Technology

Structural Demand: Remodelers Reckon With Aging Home Stock

Long-in-the-tooth American home stock suggests demand could fuel markets, and spawn pivot to quality and durability.

“There are 80 million owner-occupied homes in the United States and 55% of them are 40 years old or more – which tallies up to 44 million 40-plus-year-old houses,” says Jack Truong [CEO of the $2.8 billion in net sales global fiber cement building products manufacturer James Hardie (ASX: JHX; NYSE: JHX)]. “When you think about it, just 5% of that total would come to 2.2 million homes, which is double the size of new construction. We believe that many of those homes are built with wood, vinyl and other materials that are not durable enough, or are highly flammable, or are just not going to be fit to survive more adverse natural disaster conditions. We see James Hardie in that light as a solution homeowners can turn to, and we’re working to transform that landscape of opportunity.”

We wrote this in April, for Forbes.

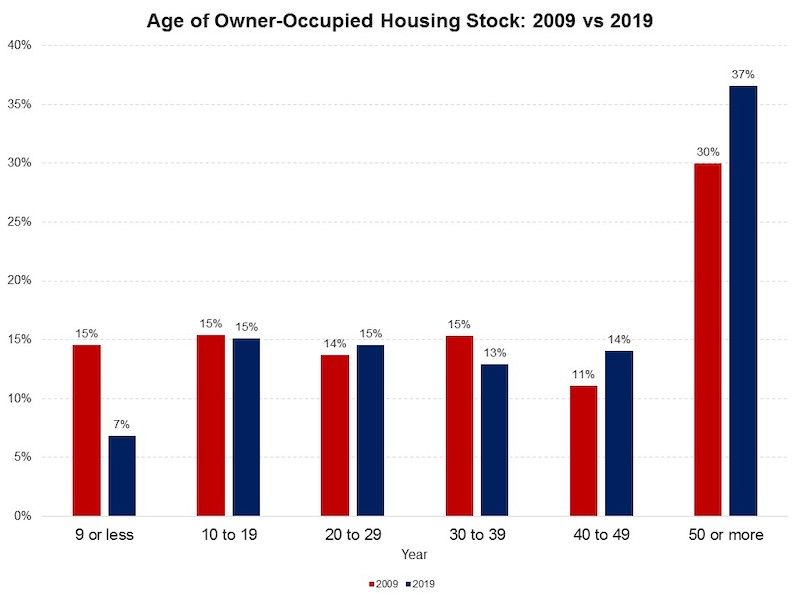

The calculus for fundamental demand for remodeling and renovation keeps getting better, according to an update on the Census' American Community Survey from the National Association of Home Builders senior economist Na Zhao.

Zhao notes:

The median age of owner-occupied homes is 39 years, according to the latest data from the 2019 American Community Survey. Compared to a median age of 31 years in 2005, the U.S. owner-occupied housing stock is aging gradually. The residential construction continues to fall behind in the number of new homes built especially after the Great Recession.

Structures – especially the ones we build in the United States – need replacing, restoration, remodeling, all a function not only of their durability limitations, but changing waves of taste and style, economic shifts, and, of late, the increasing pounding of natural disaster and human-caused hazards.

There are four hugely material implications in the aging housing stock data:

- One, James Hardie CEO Truong's point that the 44-million or more 40-plus year-old houses market is only beginning to be tapped.

- Two, new construction to replace aging housing stock has nowhere nearly kept pace in the past 10 or more years with historical rates of new building vs. aging stock.

- Three, as climate, global warming, and rising seas – as well as other natural hazards – impact the future of more than 20 million residences considered at risk, this suggests massive relocation of people currently living in those homes to new, safer ground in the years ahead.

- Four, U.S. builders have an opportunity to upgrade the quality of buildings so that they're capable of enduring 100 years or more, as is common in other countries using new technologies and a different model for valuations that places greater importance on life-time value rather than first-course prices.