Leadership

Homebuyers Face Insurance Hurdles. Here’s A Path Forward

Especially among all-important entry-level, first-time homebuyers, the certainty and transparency of an ‘embedded’ homeowners insurance solution offer a beacon of hope.

Two force factors – undeterred resiliency among first-time homebuyers and the pervasively nimble skills of homebuilders nationwide who kept first-timers engaged and priced to participate in an otherwise challenged housing market – swayed the 2023 narrative of a better-than-expected year for new residential development and construction.

A couple of recently released data points help illustrate the importance of first-time buyers in 2023. Many of them were younger adult households, left without quality existing home purchase options due to the daunting lock-in effect of historically low-interest rates among homeowners who might otherwise consider selling their current residence.

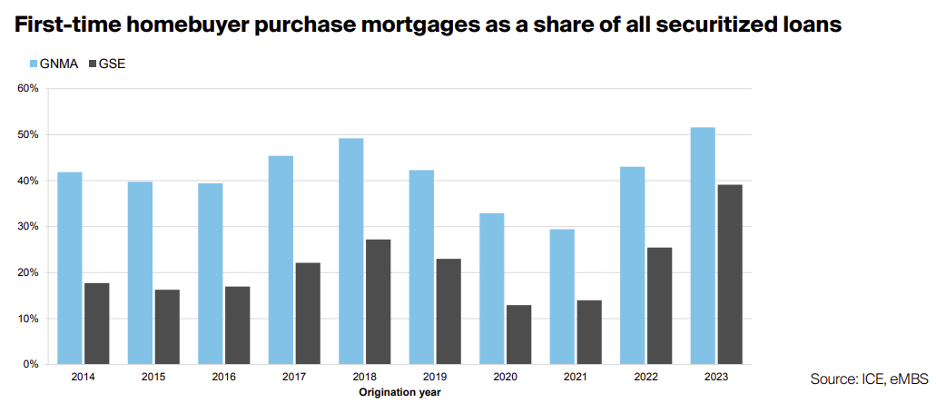

- In 2023, the first-time homebuyer share of mortgage loan applications hovered at around 38%, just shy of all-time highs in 2022, according to CoreLogic.

- Further, according to Intercontinental Exchange, Inc. (NYSE:ICE) “A large share of GSE purchase loans in 2023 were for first-time homebuyers (FTHBs).”

However, a repeat of better-than-expected success in 2024 – especially among more price-sensitive entry-level and first-time buyers – is far from being a sure shot. Despite a growing consensus around a strong and improving U.S. economy, moving-target factors now include a surge in volatility and uncertainty on the jobs and income front – and, in some cases, dramatic spikes in homeowners’ insurance costs. Factoring for those new variables, popular mortgage buy-down programs may only go part of the way to bridging monthly hurdles among would-be buyers who may be on the payment power bubble among mortgage lenders.

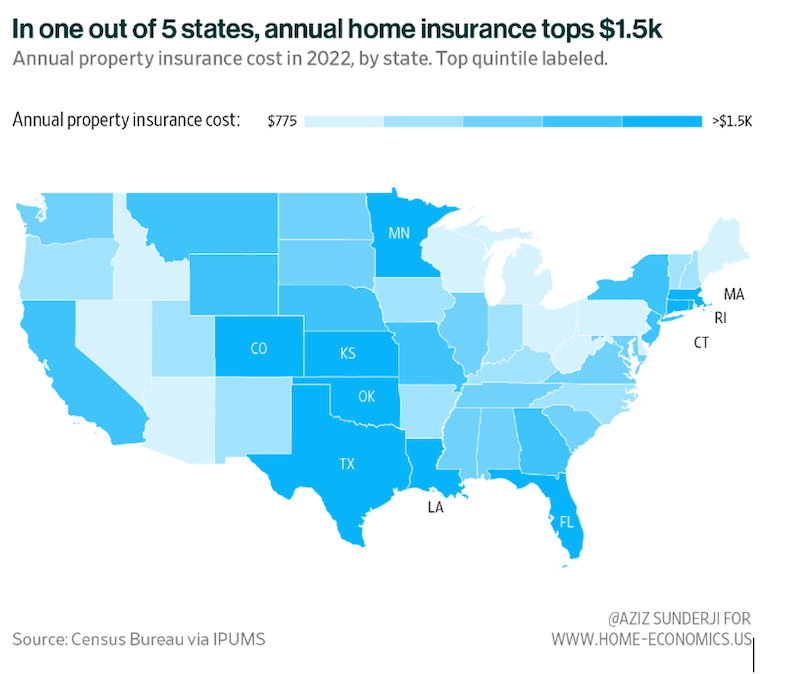

One of the more mercurial variables challenging homebuyers in any price range – but, critically, among entry-level, more price-sensitive first-time buyers – has been the unspooling of uncertainty and higher prices on the homeowners’ insurance front. Driving accelerated increases in insurance costs, notes housing economist Aziz Sunderji: 1) A spike in highly destructive natural disasters; 2) higher replacement costs; 3) elevated reinsurance costs.

