mortgages also struggled to pay other expenses. Some 60 percent of households in arrears experienced feelings of depression or anxiety, while 35 percent reported being in fair or poor health. Many of these households may have little recourse to get help with these health issues, with a fifth having no public or private health insurance.

The tale of two markets in housing is at the crux of housing's opportunity – rather, the leaders of homebuilding, development, apartment construction, property management, real estate investment, as well as manufacturers, distributors, and their partners – to lead to solutions that expand and improve the sector's role in helping to knit more resilient societal fabric in the years ahead.