Technology

Generative People Learning Is A Path Forward For Fledgling BTR

What's exciting about business leaders in the BTR space – the ones with genuine residential real estate operational experience, anyway – is that they're as adaptive as they are driven.

Residential investment, development, and construction's newest bright shining opportunity – exactly no one is surprised – comes with equally imposing challenges.

Build to rent hid in plain sight from all but a few pioneers a decade ago. Today it's on everybody's radar as a housing preference, a sustainable community type, and an asset class that will only grow as investors, developers, and builders strive to answer the nation's ever unmet need for homes of all types in the decades ahead.

Validation came clear as BTR neighborhoods came online, leased up, and began serving broader local and regional areas as a welcomed, vital, core part of the residential community fabric. They're places for people to live in, love, and carry on pursuing what they value. That's unambiguous.

So, too, are challenges.

One of them clearly is a capital investment context that is night-and-day different today than it was three or four years ago, and a likelihood it will remain adverse indefinitely. This new capital context and what's coming in terms of credit disruption, busted deals, and, possibly distress, will as likely bedevil the BTR juggernaut as it does any other real estate asset class out there. Residential rental may serve as a hedge to residential for-sale, or not ... not when household incomes can't keep up with ground-up rental projects.

These challenges don't demoralize a business community so used to periods of turbulence and trial. They're part of the thrill of it, from what we've always seen through two decades of covering the business community.

What's exciting about business leaders in the BTR space – the ones with genuine residential real estate operational experience, anyway – is that they're as adaptive as they are driven.

For them, and they're proving it now as they navigate a far less generous fairway to their project pipelines' success, a baseline operating principle is that there's always more to learn than you know, no matter how long you've been at it, or how smart you are, or how successful the track record looks.

Case in point. Many BTR pro formas up to 18 months ago or so didn't need to fret construction costs. That was partly due to dirt cheap term loan costs, and partly due to calculations on property cash flows and residual valuations after lease up that are now known to be pipe-dreams. In post-Fed-hike higher interest days – ones showing their full non-linear glory in slow to no-rent growth, a glut of new rental properties coming online in the next year or so, and at least a strong possibility of a recession with job losses, business failures, etc. – construction costs are absolutely a matter for BTR projects to pencil.

The discovery – if you can call reckoning with a reality that was staring you in the face but could choose to ignore because you could always pass high cost on to another part of the value stream – is that residential BTR community development and construction didn't have an ideal construction-as-a-solution model as it entered the second state of its early success.

Builders and their subs were most familiar with the floorplans, structures and systems, but were not accustomed to a for-rent cost and value stream that stripped away mark-ups and premiums they regarded as essential to their margins.

Multifamily developers were familiar with the cost and value stream model, but had no significant prior experience with the trades, the materials supply chains, and the building typologies.

Commercial hospitality developers were familiar with the real estate investment model and had capabilities at driving cash flow and residual valuation growth on property, but again, lacked experience with building types, trades, and supply chains.

Here's where learning – not machine learning but people powered generative learning – comes to play a key role in what happens next to secure a more sure-footed path forward for BTR's still early ability to scale as a housing solution.

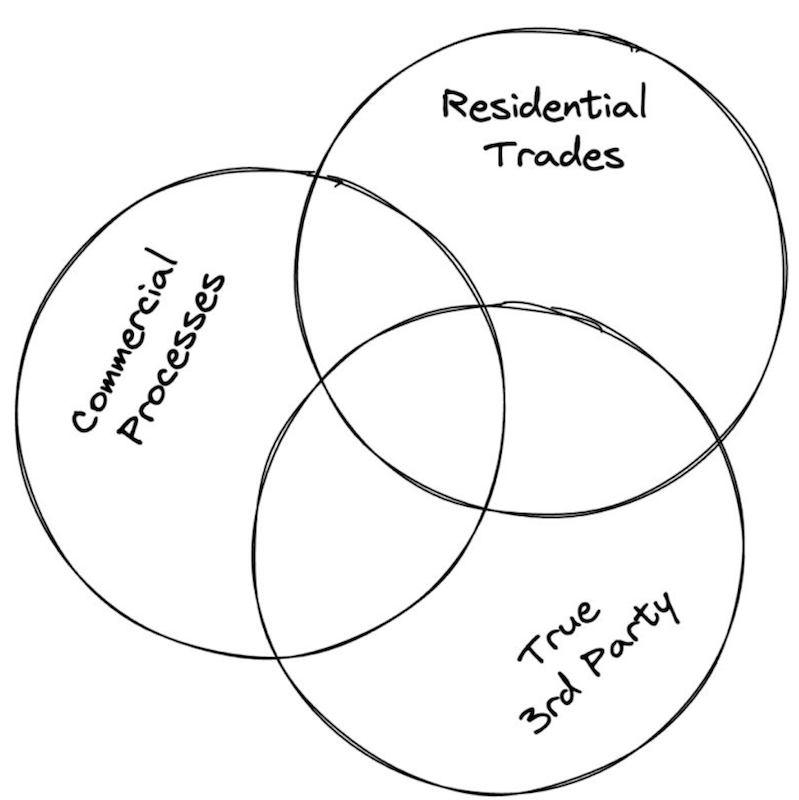

Check out this graphic from Mosaic co-founder and CEO Salman Ahmad:

In a LinkedIn post, Salman says:

When I get asked by build-to-rent developers what they should look for in their GC/builder/construction team, I tell them that effective construction of BTR projects is a Venn diagram of three homebuilding elements that are often at odds.

Experience with residential trades. Working with residential trades is the best way to improve productivity and cost effectiveness.

Commercial construction practices. Your GC’s internal processes must be institutional-grade to meet the expectations of developers, institutional capital, and lenders.

A truly third-party GC. Many builders have their own deals that can compete for their attention.

Construction teams that can hit this 'BTR trifecta' will ultimately dominate this asset class."

Ahmad's BTR building-as-a-solution challenge here is no mean feat. That "trifecta" will elude those whose efforts, mistakes, wins, and losses don't become invaluable data points from which to learn and improve.

What it also signals, though, is a business community of leaders and workers among workers who embrace this constant wonderful go-get we wake up to only in this business of making homes and neighborhoods for people.

That is that we always need to learn more than we know. Who would want it anyway other than that?

Residential construction made easy. As a tech-enabled general contractor for the residential development industry, Mosaic focuses on production-scale projects of all types, from single-family homes to horizontal apartments to other build-to-rent product types.

MORE IN Technology

How Homebuilders Gain Ground Control With Digital Land Tools

Land banking is complex and costly. A new digital approach shows how builders can cut errors, speed deals, and stay competitive.

Silos Kill Margin — Here’s How Homebuilders Can Fight Back

Texas-based Riverside Homes, Boulder Creek Neighborhoods, stand as proof cases in how platform integration cuts costs, clarifies performance, and transforms builder culture.

Design-Estimating Disconnects Cost Builders Time And Margin

Former builder-operators Brandon Pearson and Marcus Gonzalez share what’s broken—and how connected teams can win now and in 2030.