Leadership

Beyond The Correction, Get Right With Building's No. 1 Challenge

Economic natural forces, such as they are today, give homebuilding leaders a choice. Either shape what happens within them, or get shaped by them.

Employee engagement.

There, we said it. As noisy and turbulent as times are now, it remains a homebuilder's top business risk to survival and flourishing to 2030 and beyond.

Here's a statement you could connect the dots to homebuilding's No. 1 business threat, recession or not, of the next decade.

Unless efforts are refocused on retention, managers will be unable to drive performance and affect change. Leaders need to take action to enable their managers to keep their talent while still being able to deliver on results. Managers need help with three things. First, they need help shifting the focus of career conversations from promotion to progression and developing in different directions. Second, they need help creating a culture and structure that supports career experiments. Finally, managers need to be rewarded not for retaining people on their teams but retaining people (and their potential) across the entire organization."

Still, one might safely guess that the term – employee engagement -- as it applies strategically to the residential construction frontline workforce and the known big challenges of capacity, cost, quality, and generational perpetuity is a homebuilding business equivalent of fingernails on a chalkboard ... for a majority of the business community's leaders.

For a little minute, though, let's set aside what we might dismiss as squishy soft or woke, and consider it sheerly as a business tool in its own right. A new report from the Leading Builders of America's Building Talent Foundation does so here:

While increased engagement yields positive outcomes, decreased engagement leads to greater employee turnover, which can be costly. A recent study by Work Institute2 found that, on average, employers can expect to incur costs of $15,000 per employee for expenses relating to separation, replacement, training, and lost productivity. The study also found that nationwide, turnover cost employers more than $700 billion in 2021 alone.

People who are more engaged are more productive, more dedicated, more loyal, and more likely to promote the organization. Additionally, they are often more trustworthy and reliable and use their initiative to solve problems and improve processes. They are happier in their work and make others around them, including customers, happier.

Engaged employees tend to exert discretionary effort, such as finishing a task even though it’s outside normal working hours. They are also much less likely to think of quitting, and staff turnover is much lower in organizations with high engagement levels. According to Angi’s 2021 Skilled Trades Report3, organizations in the top quartile in engagement outperformed those in lower quartiles in several key performance indicators. Specifically, high-engagement companies, compared to those in the low quartile in engagement, were in the top 10% in customer loyalty/engagement, 23% in profitability, 18% in sales, and 14% in productivity. These companies also performed well in other important areas, such as safety, quality, and organizational citizenship.

If that's still not convincing, or sounds generic or somehow disconnected from what's going on this minute in the business of home construction, let's address that with the current context.

"Jobs weeks" – like this one – come monthly with two or three or so important labor market health benchmarks from both private sector and government researchers. Headline payroll numbers, employment rates, income, macro labor participation measures, job openings and quits, and unemployment data make for closely-watched leading economic indicators.

For homebuilders and the multi-trillion-dollar business ecosystem they impact, that early-month jobs week predictably winds up slicing two ways: Good-news-bad-news.

From homebuilders' vantage point, the double-bind matrix works typically like this.

- Payroll and/or income level growth is, naturally, good news that economic momentum is adding job-formations that, in turn, add to residential construction and development's customer food-chain; conversely, strong employment growth means tighter labor markets – i.e. more unfilled headcount positions and more quits – adding up to.higher direct input expense for skilled labor, plus weakened leverage to induce next generation frontline workers to enter construction occupations.

- Then there's the flip side. Negative growth in payroll headcounts accompanied by spikes in unemployment and lost household income amount to bad news for the economy and the housing economy that nests within. It hits demand fundamentals on the macro-economic and household consumption side and does a number on consumer sentiment front as well as intensifying income insecurity among those who still hold jobs. An offsetting silver-lining behind periods of mass layoffs, unemployment growth, and muted economic activity has, at least historically, meant looser, less expensive, more flexible access to skilled construction front liners.

The challenge is that what was typical is no longer. A late-pandemic-Ukraine War-afflicted economy has complicated this axis. How? For one, we still see a dialing up on the supply and labor constraints front, even as policy mechanisms to cool down an inflationary spiral start to weaken momentum in the consumer household spending, corporate profitability, and overall economic stamina.

