Capital

UHG’s Crossroads Signals M&A Momentum, Market Reckoning

A struggling public builder weighs strategic alternatives as prospective acquirers circle amid capital constraints and consolidation tailwinds.

In today’s accelerating homebuilding M&A cycle, a familiar inflection point is emerging — an operationally solid, regionally dominant builder, pressured by capital constraints and macro volatility, seeks a suitor with deeper pockets and staying power.

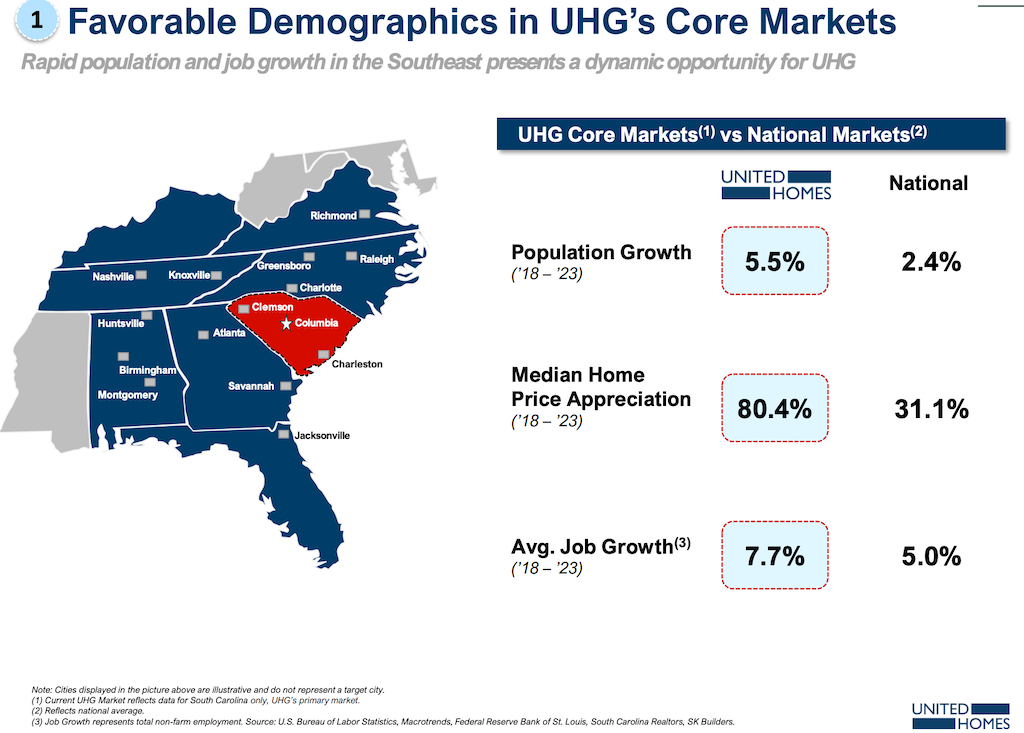

United Homes Group (UHG), a public homebuilder with roots in South Carolina and reach across the Carolinas and Georgia, now stands firmly at that juncture.

On May 19, UHG’s board of directors announced a formal review of “strategic alternatives,” including the company's potential sale. The decision caps months of visible signs: operational pressure, market underperformance, a shifting capital structure, and leadership reshuffles. It also places UHG squarely in the path of a consolidating housing sector where both financial and strategic buyers — ranging from public giants to private equity–backed acquirers — are aggressively reshaping the competitive landscape.

From Local Powerhouse to Public Struggles

UHG’s origin story begins with Michael Nieri’s founding of Great Southern Homes in the early 2000s—a grassroots success narrative that saw the company scale from a pickup-truck startup into one of South Carolina’s largest builders. Over nearly two decades, Nieri’s team mastered land-light strategies, cultivated deep local relationships, and steadily grew market share. But the move to go public in 2023 via a SPAC merger came at a treacherous moment.

