Leadership

Homebuilders Face The Long “Muddle-Through” Economy

Moody’s Analytics Deputy Chief Economist Cristian deRitis kicked off Focus On Excellence in Denver with a clear-eyed view of a cooling—but not collapsing—economy. His message for homebuilding leaders: plan for a grind, not a rebound, as 2026–2030 take shape.

Slowing growth, stubborn inflation pressures, and only modest mortgage-rate relief set the backdrop for builder decisions over the next 18–24 months.

Cristian deRitis, Deputy Chief Economist at Moody’s Analytics, delivered the Tuesday morning keynote at The Builder’s Daily Focus On Excellence summit in Denver. What follows is an analysis drawn from that talk — aimed at what public and private homebuilding operators should take into 2026 budgets and 2027–2030 plans. All quotations are verbatim from the session.

For firms trying to finalize 2026 budgets and lock in 2027–2030 trajectories, deRitis’ message boiled down to this: expect a longer “grind” than a “pop.” Rate cuts may continue, but spreads and inventory frictions will keep housing’s normalization slow, market by market.

Various uncertainties, including the impacts of tariffs, AI, and Federal Reserve policy, also muddy the future outlook.

Outlook for the Broader Economy

Government data reported a 3.8% annual GDP growth rate in Q2, but there are some real fault lines in the economy under the surface, according to deRitis.

Inflation is expected to rise from 2.8% to 3.6% next year, bolstered by the effects of tariffs, and the unemployment rate is expected to rise 40 basis points between this year and next as hiring slows down.

The private payroll diffusion index, which tracks the extent of job gains or losses across various private sector industries, was at 48.0 in August. A diffusion index below 50 is typically associated with a recession, revealing an underlying weakness in the economy.

Most of the spending growth is concentrated among the top 10-20%, while lower income percentiles maintain their spending on essentials, often while using credit.

Mortgage Rates Could Hover Over 6% Next Year

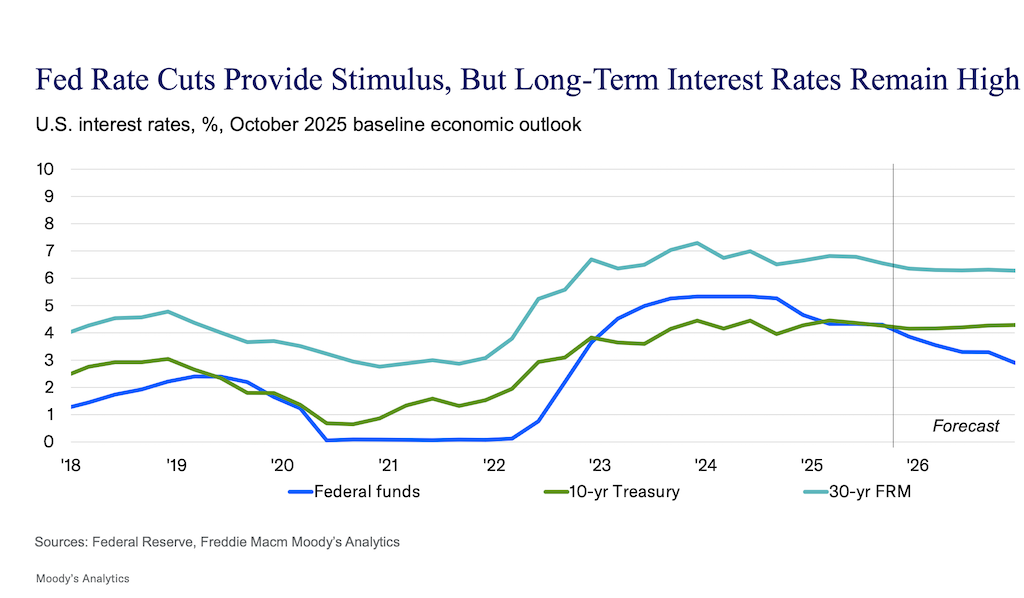

The Federal Reserve delivered a 25-basis-point cut to its benchmark interest rate on Wednesday, bringing the federal funds rate to its lowest level in three years. HousingWire’s Mortgage Rates Center shows 30-year conforming loan rates averaging 6.27% as of October 29, down from a high of 7.18% in January.

deRitis expects the Federal Reserve to continue cutting rates through 2026, but he cautions against pinning hopes on a swift reset lower. He anticipates that the 30-year fixed-rate will decrease modestly and remain at or slightly above 6.0% through 2026.