The greater frequency and violence of natural disasters is the main reason insurers are charging more for protecting homes.

In addition to Texas, other states with especially expensive insurance include Florida, Colorado, and California. These are all states prone to natural hazards and large annual property losses, according to the Federal Emergency Management Agency’s national risk index³.”

He illustrates below a U.S. map showing 10 states where annual property insurance costs now exceed $1,500.

In an era marked by economic volatility, surging interest rates, and escalating natural disasters, securing affordable homeowners' insurance has reared up as a formidable and unnerving challenge for first-time buyers and a concern for the residential construction and development sector.

Amidst these challenges, Westwood Insurance Agency offers a solution, providing a seamless and transparent pathway through the home shopping and purchase experience, alleviating the anxiety and uncertainty surrounding homeowners' insurance.

The Challenge at Hand

The American Dream of homeownership has become increasingly fraught with obstacles for younger, first-time buyers. Economic pressures, compounded by the relentless threat of climate-related disasters, have rendered the quest for affordable homeownership more daunting than ever. Notably, some of the nation's most reputable insurance companies have retreated from markets hardest hit by natural calamities, leaving potential buyers in a lurch.

Seamless Integration and Predictability

Westwood Insurance Agency stands out as a vanguard, offering a solution that integrates insurance seamlessly into the home buying process.

By embedding our insurance program into builders' offerings, we ensure availability and competitive rates, addressing two major concerns for first-time homebuyers,” says Kimberlee Furcht, VP – Executive Account Manager at Westwood Insurance Agency.

This approach demystifies the insurance buying process and guarantees cost transparency and stability.

Pre-underwriting Communities: A Game-Changer

A distinguishing feature of Westwood's model is the pre-underwriting of communities.

Furcht elaborates:

We have all the information on the home, which is pre-underwritten and pre-rated, before a buyer even walks into the model. So we can tell them the insurance rate before they even sign their contract. We also work directly with a buyer’s lender to ensure everything is set for closing, making it a seamless process for them."

This level of predictability and transparency is invaluable, making the insurance aspect of home buying worry-free and streamlined, a crucial advantage for first-time purchasers.

The Impact on First-Time Buyers

With first-time buyers constituting a significant portion of the market — often at least 50% among builders Westwood collaborates with — their needs and concerns are central to Westwood's strategy. Furcht highlights the importance of easing the transition for buyers moving across state lines or into new regions, offering comprehensive services beyond homeowners' insurance to include automobile coverage, further simplifying the relocation process.

We proactively send them information on a quote,” Furcht notes. “They don't have to go to a local agent and start from scratch. We can also help with automobile insurance if that's something they're interested in as they move. We're a full-service agency.”

Builder Collaboration: Enhancing the Buyer Experience

Westwood Insurance Agency's proactive approach extends to its collaboration with builders. By pre-rating homes and providing rate sheets, Westwood ensures that insurance costs are clear from the outset, facilitating a smoother closing process. This partnership benefits buyers and empowers builders by enabling them to offer a more attractive and secure package to potential customers.

A Beacon of Hope in Uncertain Times

Westwood Insurance Agency represents a pioneering force in the residential construction and development sector, offering a solution that addresses the acute challenges of securing affordable homeowners' insurance amidst economic and environmental uncertainty. By prioritizing transparency, predictability, and ease, Westwood not only alleviates the anxieties of first-time homebuyers but also strengthens the resilience of the housing market against the backdrop of changing climates and economic landscapes.

In a world where the path to homeownership is increasingly complex and often fraught with anxiety, Westwood Insurance Agency shines as a model of innovation and customer-centricity, paving the way for a future where securing homeowners' insurance is no longer a hurdle, but a seamless step in the journey to owning a home.

MORE IN Leadership

Public CEO Compensation Averaged $11.5 Million In 2023

Here's The Builder's Daily annual scorecard and analysis of CEO, Executive Chair, and corporate President pay across the 21 U.S. pure-play public homebuilding enterprises.

Public Firms Seize Advantages; But Private Builders Hold An Edge

Often, private homebuilder leaders and their teams solve the problem of how to survive and thrive, just when all the headlines cry, "It's a bad time to buy."

D.R. Horton's Q3 Earnings Reveal A Case Study In Winning Market Share

A turbulent, volatile, uncertain demand market is not the only force making life difficult for 99% of homebuilding operators right now.