Technology

With All The Reasons Why, What's Holding Back Building's Technological Pivot?

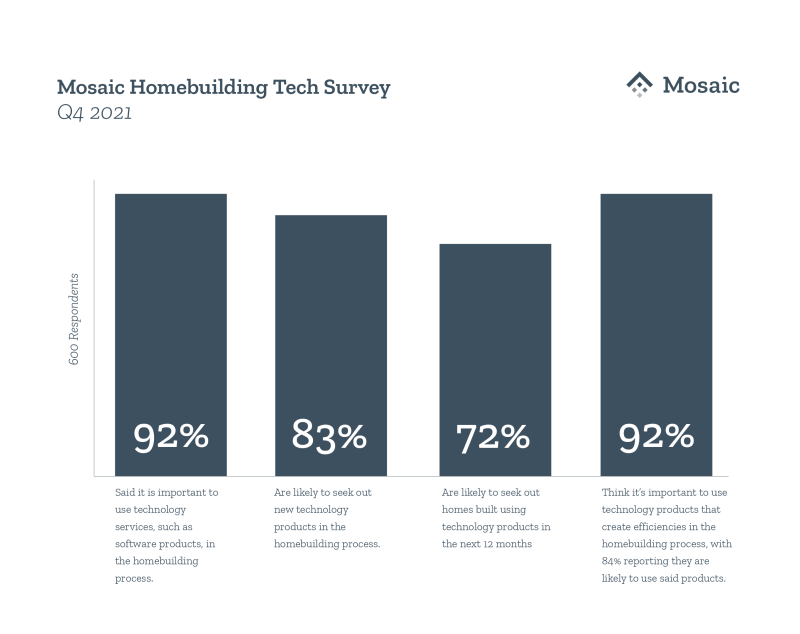

New data from Phoenix-based Mosaic show encouraging signs builders are embracing technology to a greater degree as they deal with today's raft of construction and supply chain challenges.

Which of the following capability struggles homebuilders face at this intense mixed-signals moment would not be eased by the latest array of industrialized manufacturing technology solutions for start-to-completion building lifecycles?

- Supply chain

- Skilled labor

- Schedule predictability

- Weather-proofing

- One-time quality

- Materials waste

- Structural performance

- Velocity

We'll come back to your answers to the question. First, we'll consider why there may be a gap between logical answers to them and what will actually happen in 2022, a year like the past two or three that should have signaled an inflection point embrace of exponentially-growing tech solutions in new construction.

A brief digression.

There are memes these days for a lot of things. One is the state of being in two different conversations on the same topic with the same person in the same instant. But it doesn't require two or more devices, nor any devices at all for that to occur. It can happen sitting across a table from one another in the same room.

It happens, almost as a rule, when two people – one a homebuilder and one not – engage on the topic of building technological modernization.

Mostly, the non-homebuilder finds it difficult to fathom how so much homebuilding still, well into the 21st Century, gets done without modern tools of industrialized, precision-data-driven, machine learning and robotics-automated systems common to manufacturing worldwide.

Mostly, the homebuilder finds it difficult to fathom how so few people grasp how any single private enterprise organization – even if it's the highest-volume producer of single-family detached homes in the 7% or 8% or even 10% market share of the new construction universe – would bankrupt itself if it attempted on a solo basis to fully industrialize its construction life-cycle.

So it so often goes.

Part of the reason for the two entirely separate conversations about the same topic among the same people owes to a simple lack of understanding on the part of the non-homebuilder about the business he or she is in. The non-homebuilder looks at a vertical assembly of 18,000 parts that add up to structure and systems of a depreciating durable asset, a house.

The homebuilder, on the other hand, more often than not, is in the business – the one that generates returns on his/her/their capital investment or their access to lending or capital from other source – of a non-depreciating asset, property.

When, a couple of years ago, I asked the CEO of one of the top 5-ranking homebuilding organizations in the U.S. the reason for not pivoting faster and more committedly into offsite manufacturing, industrialization, and new building technologies to capture at a scaled, enterprise level the already evident benefits in velocity, labor-productivity and efficiency, first-time quality, materials waste-reduction, his answer bridged – fleetingly – the two separate conversations we were in.

We are investing in the learning about how these technologies will improve our building start-to-completion cycle," he said. "However, that's simply one area of our holistic business that drives our costs and the value we create. We can't simply look at offsite as a panacea for us to take our costs down, we have lots of other processes that go into how we generate value that we have to learn to do better so that our construction cycle improvements don't happen in isolation."

Every builder knows that the lock and key to his or her business success has mostly to do with the dirt. The vertical structure that goes on that, and its cost basis, is tangled inextricably with the property, its zoning, its locational desirability, its appreciating – not depreciating – value. The tangle that traps profitability in a formula that blends both the vertical structure and the property itself is where non-homebuilders find difficulty getting their brains around.

