Products

A Sign Of Trying Times: Jobsite Robberies Rise For Scarce LBM

Surging commodity prices on the black market of goods have begun rewarding theft and fraud.

It's come to this.

Akash Homes in Edmonton, Alberta, has endured repeated heists of lumber, with losses totaling C$100,000 ($82,915) since February, according to vice president Hersh Gupta. The company installed security cameras at its construction sites and joined forces with other builders on nearby lots to hire guards to patrol overnight and on weekends. “It’s getting pretty crazy, to the point that thieves are starting to hot-wire zoom booms to load their own trucks,” he says, referring to a type of forklift.

The company now uses spray paint in a sky-blue shade that matches its corporate logo to tag its lumber with the letter “A” to help identify it if it’s stolen. But though some victims of lumber theft monitor online sales platforms such as Facebook Marketplace in search of stolen goods, markings are easily shaved off, making the wood unidentifiable.

And, insult to injury, if you will, builders and distributors would hire in a nanosecond such clever people as these thieves, scammers, pirates, and fraudsters, to work legit jobs on and around the sites if they could.

Job site security, by no means overlooked in pre-pandemic times, stands now as just one more operational area builders need to beef up and lock down. Disappearing building materials stand as a beacon of just how low bad players can go as builders, developers and their partners navigate the throes of a supply chain racked in dysfunction.

Here, David Logan, National Association of Home Builders director of Tax and Trade Policy Analysis, delivers yet further affirmation of how unhinged getting materials to job sites for start-to-completion construction has become.

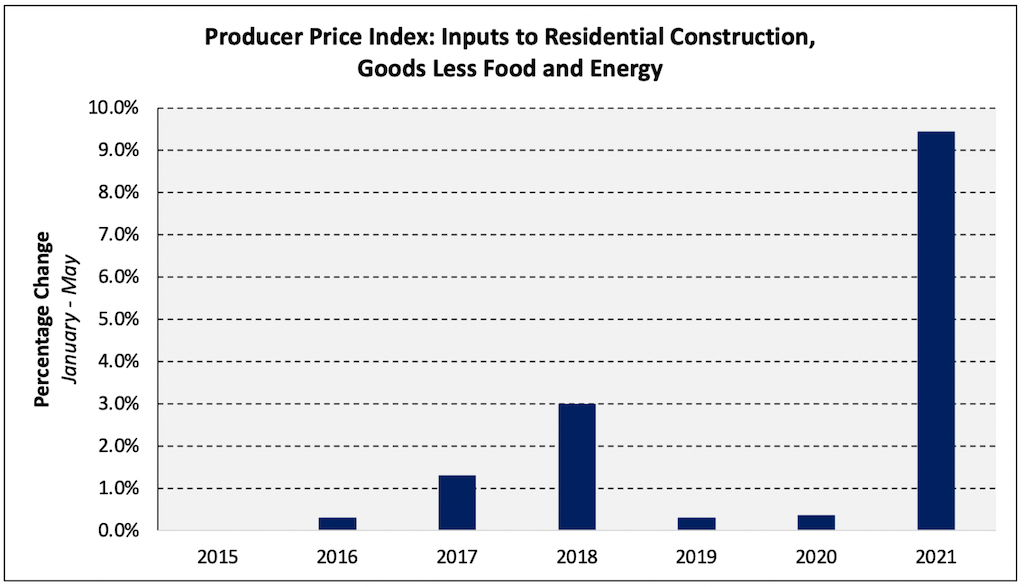

Detail from Tuesday's Bureau of Labor Statistics Producer Price Index that applies to builders' direct cost inputs gives a measure of lumber and building materials ground literally shifting under the feet of purchasing, sourcing, and procurement pros tasked with supplying active community sites with what they need.

The index for inputs to residential construction, including food and energy, increased more (+4.1%) and is up 22.5%, year-over year. This increase closely mirrors the 26% increase found in a recent NAHB survey.

Building materials prices have increased 9.4% year-to-date (YTD), in stark contrast to the 0.4% YTD seen in 2020. However, the 2021 increase YTD is an outlier when compared to pre-pandemic years as well, more than tripling the largest January-to-May increase since 2015 (the most recent data available).

Price volatility, stingy product and materials allocations, pivots to untried sources and suppliers notwithstanding, builders and their partners know in their heart of hearts, those are the "lesser of evil" challenges they face.

Why? Well, it's highly likely that producer price flux and supply chain disruption are temporary – albeit protracted – issues that will clear, settle, and reset as the economy better matches people, processes, and workflows to the pull of demand.

Likely, demand will not pull as hard after this initial superthrust of pent-up consumer activity, and supply will have regained its ability to more smoothly deliver goods to market.

Meanwhile, man your posts and keep close watch of all the materials moving in, around, on and off your job sites.

Any possibility these unsavory heisters would convert to the light side? Good jobs for smart, entrepreneurial, resourceful types are plentiful.