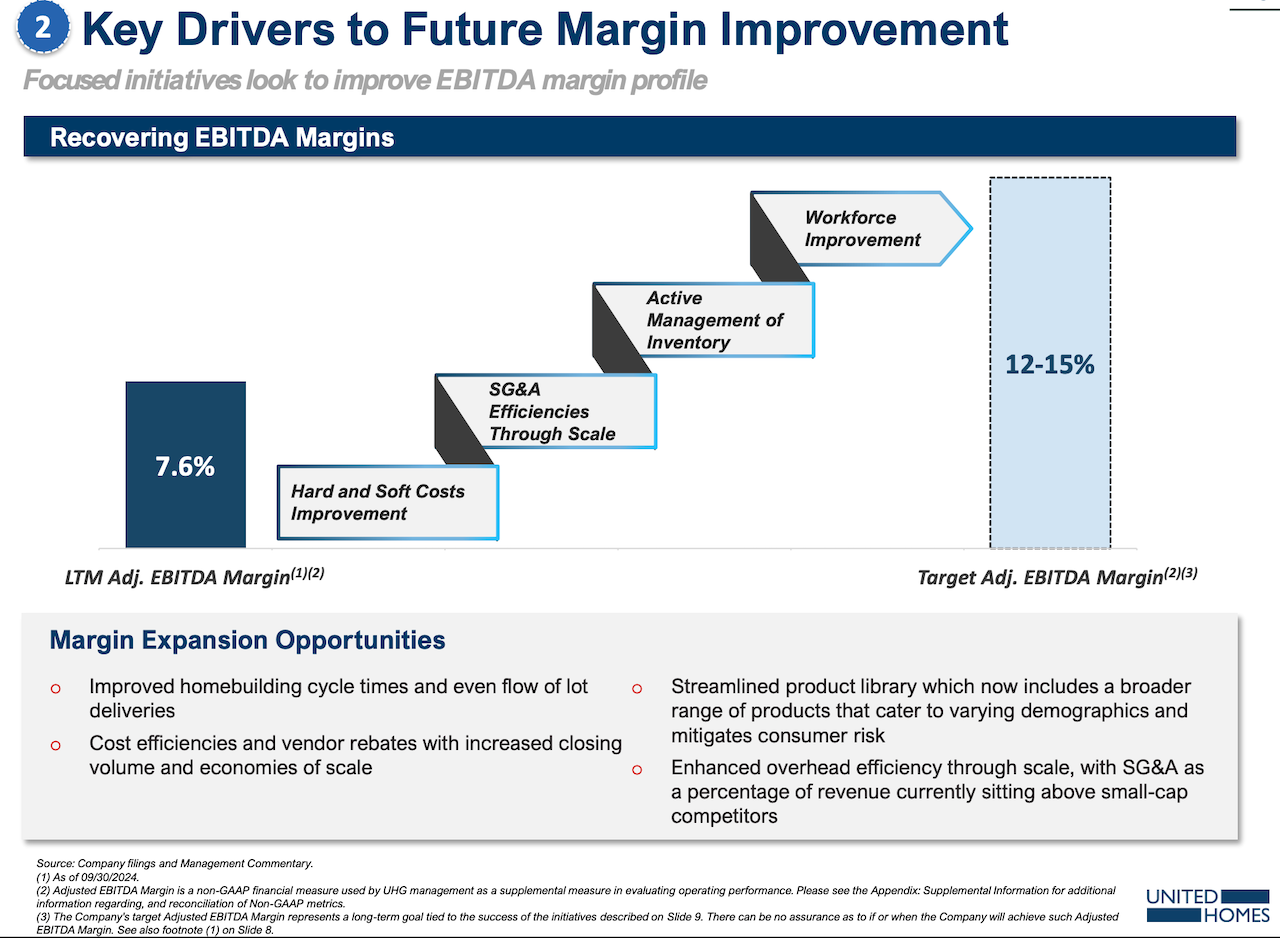

Rising interest rates, construction inflation, and intense competition from better-capitalized national and regional players converged on UHG just as it stepped into the glare of quarterly earnings and public market scrutiny. Instead of riding the post-COVID homebuilding boom, UHG found itself playing defense — especially in product competitiveness and operational efficiency.

In recent quarters, these struggles have been reflected in the company’s numbers. According to UHG’s Q1 2025 earnings report, net new orders fell nearly 23% year-over-year, starts were down 10%, and closings dropped 19%. Net income for the quarter totaled $18.2 million, positive, but buoyed by non-operating gains tied to the change in fair value of derivative liabilities. Top-line revenue was $134.8 million, a relatively modest result in the context of the Carolinas' broader housing demand.

What's more, the company’s debt-to-equity ratio stood at a stark 7.16—an artifact of an expensive capital structure from its SPAC origins and the burdens of being a young public operator amid tightening monetary policy. A slew of recapitalization efforts, including a December 2024 convertible debt redemption and equity sale to Conversant Capital and a subordinated loan from Kennedy Lewis, have stabilized UHG’s current liquidity, but at a cost.

Boardroom Reset, Market Repositioning

The company's leadership has also shifted. Longtime homebuilding operational and finance business leader Jamie Pirrello, who served as interim CEO, led key improvements in cost management, product rationalization, and operational focus. But the May 19 announcement handed the reins to Jack Micenko, formerly UHG’s president and a seasoned capital markets advisor. Micenko is now in charge of leading the strategic alternatives process.

Micenko’s appointment signals a clear intent: Run a credible, data-driven process to find the best path forward for UHG shareholders. It also underscores a growing recognition that the company may not be positioned to thrive independently in the current environment.

As board vice chairman Robert Dozier put it in the official statement,

Jack is well-qualified to lead our company during this time as we review available alternatives to unlock additional value for our shareholders.”

