Leadership

Here's What Promise Homes' Access To Global Capital Means

Wall Street investment giant Baring's $200 million debt facility opens Promise's access to capital rocket-fuel that can allow it to scale, expand its ecosystem, and set a transformative housing economic equality cycle in motion.

Hope's his middle name.

John Hope Bryant, founder, chairman and ceo, of single-family rental investment company Promise Homes, had an announcement just before this past weekend.

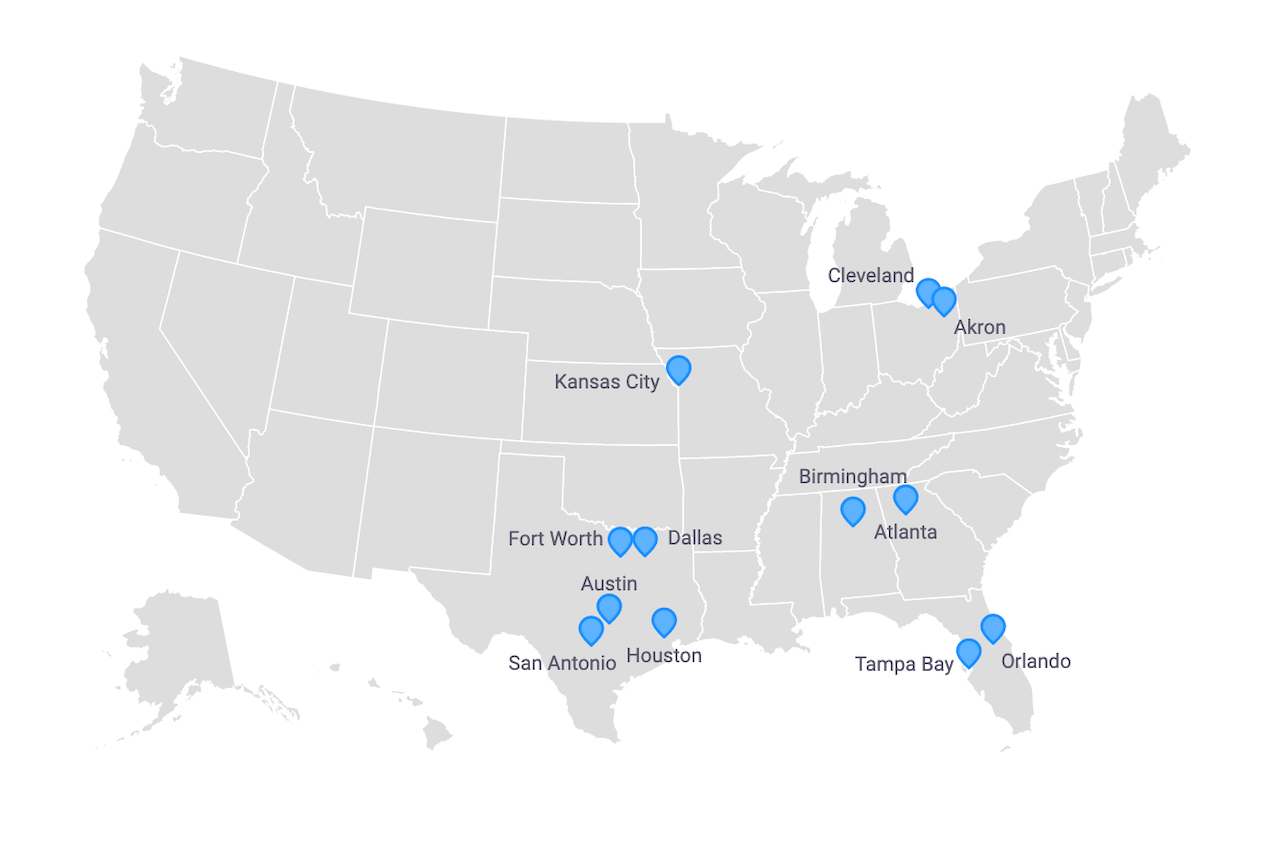

On its surface, closing a $200 million debt facility deal with global investment giant Barings, to capitalize and seed further real estate acquisition and community development financing whose purpose is to fuel growth at Atlanta-based Promise Homes Company, from its current portfolio of 663 homes to more than 10,000 in two to four years, is a landmark – not just in housing, but in business.