The implication, then, for the 30-year fixed-rate mortgage is a very gradual decrease over time. We'll get some stimulative impact here,” deRitis said. “If you told me we are going to dip down below, say, 6% that's certainly within the range. Our mortgage rate spreads are still quite wide, but that's only going to have a moderate impact in terms of the housing market.”

Planning Implications

- Sales pacing & incentives: Budget for incentives as a structural line item, not a temporary lever. With rates hovering near ~6% and spreads sticky, price discovery will remain delicate; assume “moderate” incremental demand from rate relief.

- Spec vs. BTO mix: Maintain optionality. BTO can support margins in select submarkets, but spec remains essential to capture the thin bands of urgency the market still produces.

- Starts discipline: Track absorption-to-start ratios weekly. “Even flow” planning should anticipate sideways demand into 2027.

Construction Costs and Labor are Concerns

Construction costs continue to outpace inflation, led by steel, copper, and gypsum. One positive from the perspective of margin-squeezed builders looking to cut costs, but not necessarily from that of workers, is that wage growth in construction is increasing at roughly the same rate as inflation.

We haven't seen much in the way of wage growth construction, at least not on a national basis,” deRitis explained.

However, many observers fear that the Trump administration’s immigration policies could exacerbate what is already a labor shortage in the construction industry. Employers may have to raise wages to attract workers as a result.

We know that labor is a big component in many Southern and Western markets. You definitely have to keep an eye out here, too. Demand should start to increase. You can certainly see some of those wage impacts rising here,” deRitis said.

Home Sales Decline and Inventory Challenges Remain

By some measures, the housing market is in more of a recession than growth for the economy,” deRitis claimed.

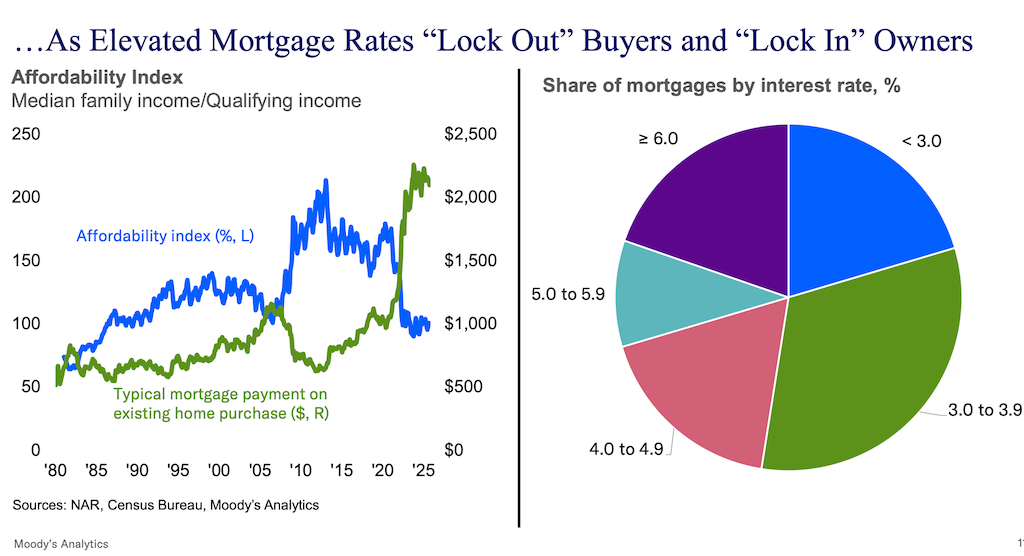

He pointed to low home sales as the reasoning behind this claim and high interest rates as a major culprit.

Larger mortgage rates are locking out potential home buyers, and they're locking in existing homeowners.”