For homebuilders and their partners, jobs week's good-news-with-a-big-dollop-of-higher-cost-margin-squeezing-downside, and its opposite, a negative reading that shows stalling-payroll headcounts, growing unemployment, mounting job insecurity, and grimmer consumer/household confidence levels, with a saving-grace side-effect of more pliant, less expensive skilled workers effectively all add up to more negatives and less upsides.

Rather than a double-edged sword, jobs weeks' data releases now portend a double-whammy of increased input cost pressures – due to continued constraint on materials and front-line worker capacity – and decreasing demand owing to price-rigidity, inflation impacts, and growing economic insecurity.

Here, National Association of Home Builders chief economist Robert Dietz articulates the high-level challenge within a darkening economic backdrop as he reports a tipping-point decline in construction job openings in the latest Bureau of Labor Statistics JOLTs release:

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. However, while a slowing housing market may take some pressure off tight labor markets, the long-term labor challenge will persist beyond an expected near-term recession."

The mistake for homebuilding company leaders – naturally apt to look at the world as discretely divisible into one realm over which he or she has no control, or another bucket made of matters they need to manage – would be to relegate outcomes or influences entirely to outside forces they have no sway over.

They do. Although for the better part of two centuries, excepting for a couple of World Wars and their aftermath, American homebuilders could more or less passively allow economic nature to take its course to support a flow of construction workers into the capability pipeline – people who'd by and large spend entire working careers plying their trade, gaining skill, and passing those skills along to a next young cohort as economics' big-playing-field-in-the-sky would tilt them into the construction fields.

Economic natural forces, such as they are today, give homebuilding leaders a choice. Either shape what happens within them, or get shaped by them. The way to shape rather than be molded, or flattened, or misshapen by a sudden loss of capability is to seize control of your team, and your team's partner network, with respect to retention, which means, practically, pragmatically, and unavoidably, engagement.

A boss we had once said often, "Turnover is good." That was then, and today it may partly hold true, but not as a rule.

Rather, the rule today would be retention is a leadership and cultural matter. What goes along with that is that retention is a fulcrum – a business cultural tool – for both recruitment and training.

Consider:

- To get back on the beam for balances between new residential construction and front line workers, data from the Home Builders Institute suggests that every 60 seconds that passes between now and the end of 2024, two new front-line workers would need to enter and stay on board as the next generation of home construction's front liners.