In no uncertain terms, as Black Enterprise correspondent Jeffrey Mckinney notes, the financial event itself is momentous.

The transaction is reportedly one of the 10 largest capital raises for a Black-owned company over the last decade. Debt financing typically happens when a business raises money for working capital or capital expenses by selling debt instruments to individuals or institutional investors. For providing the financing, they become creditors and are promised the principal and interest on the debt will be repaid.

John Hope Bryant, founder, chairman, and CEO of Promise Homes, will continue to lead the organization as managing principal. He is the largest individual shareholder of the fresh joint venture. Promise Homes also works with Operation Hope, the nation’s largest financial literacy nonprofit; Bryant serves as its founder, chairman, and CEO. The organization provides financial and access to credit.

As an investment-quality platform intent to put together a meaningful portfolio of residential properties that open access for working and middle class households to rental homes and an array of financial tools and training that create – for some – a steady path to homeownership, an infusion of this level of capital means a step-change in scale and accelerated impact. As Bryant states here:

A $200 million investment from Barings for a Black man is a big deal," says Bryant.

Earlier last year, we reported here of Blackstone's $6 billion acquisition of Home Partners of America, a model in many respects like the Promise Homes platform, in that it welcomes people in through entry point of single-family rental, and provides tools, training, and services aimed at helping them own one day. We wrote last June:

It took a for-sale affordability crisis, a sustained surge in rent-by-choice preferences among Millennials dragging their feet on family formation as well as among Baby Boom downsizers, and, finally, the Covid-19 pandemic to peel back a realization that has transformed the housing landscape.

People want to live in single-family detached homes that they rent, new or not, in intentional horizontal planned communities, or in scattered lots in older neighborhoods; they prefer single-family rental to ownership and to renting in vertical apartment communities.

They just plain choose SFR as a preference that yields flexibility, more carefree maintenance, less local tax, etc.

And some, it turns out, want to live in single-family-rental homes that they may want to buy, and in that case, want their rent payments to tip toward homeownership journey.

This is where Blackstone's $6 billion deal to acquire Home Partners of America and its portfolio of 17,000 homes it rents to people who may want to buy them comes in.

Why it matters for housing's business culture

Promise Homes' line of access to global investment liquidity – in desperate pursuit these days of inflation-hedged, safe haven yields, less vulnerable to pandemic-related risk and the turbulence of ongoing market volatility – should come as no surprise.

Since its 2017 founding by serial entrepreneur and Operation Hope founder John Hope Bryant, Promise Homes has checked the boxes in building a model designed to thrive in a market position – focused on working class households – regarded by many peer organizations as too challenging to serve due to property prices, zoning barriers, and construction costs.

