Land

New Home–Landsea Deal Redraws Builder Power Map

A $1.2 billion private equity-backed merger creates a Top-25 national homebuilder — and signals four pivotal shifts redefining U.S. homebuilding's M&A battleground.

A Power Move With Layers of Strategic Meaning

In a transaction that accelerates a generational reshuffling of strategic leadership in U.S. homebuilding, The New Home Company, backed by private equity giant Apollo Global Management, has announced its acquisition of Landsea Homes for $11.30 per share in a deal valued at $1.2 billion.

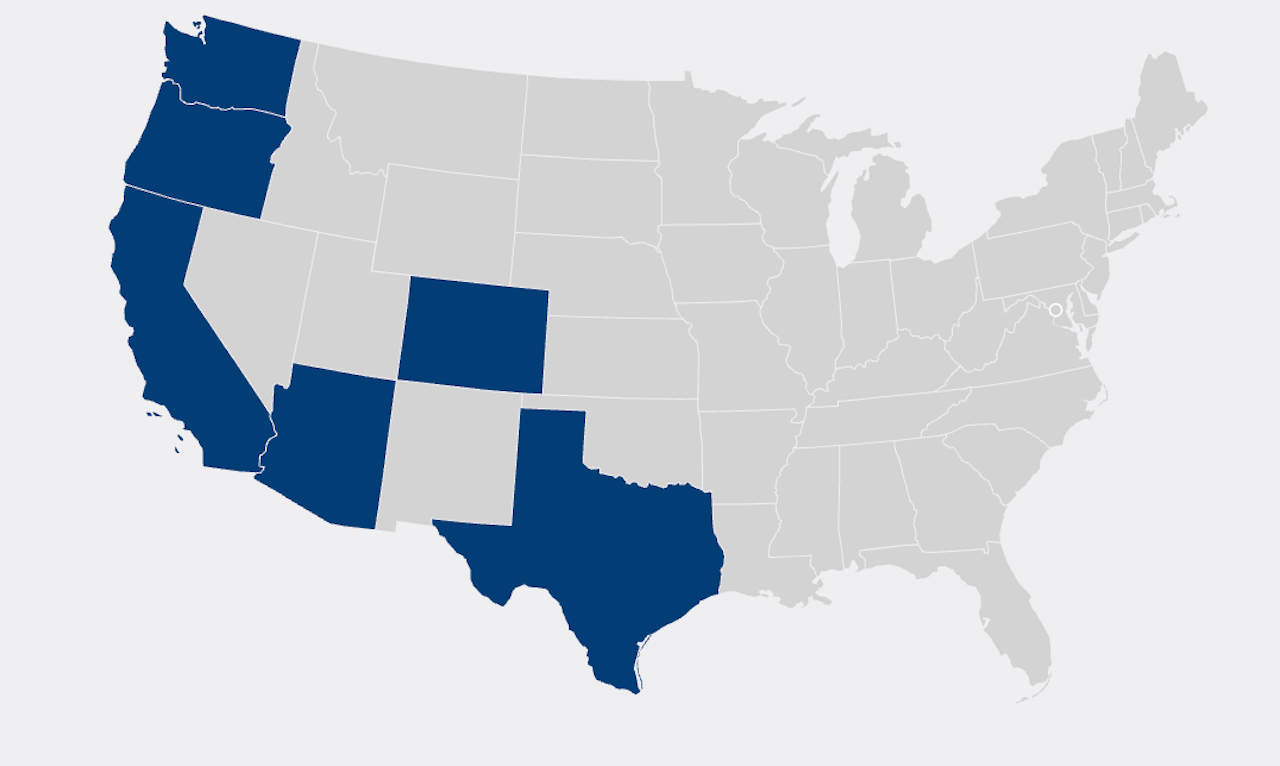

The all-cash transaction — representing a 61% premium over Landsea’s share price at the time — creates a privately held, top-25 national homebuilder with nearly 4,000 annual closings and active operations in 10 of the country’s highest-growth housing markets.