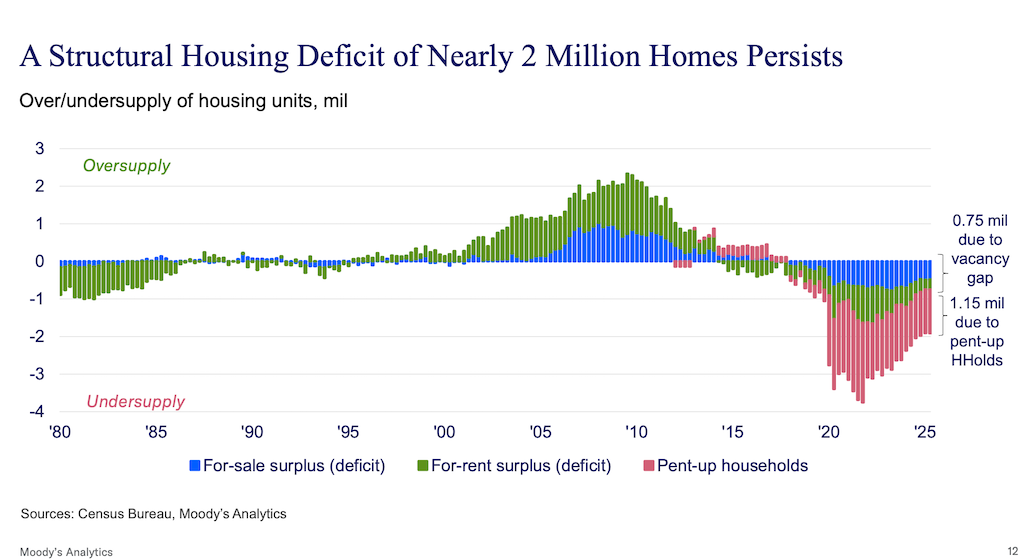

There is a structural housing deficit of nearly 2 million homes, deRitis's research shows, partially driven by a vacancy gap but also primarily by pent-up demand from young adults aged 25 to 35 who are currently living with family or roommates and can’t afford their own housing.

This gap could correct itself and transition into a surplus as Baby Boomers begin to retire en masse and downsize, and as population growth slows.

deRitis also pointed to a bipartisan capital gains tax reform proposal that would raise the exclusion for the sale of a primary residence from $250,000 to $500,000 for single filers and from $500,000 to $1 million for joint filers. The proposal, if enacted, could incentivize more established homeowners to sell their homes and introduce more inventory into the market.

Planning Implications

- Micro-segmentation: Tighten price-point bands and product elevation choices by submarket; remove SKUs that create construction drag without driving turns.

- Option strategy: Nudge margins with finish-level options that don’t impede cycle time.

- Sales ops: Calibrate digital lead routing and online sales consultant follow-ups to capture smaller, episodic waves of readiness.

New Home Starts Could Stabilize

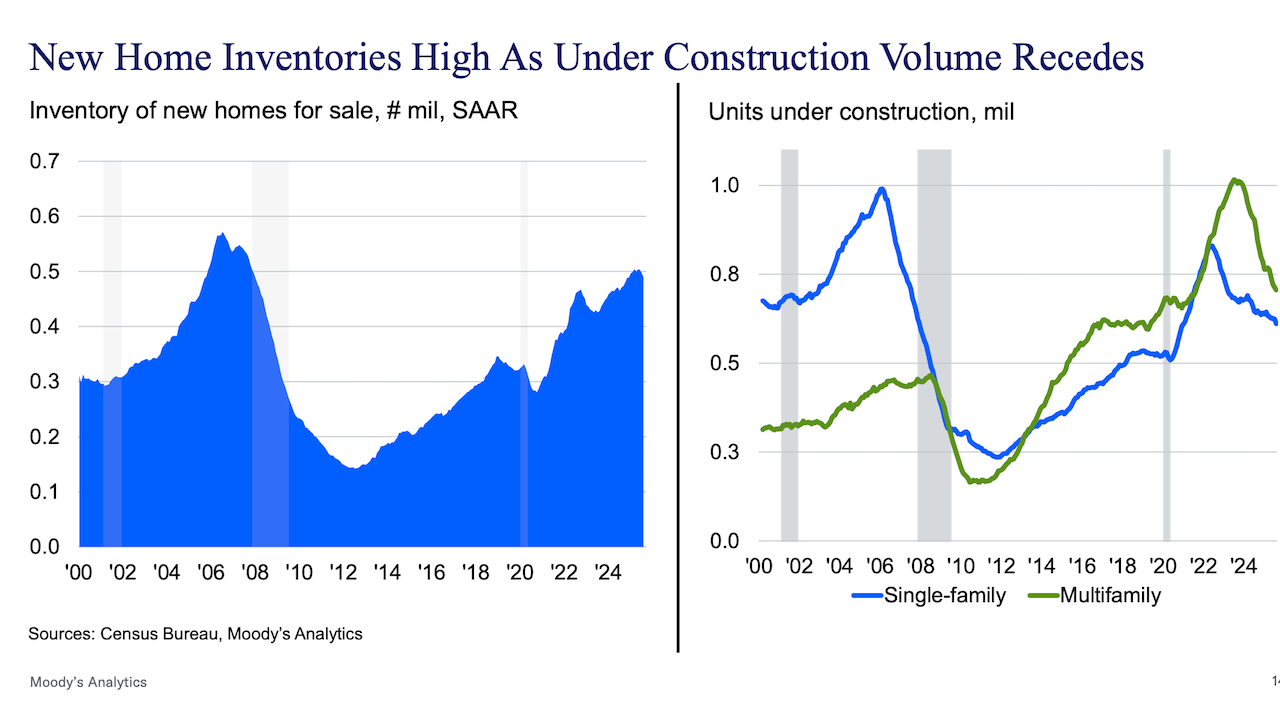

Unsold new home inventory also remains high at roughly half a million, just shy of the peak during the housing bubble of 2006-2007. As a result, builders have steadily reduced the number of new single-family homes under construction.