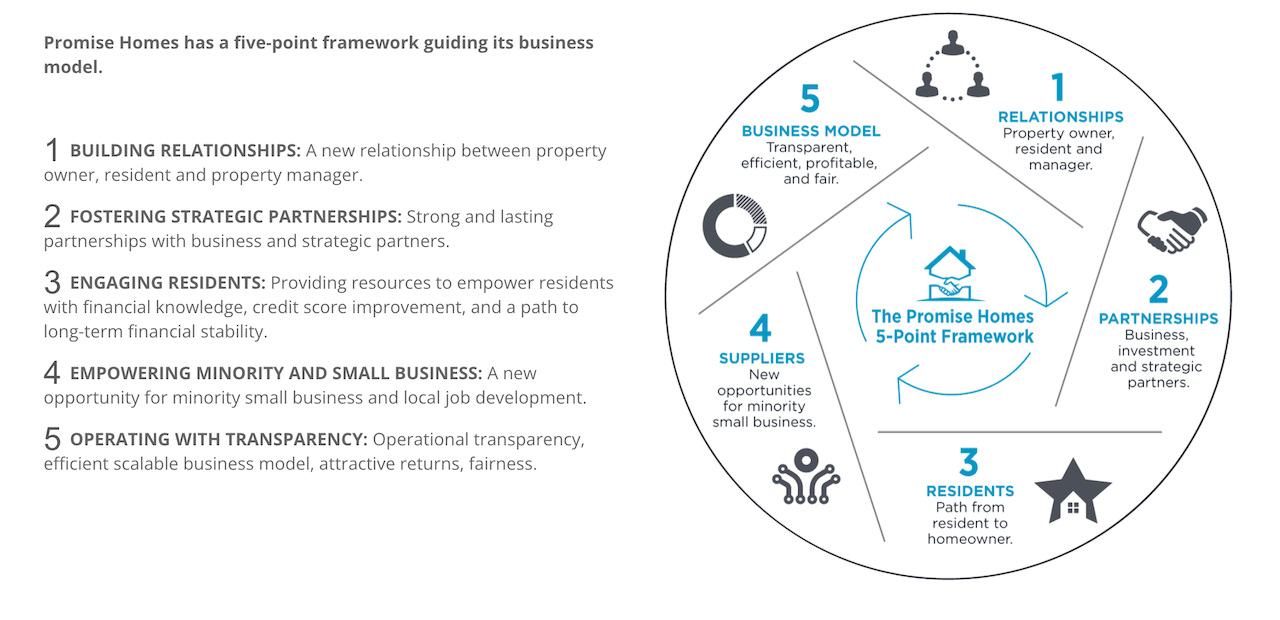

Integral to the management of this portfolio is a unique offering to residents of a comprehensive array of financial empowerment and counseling services, free of charge. In a fragmented industry with a range of institutional and mom-and-pop sellers of single-family homes nationwide, Promise Homes has a desire to nurture relationships, not simply close transactions.

Promise Homes differentiates itself in the national real estate marketplace by creating both an institutional-quality investment platform as well as best-in-class resident, manager and vendor operating system.

That the deal is noteworthy for one of the reasons it's noteworthy is where the word hope – a verb, a noun, a feeling, a fact, a concept, and, yes, a person's name – comes in.

That is, hopefully, at some point in the natural history of market-rate and low income and masterplanning, and urban, suburban, rural community and home development, a major league capital investment or debt facility, or M&A, or strategic initiative deal involving a smart, capable, visionary, and driven leader who is a person of color should come as no surprise.

Today, though, John Hope Bryant understands – hailing as he does from humbler beginnings in his early life in Los Angeles' South Central and Compton neighborhoods – that progress and solutions don't emerge from fixes here and there in a system.

Promise Homes – as much as it's a real estate platform and portfolio of properties – is very much a culturally-transformed business approach to housing. It looks at equity – and inequity – from the ground up; it builds linkages across education, job training, financial literacy, financial footprints, credit history, and social support from the foundation to the rooftop.

John Hope Bryant looks at housing as a solution, nested, however, with in an ecosystem that's larger, economically more dynamic and value generating, and ultimately more embracing, inclusive, and equitable in its scope.

"The beautiful thing about this model is that it's a multi-stakeholder model... In this situation, every resident got free access to financial literacy if they want it; two, minority vendors, plumbers, electricians, lighting, roofing, landscaping, a range of skilled labor – they're getting a living wage in compensation or they're getting a contract ... 65% of all the contracts of Promise Homes company went to black and women-owned and minority-owned businesses. I believe that has a lot to do with our ethos, our values, and how we run this company, which is doing well by doing good.

The third leg of the Promise Homes strategic stool, says Bryant, is a more equitable, educated, and financially sound path from renting to owning a home, a foundational access point to the American Dream of wealth creation and comfort.

While no single enterprise can by itself meaningfully solve for the stubborn and daunting barriers to America's housing crisis, Promise Homes' capital infusion, its ecosystem-focused multi-stakeholder model, and its heart and soul of hope represent a bright line where capital, vision, know-how, and resolve converge.

They say hope is not a strategy. Without it though, no strategy to find solutions for what chronically challenges people's access to safe, healthy housing they can afford, would stand much of a chance of survival.

So, today's a day, if any, to celebrate Hope.

Join the conversation

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.