Competitive Headwinds in the Southeast

UHG’s greatest strength — its Southeast footprint — is also its most competitive battlefield. Since 2020, the Carolinas have become magnets for both migration and capital. Public homebuilders including D.R. Horton, Lennar, PulteGroup, Dream Finders, and LGI Homes have significantly expanded operations in the region. Smith Douglas Homes, which went public shortly after UHG, is similarly doubling down in the Southeast. So too are Japanese-backed firms like Sekisui House (via Holt and Chesmar), Daiwa House (Stanley Martin), and Sumitomo Forestry (Edgewater).

UHG’s original playbook — build an asset-light, land-light NVR-style enterprise and consolidate smaller builders into a mega-regional public platform — was bold.

But it’s stalled. The capital structure has constrained land acquisition, slowed product evolution, and hampered local scalability. Floorplans and value engineering have lagged buyer preferences. Meanwhile, rivals with stronger balance sheets have grown more agile, opportunistic, and aggressive.

As one industry strategist familiar with the market put it:

They’ve got good people, good local relationships, and good intentions. But it’s hard to run an acquisition play when you’re the one being outspent, outbuilt, and outmaneuvered.”

Conversant and Kennedy Lewis Step In

In late 2024, as cash burn and debt pressure mounted, UHG refinanced a $35 million convertible note with Conversant Capital. In return, Conversant received $30.7 million in cash and more than 4.4 million shares of Class A stock. Shortly after, UHG entered a $70 million subordinated credit agreement with Kennedy Lewis. These moves simplified the capital stack and injected needed liquidity.

Still, Conversant’s reduced stake (now 8.1%) and the resulting board seat turnover have left a streamlined, strategically retooled boardroom — but one facing a difficult valuation dilemma. In recent months, UHG’s stock has traded under $2, down from its 52-week high of $7.80.

The challenge?

UHG must now convince potential acquirers that the enterprise is worth more than the market says it is — while delivering enough upside to entice shareholders, steady the business, and align the remaining leadership.

What Makes UHG Appealing

Despite its challenges, UHG does offer clear assets for the right buyer:

- Geographic Reach: The company’s strong base in South Carolina, with extensions into North Carolina and Georgia, remains a highly desirable footprint.

- Local Team Strength: Founder Michael Nieri, now executive chairman, has cultivated a culture of trusted land and construction partnerships.

- Land-Light Strategy: While not as pure as NVR’s, UHG’s lot pipeline includes scalable option relationships and flexible deal structures via its land platform, Pennington.

- Turnaround Traction: Early signs of product repositioning and construction process improvements are visible in backlog quality and cost-per-start progress.

For a national public looking to deepen its Southeast presence — or a capital-backed acquirer like Apollo (which just bought Landsea) — UHG could represent a strategic bolt-on or an accelerated growth platform, depending on price.

A Changing M&A Environment

The broader context has shifted. M&A activity in homebuilding continues at a brisk pace, but acquirers are pickier. With uncertainty around the Fed’s next moves, insurance costs destabilizing affordability in key markets, and land pricing sticking stubbornly high, buyers are showing discipline.

The recent Landsea Homes acquisition by Apollo’s New Home Company at a hefty premium sets a high bar and invites uncomfortable comparisons. Landsea, too, was struggling, but it brought with it a deeper balance sheet and a more polished, differentiated product platform.

UHG may have the people and the plan, but not the polish or the numbers.

As one executive close to recent M&A activity told TBD,

It’s a buyer’s market — until a really differentiated deal comes along. The burden is on sellers now to show not just potential, but execution.”

Can the Strategic Alternatives Deliver?

Ultimately, UHG’s fate will depend on the quality of its process, the credibility of its team, and the realism of its valuation targets. Vestra Advisors, now retained to explore options, will need to court capital-rich and culturally compatible suitors.

Could a regional private builder with institutional capital see UHG as a launchpad into public scale? Could a Japanese or Canadian entrant seek a local operator with management continuity? Could a public builder aiming for Tier 1 land access in the Carolinas strike a favorable deal?

All are possibilities. However, each is complicated by UHG’s financial baggage, integration risk, and the still-tender nature of its public company transformation.

UHG’s next chapter will either be written by an acquirer willing to bet on its upside, or by its own team, digging in for a long, grinding rebuild.

Either way, the clock is ticking.

MORE IN Capital

Capital Optionality Is 2026's Winning Homebuilder Strategy

Tony Avila breaks down the competitive edge capital brings—and how private builders can win big in 2026’s reshaped landscape.

How Developers Can Miss Millions In Infrastructure Recovery

Too many landowners front infrastructure costs without a plan to get paid back. Carter Froelich explains how to set up recovery mechanisms early — before it’s too late.

Toll Brothers Exits Apartments, Sharpens Playing To Strengths

The $347 million sale of Toll Brothers’ Apartment Living platform to Kennedy Wilson transfers $5.2 billion in assets under management and a national development team. For Toll, it’s less about retreat than an embrace of its cultural pedigree of focus, discipline, and luxury market leadership.