Home starts are expected to stabilize — or even modestly decline — through 2027 at about 1 million annually, according to deRitis’ forecast.

There is still the structural demand out there, so there's still certainly room for additional demand to fill homes. But until we work off the inventory, and until we really come back down to our normalized market in terms of the lock-in effects, in terms of the lock-out effects, it's going to be sideways here.”

Home Prices Will Grow Modestly, but Regional Differences Persist

Moody’s expects home prices to flatten through 2027, although a crash is highly unlikely, and the results are variable depending on how certain risk factors in the economy evolve.

The baseline growth forecast is 0.7% for the next year. Three years out, the baseline is 1.0% growth, and five years from now it is 1.7%.

Essentially, what this forecast embodies is a period of transition here where prices got ahead of incomes, they got ahead of rents, and we're allowing the market to correct itself, grow into the prices that we have in the markets, and then as we go beyond 2027, we're kind of back to a more normalized house price growth,” deRitis said.

However, home price growth varies widely across markets and regions. Prices are expected to decrease in many Midwestern markets and the Sunbelt, especially in metro areas that boomed during and immediately after the COVID-19 pandemic. Examples of such markets include Miami, Dallas, Austin, Nashville, Phoenix, and Charlotte.

On the other end of the spectrum, many Northeastern and Western markets that retracted during COVID are expected to see the highest home price growth. Seattle, Silicon Valley, Pittsburgh, Baltimore, and Boston exemplify this trend.

Planning Implications

- Market picks: Lean into markets with income growth tailwinds and lower regulatory drag; be surgical in Sunbelt boom metros where reversion risk is higher.

- Land underwriting: Stress test takedowns at flat price scenarios and conservative paces; re-underwrite Phase II/III against updated absorption.

- Active adult & BTR: Expand in 55+ and BTR segments where demographic and affordability vectors support steadier velocity.

The Uncertainty Ahead, Key Takeaways, and Opportunities

The near- and medium-term impacts of tariffs, AI, national foreign policy, mass deportations, and future Federal Reserve policy aren’t yet known.

What is clear is that homebuilders will need to tailor a regional strategy to match the unique conditions of each market.

On a national level, the housing market could normalize by 2027 as builders work through their existing new home inventory and new home starts begin to level off.

deRitis pointed to opportunities in active adult and 55+ communities as Baby Boomers look to downsize. There is also potential for growth in build-to-rent and opportunities for builders to partner more extensively with municipalities on workforce and affordable housing, as the average consumer remains squeezed.

What to Do Between Now and Q2 2026

- De-risk the 2026 land book. Swap options where entitlement timelines collide with slowing absorption; accelerate fee-build, JV, and land-bank structures to stay asset-light.

- Cash over GAAP. Protect cash conversion by shaving days across pre-dev, starts, inspections, and COs. Treat every saved day as a margin lever.

- Price governance. Weekly price councils with real-time comps, MLS resale reads, and OSC pipeline signals. Avoid “set-and-forget” list prices.

- Cycle-time analytics. Instrument your build with stage-gate timestamps; reward superintendents and trades for predictable handoffs more than occasional sprints.

- Channel mix. Strengthen broker relationships where lock-in suppresses organic traffic; keep buy-now/online pathways clean for off-hours conversion.

- Scenario sets. Run base/low cases with rates ~6%+, mortgage spreads sticky, and flat prices; tie bonus plans to cash, cycle-time, and customer satisfaction, not just gross margin.

MORE IN Leadership

How Homebuilding Sales Became A Strategic Center Of Gravity

Dave Rice and New Home Star help turn homebuilder sales associates into data-powered business strategists and a linchpin to critical customer feedback. Here’s why that matters now more than ever.

Century Communities Keeps Control, Delivers In A Tough Quarter

Q3 performance spotlights cost control, strategic pricing, and buyer-first execution as Century Communities sets foundation for sustainable growth into 2026.

Tri Pointe's Long Game Bets On Disciplined Growth, Not Speed

Strategic patience over sales velocity. Tri Pointe reins in starts to protect margins and wait for stronger demand from resilient move-up buyers.