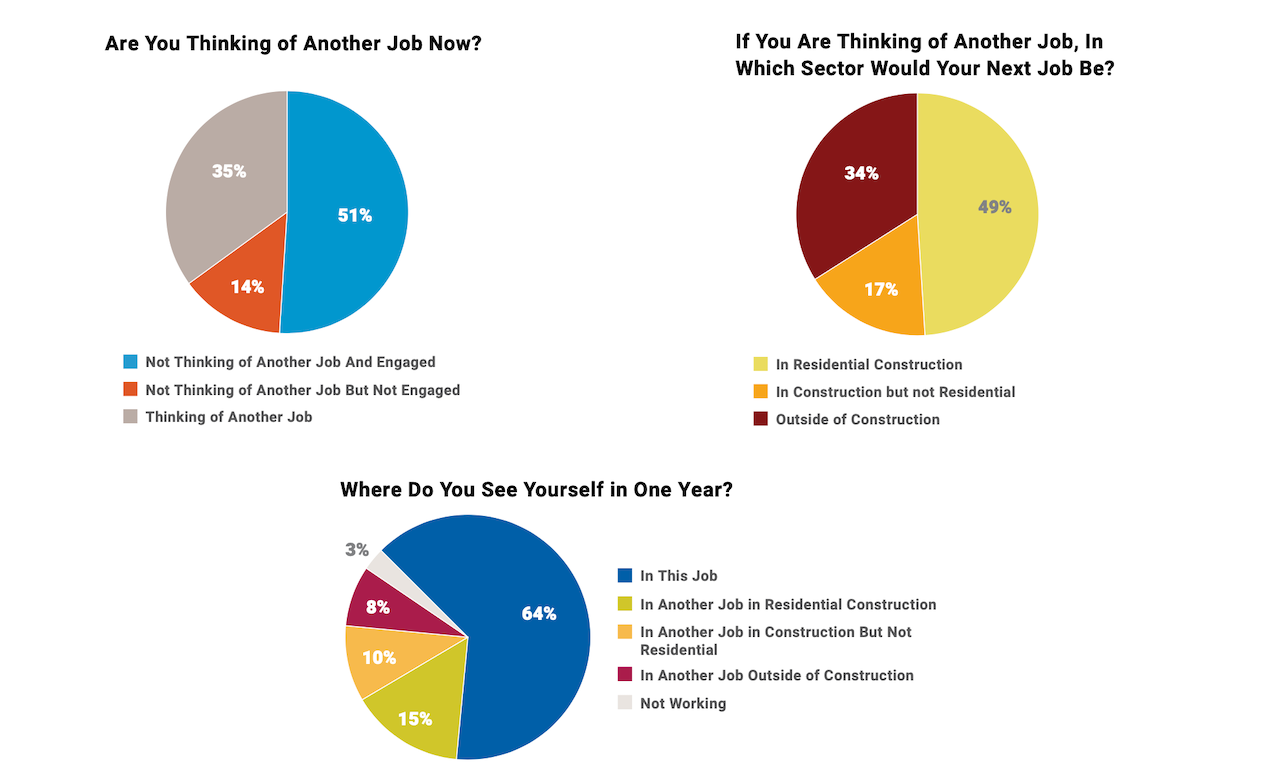

- Turnover is a thing. Word is that over the past several years, for every three new recruits who've started in on residential construction job sites, two of the three angle to leave the field within six months or less. Even this months JOLTs data reflects "quits" rates soaring even as the overall complexion of the housing economic cycle softens.

According to McKinsey analysis:

Between December 2019 and 2021, construction wages grew by 7.9 percent, reflecting intense competition for employees.1 And the prospect of higher pay and better working conditions is tempting experienced personnel away from construction and into sectors such as transportation and warehousing, where wages grew by 12.6 percent over the same period.

Shape or be shaped. The fact is that the luxury of human capability – your 25 or so trade crews consisting of frontline workers who assemble homes in the building lifecycle – as an externality is just that, a luxury.

Either internalize and operationalize your capability – human, technology, capital, land, materials – or suffer the consequence of harm to your business and profitability viability and resiliency.

Leaders of homebuilding organizations that have tapped into and fed the sprawling community of practice through which start-to-completion cycles can occur at a rate of about 3,500 per day on a good day now need to look at their human capability not as an externality, but as a matter they no longer can afford not to impact by moving it from the "can not control realm" to the "need to handle domain."

Branka Minic, ceo of Building Talent Foundation, has made action items – versus talk-and-little-or-no-action – her signature in the first two years of the Leading Builders of America drive to attract and activate America's crucial next generation of construction skill, evolving capability, management, and business leadership.

This shows that prioritizing engagement, and providing upskilling, career pathways, and well-trained supervisors, will help companies keep good people,” Minic said. “Engaged employees are also more productive, dedicated and happier. Put simply, companies with an engaged workforce are more successful.”

First step for homebuilding business leaders, pros, veterans, and time-tested culture setters is to rethink of the term – employee engagement – not as H.R. speak but as a simple, essential matter of business practice ... an area you do have control of as a way to ensure present and future success.

Next, start into action in small doses, like learning anything new, with a few ideas that can produce nearly immediate upside results:

These include allowing and encouraging employees to pursue professional and skill development, fostering supportive, team-centric work environments, and training supervisors in effective leadership. A variety of resources and training modules are available online at low or even no cost.

Join the conversation

MORE IN Leadership

Public CEO Compensation Averaged $11.5 Million In 2023

Here's The Builder's Daily annual scorecard and analysis of CEO, Executive Chair, and corporate President pay across the 21 U.S. pure-play public homebuilding enterprises.

Public Firms Seize Advantages; But Private Builders Hold An Edge

Often, private homebuilder leaders and their teams solve the problem of how to survive and thrive, just when all the headlines cry, "It's a bad time to buy."

D.R. Horton's Q3 Earnings Reveal A Case Study In Winning Market Share

A turbulent, volatile, uncertain demand market is not the only force making life difficult for 99% of homebuilding operators right now.