According to the announcement release:

This transaction is supported by the Apollo Funds, the majority shareholder of New Home since 2021, who are committing $650 million of new cash equity to facilitate this credit-enhancing transaction and position the business for future growth."

But beyond the price tag and scale, the deal reveals four defining trends reshaping the homebuilding business:

- The emergence of global capital powerhouses like Apollo, J.P. Morgan, and Blackstone as direct strategic players in residential development

- The new competitive premium on deep local scale across the most economically active markets

- A pivot to asset-light, land-banked operational models backed by institutional capital

- An M&A cycle that, despite economic turbulence, shows no signs of slowing

Per a provided statement:

J.P. Morgan Securities LLC, RBC Capital Markets, Vestra Advisors, and Wells Fargo served as financial advisors to New Home. Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal counsel to New Home.

Moelis & Company LLC is acting as the exclusive financial advisor to Landsea Homes. Latham & Watkins LLP is acting as legal counsel to Landsea Homes.

A Global Capital Push into U.S. Homebuilding

This transaction underscores our high conviction in the housing market opportunity,” says Peter Sinensky, a partner at Apollo and board member of New Home, in the announcement. “We believe the companies’ shared vision as well as cultural and operational alignment is a winning formula for success.”

With $785 billion in assets under management, Apollo joins Blackstone, Brookfield, and J.P. Morgan among a growing list of mega-capital allocators treating homebuilding as an infrastructure-adjacent, long-horizon growth play. Their bets go beyond simple returns — they reflect a thesis that demographic pressure, land scarcity, and policy failure will continue to make housing one of America’s most durable long-term investment opportunities.

Landsea Homes CEO John Ho hints at this alignment:

We believe this transaction delivers immediate cash value to shareholders and a well-capitalized partner to accelerate our next phase of growth.”

2. Why Now? A Push From Within

A key behind-the-scenes catalyst: activist investor Mill Road Capital. With a 6.5% stake in Landsea, Mill Road launched a board challenge in early 2025, pressuring the company to explore strategic alternatives. While Wall Street analysts questioned Mill Road’s claim that Landsea could fetch 1x tangible book value, the campaign did its job — forcing the company to reckon with its high leverage, constrained capital position, and fading premium in the public market.

Landsea’s high leverage limits its growth potential and makes it unlikely to be sold at 1x TBV," one Seeking Alpha analyst wrote in March. “The activist agitation, paired with challenging market conditions, appears to have nudged Landsea into a sale process.”

Indeed, Apollo's $11.30 offer represents a rare full-price exit in today’s choppy housing capital environment.

3. Strategic Synergy: Geographic Scale Meets Operational Fit

The combination isn’t just about size. It’s about complementary footprints, leadership alignment, and efficiency gains.

From Phoenix to the Gulf Coast, from the Carolinas to the California coast, the battleground for new home growth is clustered in migration-fueled metros. New Home Co., since its 2021 take-private by Apollo, has been playing the long game — investing both organically and through acquisition.

This transaction creates geographic diversification and scale in markets where both organizations were already committed — but not dominant,” says Tony Avila, CEO of Builder Advisor Group, which advised on two key acquisitions that brought Landsea into Texas and Florida. “Together, they can go head-to-head with the largest players.”

Landsea’s 2021 Vintage Estates acquisition (with a footprint in both Florida and Texas, and its 2022 Hanover Homes acquisition in Florida — both advised by Avila’s firm — are now foundational for New Home’s presence in those regions.

Those platforms now become launching pads of strategic value and fast growth for New Home,” says Avila. “It’s a full-circle synergy.”

Beyond land strategy and geographic complement, the integration allows The New Home Company to eliminate significant corporate overhead and public-company compliance costs from the Landsea side of the ledger. Immediate savings on executive comp, audit and reporting expenses, legal, HR, and IT redundancies come with a careful and competent integration process.

That capital can be redeployed into land acquisition, operational efficiency, or margin expansion," Avila observes. "It’s a textbook example of the synergies private equity looks for in a bolt-on deal.”