Logically, we untangle the building and its processes and materials from the property it sits on, in the local jurisdiction it resides in and is permitted, in the zone relative to job centers or natural amenities it's proximate to, in the market comparable context it's in, etc.

But all of those factors, not-untangled, account for both what builders pay for and what they receive revenue for. In isolation, the same type of lean manufacturing efficiencies, precision-production, industrialized processes, and technology-aided assemblies that impact the prices and values of cars, or airplanes, or any other depreciating value durable asset, don't impact home and community development and construction to the same extent.

While the structure and the systems of a house may depreciate in value, the property behaves differently.

This accounts, in large part, for why so often we're in two discrete, virtually unrelated conversations at the same time talking about the same topic.

Likely, a seismic shift toward industrialized, modernized, advanced data and technology aided manufacturing will come when a disruptive process doesn't only bend part of builders' expense curve in the building lifecycle, but simultaneously unlocks value in the dirt itself, both for the end-user owner or renter, as well as the builder-developer, as well as the municipal jurisdiction. It's that stake, and the skin-in-the-game, and the ultimate value generation and equity in the property itself – that non-depreciating asset – that holds the key to transforming the role of building technology, offsite construction, and modernization beyond the current single-digits level to what should be more like 50% or more of new residential construction.

If as our earlier-quoted public company CEO professes, companies learn to improve holistically what they do to drive value and generate profitability – customer engagement and care, resilient supply chains, local community support and collaboration, financial and balance sheet management, and business culture development – the vertical construction cycle step changes are ripe to sweep the landscape.

Here are toplines from a just-released survey – by Phoenix-based construction technology solutions provider Mosaic – that, on a high level, show that front line homebuilding operators are game to put new technologies to work on their job sites as they try to meet today's demand surge for new homes.

Here's the key findings from Mosaic:

- 92% of respondents said it is important to use technology services, such as software products, in the homebuilding process;

- 83% of respondents said they are likely to seek out new technology products in the homebuilding process; and,

- 72% of respondents said they are likely to seek out homes built using technology products in the next 12 months; and,

- 92% of respondents said it is important to use technology products that create efficiencies in the homebuilding process, with 84% reporting they are likely to use said products.

At the same time, Mikaela Arroyo and Tim Seims, analysts at John Burns Real Estate Consulting looked at three topical "catalysts — code adoption, credibility, and competitive pressure"— as drivers that could impact more widespread adoption of offsite construction facilities in framing and building envelope solutions. In light of those three timely forces, JBREC identifies six key validation checks builders might apply to consideration of a pivot now to offsite.

Here they are:

- Your desire to control the building process. The more you control in the construction process (from initial design to the field), the more you control your own destiny. This is especially important with today’s supply chain issues. Consider moving one piece of the process from “subcontracted” to “self-performing” per quarter.

- Your emphasis on speed and quality. Offsite and prefab methods address speed, labor quality, and construction quality issues. Modular brings you speed but also creates logistical challenges.

- Your financial analysis, which needs to consider build time. The direct cost of offsite will be higher than traditional stick framing. However, those costs are made up in speed to market, less waste, eliminated scaffolding, and more. Speed to market is one reason single family build-for-rent will likely be a likely driver of offsite, since speedy construction results in quicker leasing.

- Your relationships with inspectors and permit authorizers. Building good relationships and fostering clear communication with municipalities (state and local), underwriters, and code officials will impact your success.

- Your location. Offsite construction requires careful logistical coordination between where pieces are built and where they are set. Proximity to offsite plants should be a determining factor.

- Your emphasis on the environment. Offsite can impact the environment in numerous ways, including reduced waste, reduced noise on site, safer work environment, and healthier air quality (from less dust being kicked up). If sustainability is a focus area right now, industrialized construction in some form may be a solution.

For these benefits – all of which can impact building companies' bottom line if expenses capture in each of these six areas flowed directly to profits – a pivot to industrialized, precision manufacturing construction makes sense, and amount to at least part of the necessary solution.

The other two parts of the solution remain tangled in the dirt – both as a cost basis and a potential revenue and profitability trap: policy and financial equity.

When the two conversants recognize that a homebuilder's core business is not solely vertical construction, but rather an entangled, triangular combination of building, policy, and finance, then they can be in the same conversation about the timing of homebuilding's technological advance.

It looks and sounds like that time is drawing nearer.

Join the conversation

MORE IN Technology

Design-Estimating Disconnects Cost Builders Time And Margin

Former builder-operators Brandon Pearson and Marcus Gonzalez share what’s broken—and how connected teams can win now and in 2030.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Margin Mission: Homebuilders Race To Crack Inefficiency Code

Spring 2025 has fallen short of expectations. Builders are turning to integrated data systems to protect margins and prep for the next wave.