Policy

A 20-Year Gap Of 5 Million Homes Not Built Defines '20s Challenge

In shock-therapy approach, the National Association of Realtors calls on lawmakers to call housing what it is ... infrastructure, and fund it accordingly.

If during every 60 minutes that went by in every one of the 7,300 days that make up the past 20 years, 29 homes for 29 households came online in the United States, the current case to make housing a pillar of American infrastructure would be weaker.

A newly constructed or refurbished home for a family every two minutes is what it would have taken.

That didn't happen. What happened instead was stagnating payment power – household incomes -- for an ever larger segment of the population, as costs and prices for homes unspooled upward, mitigated only by either exotic finance confabulations or a heavy thumb on the scale of mortgage interest rates.

Then, bam!

This article, from Wall Street Journal staffer Nicole Friedman, surfaces an order-of-magnitude high-water mark for housing's challenge that researchers, analysts, and advocates hope can shock lawmakers into action.

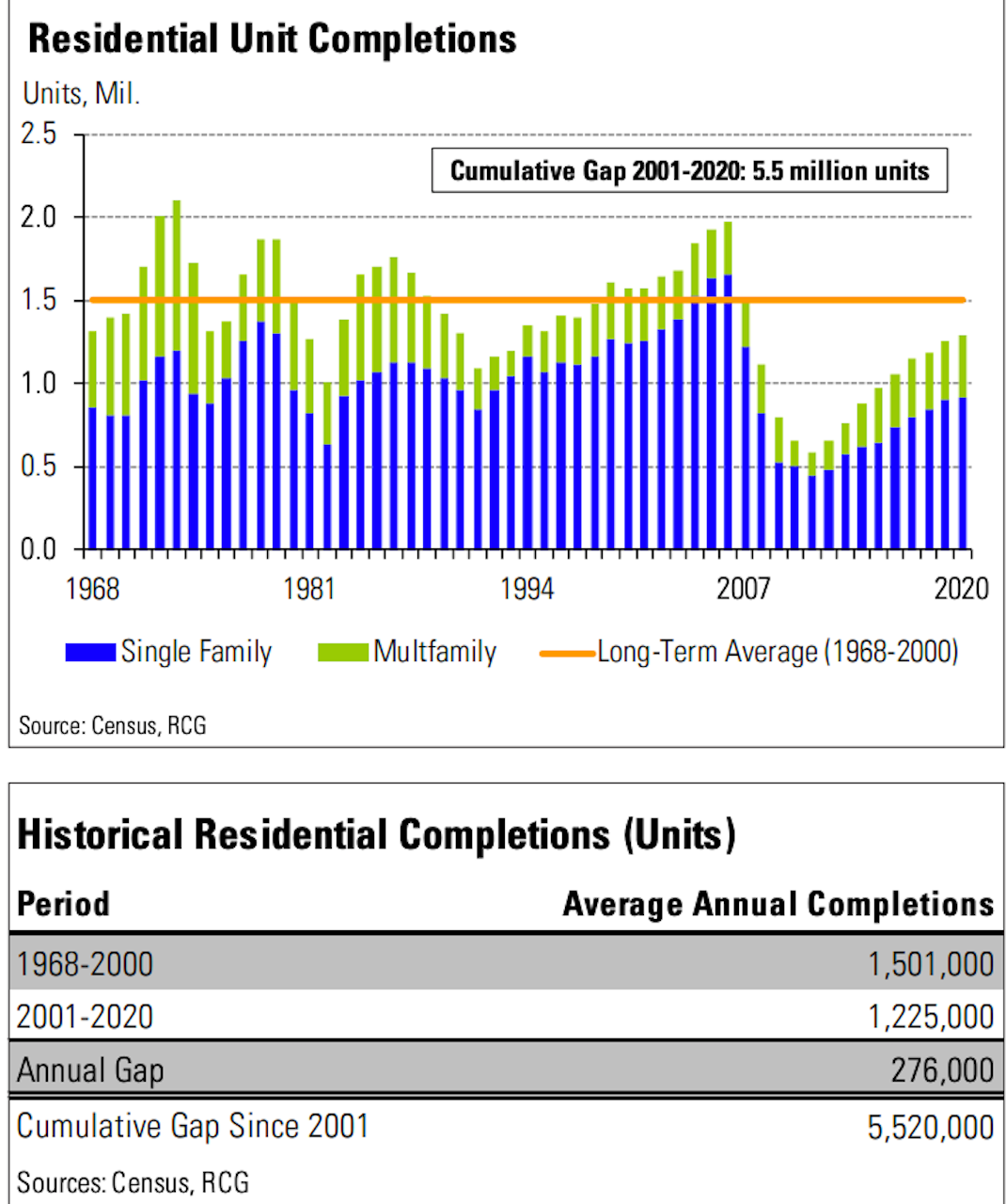

Construction of new housing in the past 20 years fell 5.5 million units short of long-term historical levels, according to a new National Association of Realtors report, which is calling for a “once-in-a-generation” policy response.

The industry lobbying group said it hopes the report, which was released Wednesday, persuades lawmakers to include housing investments in any infrastructure package.

U.S. builders added 1.225 million new housing units, on average, each year from 2001 to 2020, according to the report, which was prepared for NAR by Rosen Consulting Group LLC. That figure is down from an annual average of 1.5 million new units from 1968 to 2000.

The question is, can this math – and its underlying narrative of who's effectively been cut out of access to the American Dream of economic justice and mobility in a housing business complex that rewards fewer and fewer and punishes more and more -- act as a catalyst?

Five million missing homes. How do you fairly do the arithmetic on the health, educational, financial, and cultural consequence of underbuilding that number of shelters in communities for people who had to come up with a Plan B, or Plan C, or no plan at all?

The number – five million – or one home every two minutes every single day of every year for the past 20 years, is, of course, open to debate.

In Nicole Friedman's WSJ analysis, she notes that economists "differ" in their estimates of the role of underbuilding to account for supply and demand stresses of the moment. She writes:

In a study earlier this year, mortgage-finance company Freddie Mac estimated that the national deficit of single-family homes stood at 3.8 million units at the end of 2020.

Industry consultant John Burns said by his estimate, the U.S. has a deficit of fewer than a million homes. “Our adult population isn’t growing as fast as it used to,” said Mr. Burns, chief executive of John Burns Real Estate Consulting LLC. Compared with decades before 2000, “we don’t need to build as much,” he said.

National Association of Home Builders chief economist Rob Dietz and senior economist Natalia Siniavskaia zero in on U.S. vacancy rate data for insight in detecting housing's shelter shortage and the supply short-fall's impact on affordability.

In Dietz's view, shared with TBD:

Adding up the vacancy shortages across metro areas with abnormally low vacancy rates, there is a shortage of about 1 million vacant units (600,000 rental and 400,000 units for sale) nationwide.

Comparing apples to apples, population and household flux, fertility-mortality-life expectancy rates versus new construction, versus the age of housing stock, versus the ability remodel and renovate with new more durable and resilient materials, etc., the math still adds up to one conclusion.

Housing – with its impact on human health, educational mobility, social and economic justice, environmental balance, economic dynamism – is, in no uncertain terms, infrastructure. And, more than that, housing is a solution that, when it works, balances private sector stakeholder value and equity creation with public sector efficacy and even-handedness.