Leadership

The People Squeeze: The Risk Of Talent Drain As Pressures Build

Here's a look at why a misstep in priorities -- the hidden-in-plain-sight focus on your talent -- could carry a heavy cost at precisely the wrong time.

In two decades of moderating CEO power panels among residential real estate, development, and building enterprise leaders, two oft-quoted insights stand out for having weathered boom, bust, exponential technology, economic reset, societal upheaval, and nature's whims.

- This is a people business

- There's what you can control and there's what you can't control as a leader; we focus on what we can control

Those two, and "all real estate is local" are probably the observations I've heard most often in 20 years from the C-suite. There's probably a good reason for that, and it's what's gnawing at me today.

External – or as economists say, exogenous – challenges appear to be defining the operational, tactical, and strategic framework and environment of leading today, what with the passel of known and unknown struggles that lay strewn in the critical path of continued building.

However, it's a hidden-in-plain sight challenge – and opportunity – that relentlessly holds our own focus today. So much so that we'd go as far as to say our business community's most profound, immediate, and sweeping priority has nothing to do with what's going on in world outside our organizations, and everything to do with what's been happening inside them.

The biggest risk to your businesses, we'd assert, is a cultural one, not a nameable list of negative drivers or scenarios.

It's the real potential of losing the heart of resolve, commitment, alignment, trust, and engagement of people on the varying rungs of your organization's talent chart – who'll only deliver on your firms' promises if they're inspired, motivated, educated, and empowered.

Otherwise, what?

They'll quit. Think your firms are immune from the Great Resignation? Think again.

No, don't think. Act. Act now, during budget setting, during the frenzy of Q4 completions, during the insanity of trying to progress homes to a next stage; during holiday season; during the last five weeks of 2021, because there'll never be a last five weeks of 2021 again.

The solution: adopt the "builder of choice" mindset, and make your organization, hands-down, the preferred place of purpose, career path, and empowerment.

Because why? Because "this is a people business." And because "this is something you can control."

Let's unpack this.

Residential real estate and construction's echochamber is running at a volume-level of 10 out of 10.

The supply chain's broken. Inflation's on the loose. Interest rates may be next to flip from helping to headwinds.

Challenge, challenge, challenge.

How about solutions?

The inconvenient truth of a timing glitch between an economy heaving giddily into rebound and a hesitating, still-far-from-functional complex of worldwide panamax cranes, freight drop-and-hooks, live loads, hand-offs, gantry-cranes, offloads, transports, forklifts, casts a vague menacing pall over what otherwise would certainly have been an sustaining celebration of demographic lifestage and household wherewithal.

Talk-tracks among homebuilding and manufacturer and developer partner leaders – whether it's public or private firms – refer in more cases than not to what could and should have been achieved this year, but didn't happen for all the known explanations. And, to an increasing degree, the narrative is that those performance achievements have been delayed, not lost, and have merely moved from the end of this year to the first quarter, or at latest, first half of next year.

A populace of new-homebuyer prospects, meanwhile, still clamors for access to a promised land of expanded new home choices, new communities, and new secondary and tertiary geographical market options to move into a pandemic era balance of life and livelihood as it was unimagined a mere 36-months earlier.

Those prospects – the narrative runs – will be willing, able, and motivated to absorb ongoing ASP increases as builders need to take them to absorb shifting sands and escalating unit costs of more and more goods, services, fees, and levies in their own ledgers.

Rather than a mindset of supply producing demand, the prevailing logic is that dire scarcity will produce sufficient demand to sell out market-rate homes at higher and higher prices as a business tactic for the time-being.

Almost every public homebuilding executive guiding to financial and operational performance expectations in Q4 2021 and 2022 is tapping the same playbook, and in many cases using the same terminology.

Accounting and finance pros are wizards at language. When there's a financial "miss" or variance that can be expressed in terms of timing, they use the term "geography" to move the value from one period to the next.

And when there's current data to demonstrate that a sufficient share of homebuyers has – to date – absorbed an upward spiral in asking prices, those professionals use the term "offset" to describe the capacity to pass along rising costs to buyers while maintaining margins.

