Technology

'No Need To Change:' The Big Barriers To Homes Of The Future

If "no need to change; site built homes work fine for us" is such a strong de-motivator among homebuilders to cross the Rubicon into the future of housing, what does that say about the present and future business viability of vaunted construction tech start-ups?

Will the future of housing remain forever a hostage of the future?

Whether or not anyone likes it, until a private sector enterprise figures it's worth committing its own resources – like, say, Amazon, Alphabet, Tesla, Apple, Microsoft, Airbnb, Nvidia, or Berkshire Hathaway, etc. – housing's future may be permanently delayed.

It's not that people don't recognize it – a future that melds new hyper-productive building technologies, 10,000 local and regional policy shifts, and a land and development capital finance reset around stakeholder value creation. Many people will tell you it's inevitable one day.

However, between now and that vague one day, an intractable, implacable chunk of time, political will, capital investment, and operational focus amounts to a pervasive sense that that "inevitable" change to come won't likely come in the next five to eight years.

In other words, that would mean in 2030, not much of "the future of housing" will be in evidence.

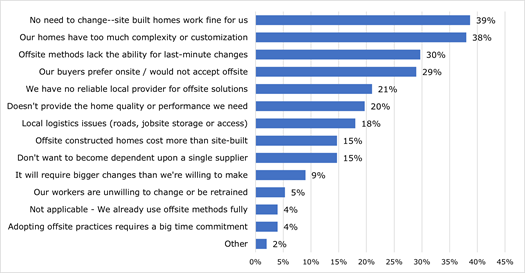

Some of that comes through in a September 2023 survey taken by Home Innovation Research Labs that looks to better understand "barriers to adopting offsite construction," a broad umbrella over factory-based, more automated homebuilding and assembly.

Ed Hudson, Director of market research for Home Innovation Research Labs charts out responses of about 350 participants in a hybrid quantitative/qualitative poll that asked respondents to name their top three reasons keeping them from "adopting" currently available offsite building alternatives.

Here's how that looks:

Whatever one might make of builders' leading reasons for maintaining the status quo rather than committing and investing in a more industrialized, modern manufacturing operational model, those responses hardly reflect a fear that their livelihoods are "ripe for disruption."

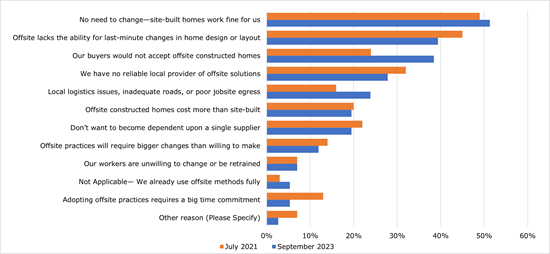

Even more startling is to look at builders' responses to the same question(s) – in 2021 and 2023 – in a year-to-year comparison.

Have a look for yourself at the 2021 vs. 2023 comparisons of "barriers to offsite" among homebuilder respondents:

As Hudson notes:

Looking back at how builders responded to innovation in the wake of the housing bust of the Great Recession, there was an observable uptick in the use of newer building materials such as cold-formed steel framing and insulating concrete forms. With housing production issues no longer as pressing, builders seemed to invest in making improvements to their homes and businesses. Further, evidence suggests that builders changed construction practices out of competitive necessity—the much smaller remaining market for new homes was much more scrutinizing, and builders adopted strategies to set their homes apart from those of other builders.

The top bar says a lot. Two years closer to "the future of housing" more builders say the way things are – site built – is "fine the way it is."

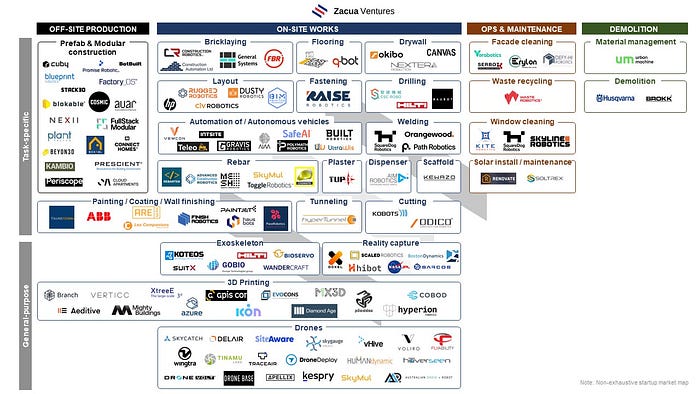

So what to make of this image, then?

If "no need to change; site built homes work fine for us" is such a strong – and growing stronger – de-motivator among homebuilders to cross the Rubicon into the future of housing, what does that say about the present and future business viability of these start-ups?

Zacua Ventures, an investor in new construction technology ventures, believes that despite challenges, a more robotic, industrialized development and construction value chain is a no-brainer.

Several megatrends are now forcing the industry to find new ways of construction to enhance productivity and efficiency of workflows, to improve environmental performance and to provide safer worksites for workers."

However, the Home Innovation Research Labs respondent base doesn't sound like a group very much "forced" by these megatrends at all. The self-evidence of construction innovation, robotics, and modern manufacturing technologies notwithstanding, Zacua acknowledges its own version of challenges to a cut-over from housing's past – which is where we are – to a future of housing that perpetually seems to dart just around the next corner or just over the visible horizon.

Despite the immense value that these technologies bring to the construction industry, these are still some challenges constraining its further implementation:

- The changing environment of the worksite requires robots that are able to adapt to the dynamic, unstructured, and complex construction site and to the different weather conditions which increases cost / complexity of development. With the rapid improvement of the perception stack, this is now becoming easier to solve.

- The opposition of unions to its implementation as they might fear a loss of employment of workers, and the demand for professional training to be able to operate some of these technologies and to adapt to new supervisory positions that will appear. The approach here needs to be one of education and identification of the right applications for deployment of robotics

- The high initial investment cost and subsequent maintenance costs which are now much lower than they used to be and are being mitigated by new business models, and

- The need to adapt the current workflows to the presence of robots on the jobsite, as the use of robots will require better scheduling, assignment of tasks, and coordination on the project. To overcome this, human centric design eventually needs to evolve to incorporate elements of efficiency — for example, a basic level of standardization across trades (in drilling holes for example) , incorporation of additional robotic capabilities during design (e.g., carrying capacity, variable designs) and efforts are already underway in this space

What's clear from the innovation models that have started out with a bang and then fallen and failed are two essential lessons learned.

- Reliance on other people's money and other people's time-value-as-money to stand up and scale a business that proposes to disrupt an operational model that hasn't visibly, generally, and inalterably broken leads to history's dust-bin rather than to housing's future.

- Businesses that zero in on solving exclusively for a full-stack of construction trades in their operational model – vs. the end-to-end property development cycle with its tax- and capital timing advantages – are ripe for commoditization in the value chain. Profitability will be a struggle unless multiple developer/investors compete for the solution. If not, lowest-bidder rules will constrain those construction technologies' ability to sustainably create value for their own investors and owners.

We've been champions of innovation and investment in the future of housing. We're just hoping that future is not caught in some never-present limbo. It needs to come in the form of a business that can stand up and work just like any other private enterprise in the domain today. Extra help is not a thing.

MORE IN Technology

Design-Estimating Disconnects Cost Builders Time And Margin

Former builder-operators Brandon Pearson and Marcus Gonzalez share what’s broken—and how connected teams can win now and in 2030.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Margin Mission: Homebuilders Race To Crack Inefficiency Code

Spring 2025 has fallen short of expectations. Builders are turning to integrated data systems to protect margins and prep for the next wave.