4. A Playbook for Asset-Light Scale

The mechanics of the deal reflect a defining trend in homebuilding finance: separating land ownership from homebuilding operations. The deal is notable for what it does not require: balance-sheet heavy land holdings. Instead, the use of Millrose Properties’ land banking capital — combined with Apollo’s equity — marks a new chapter in the institutionalization of a capital-light, operational-heavy model. In this model, land is a service, capital is fluid, and building systems drive margin.

Our thesis has been to scale operations without owning more land than necessary,” Zaist told The Builder’s Daily in a previous interview. “That’s part of what makes deals like this possible. We're focused on velocity, market fit, and value — not land inventory overhead.”

For Landsea, it’s a logical next step. Forsum has long articulated a playbook of operational excellence supported by platform integrations.

Our High Performance Home systems, our ERP, and our customer care infrastructure give us a scalable model,” he told us following Landsea’s Antares Homes acquisition.

Millrose Properties, a land banking affiliate of Apollo, will purchase select Landsea land assets and lease them back to the combined entity over time—a model mirroring what Lennar did in its acquisition of Rausch Coleman Homes earlier this year.

By using Millrose, Apollo can extend the use of capital and improve equity returns,” Avila explains. “You get the land control without the capital drag.”

Both Landsea and New Home have championed this model in recent years. The merger turbocharges it.

5. What Apollo Is Really Buying

From the outside, this might look like a simple growth acquisition. But inside the deal, Apollo is securing something far more valuable: a fully integrated, strategically located, high-performing national platform—with proven operators and an embedded culture of capability.

Operational excellence, economies of scale, and cultural alignment are key,” Avila says. “The goal is to create one plus one equals three.”

In particular, Landsea’s build-to-operate capabilities, ESG-forward brand, and high-performance construction systems align with New Home’s ambitions to differentiate through quality and efficiency.

6. The Long Game: IPO or Global Platform?

Apollo isn’t flipping houses. It’s playing the long game.

New Home’s prior organic growth into the Pacific Northwest and its Texas acquisition of Hamilton Thomas Homes signal this trajectory clearly. And Apollo, with $785 billion in AUM, has the patient capital to build slowly — and win big.

The New Home-Landsea combo does more than create a top-25 builder. It maps a future where the lines blur between capital and construction, between local and national, between growth and mission.

If New Home and Landsea can thread that needle — blending performance, purpose, and profit — they’ll not only reshape the power balance among the top ranks of builders. They may rewrite the blueprint for what a modern homebuilding company can be.

7. What Homebuilding Strategists Need to Know

For private homebuilders, the deal reinforces the growing chasm between companies with flexible capital access and those stuck in bank-constrained models. It also signals the rising bar for competitive viability in high-growth markets.

Public homebuilding leaders, meanwhile, must now reckon with a new national player—one that’s privately held, land-banked, and unconstrained by quarterly earnings pressure.

Cultural fit is not just a PR line in this deal. It’s foundational.

We’re aligned on mission, people, and how we want to grow,” Zaist told us in a prior conversation. “That’s what makes this different. It’s not just accretive — it’s additive.”

For everyone: this deal is another sign that M&A is not slowing down. In fact, says Avila, it's accelerating.

We’ve got more builders in market and more transactions underway now than at any point in our firm’s history,” he says. “And that momentum isn’t letting up.”

MORE IN Land

Texas Land, Texas Spirit: A Wake-up Call For Better Neighborhoods

Scott Finfer calls for a reinvention of how communities are built—away from formulaic lot counts and toward ecosystems rooted in landscape, design, and daily experience. His essay challenges developers to deliver neighborhoods that endure and reflect the best of the Texas spirit.

BTI’s Long-Game: Big Land Bets Amid Homebuilder Tactics Shifts

CIO Justin Onorato explains why developer BTI sees resilience in Florida, Texas, and Colorado markets, and how population dynamics shape its long-view strategy.

Land Risk Is Rising. So Is Homebuilder Blindness To It.

As homebuilders face volatile demand, rising input costs, and tighter capital controls, the risks of land missteps grow. Acres.com CEO Carter Malloy makes the case for a new class of competitive land intel—built to give builders visibility into what’s really happening before it’s too late.