These present-day explanations and machinations regarding forecasts are common and frequently turn out to be valid based on the reliability of the model.

At the same time, a greater number of unpredictables are forcing their way into these forecast models.

We talked with Tim Seims, a TBD Dream Team member who's director of building products intelligence at John Burns Real Estate Consulting about the unpredictables and how they're impacting priority and strategic focus. Under a broad topic area of "what people are not talking enough about," Tim outlines the following bullet-point areas.

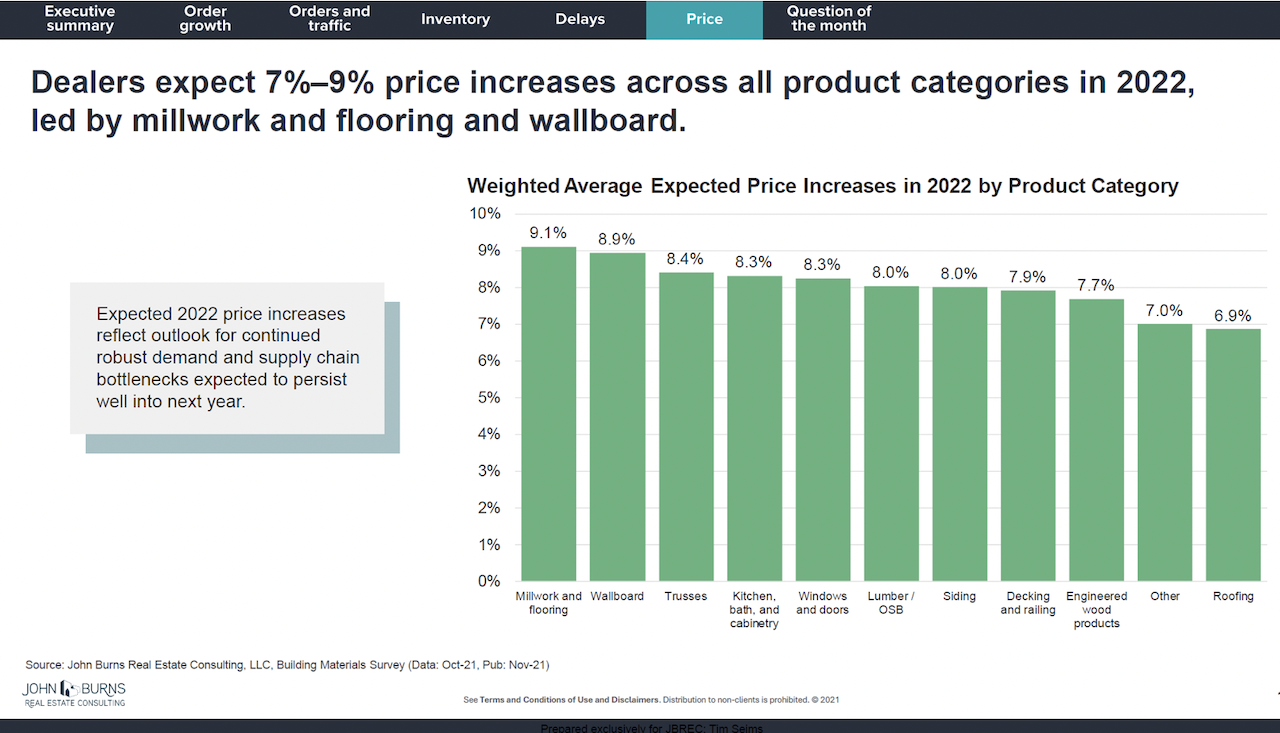

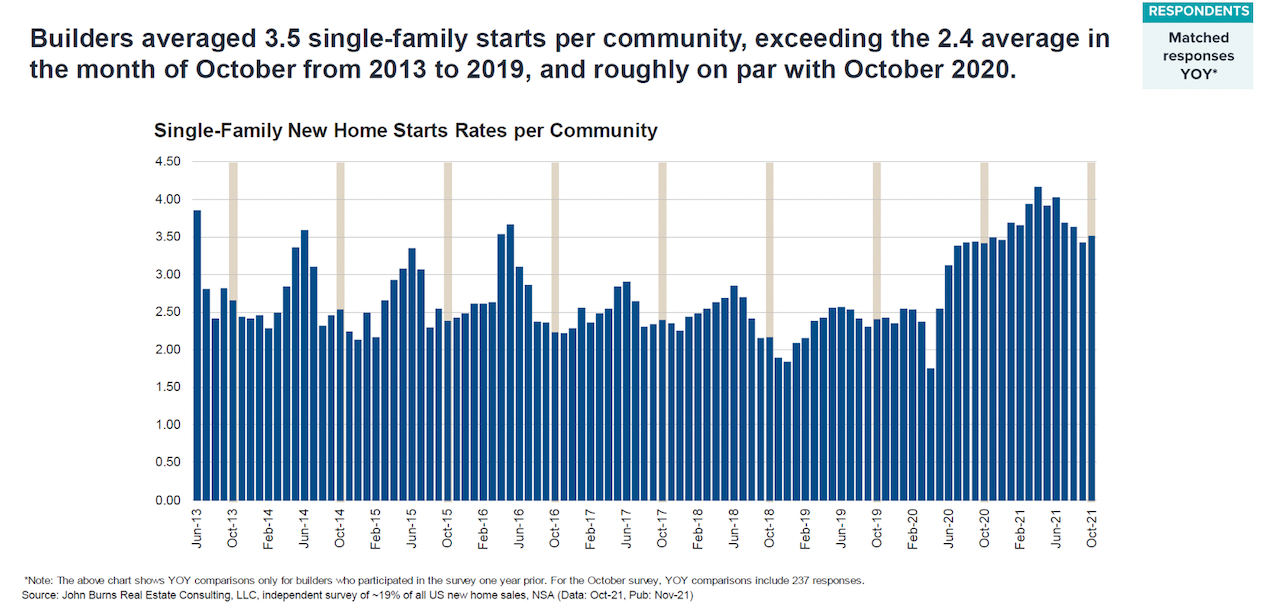

Dealers in our survey are expecting a 7-9% price increase from manufacturers across the board plus robust demand. Some national builders are guiding their community count and starts/per community will increase in 2022.

That said, we expect to see some dynamic pricing. Will the price increases stick? The best elasticity profiles are for the complex products in our vulnerability index (labor-intensive, components that cross international borders, etc). Less complex products may have a harder time getting all their increases. Will builders see price resistance with the added starts and potential inventory? Time will tell. Builders need to prove they can deliver, and in the face of the labor shortages that may be a problem.

Builders in our survey and in their earnings calls say the price pressures they are experiencing now in Q4 may stifle the earnings they’ve been used to in 2021, but those hits will be “more than offset” by their own price increases in Q1/Q2. In fact, that quote, “more than offset” was used in at least 7 earnings calls this week in relation to current results and 2022 guidance.

Below the surface of these issues, Tim affirms, roils an issue that falls very much within the realm of what organizations can control, but are at risk of not doing so. In his words, and underappreciated

Extreme shortage of construction managers and superintendents because of so many being recruited to commercial."

Consider three phenomena underlying the defining craziness of now:

- Many of your younger team member talents have entered and come of age in this business since the Great Recession. They have never known a down cycle, and they probably believe that a lot of what's gone right with their careers and their firms has everything to do with them.

- Tim Seims' point about the competitive risk of commercial construction companies tapping and poaching talent, because their interests and stakeholders are as driven and as talent-challenged as employers in residential construction. And, they have budgets for bigger compensation packages!

- Thirdly, we haven't even begun to see the impact of the release of infrastructure spending on federal, state, and local government construction projects, again a risk of siphoning off your talent, in every discipline and at every management level.

This is why – for all the priority given these days to supply chain externalities, to inflation, to interest rates, and to the economic impacts of these forces on your business – the big business risk of the moment is a cultural one.

It's also your biggest opportunity. If you solve for how to retain your most talented, committed, resolved, empowered, and engaged team members, solutions to what you can control in your business arc will come second-nature.

Join the conversation

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.