Products

With Cash From Record Profits, LBM Deals Shake Up Rankings, Portend M&A Arms Race

TBD explores what this week's building channel consolidation moves mean for builders and for the building and real estate landscape in the months ahead.

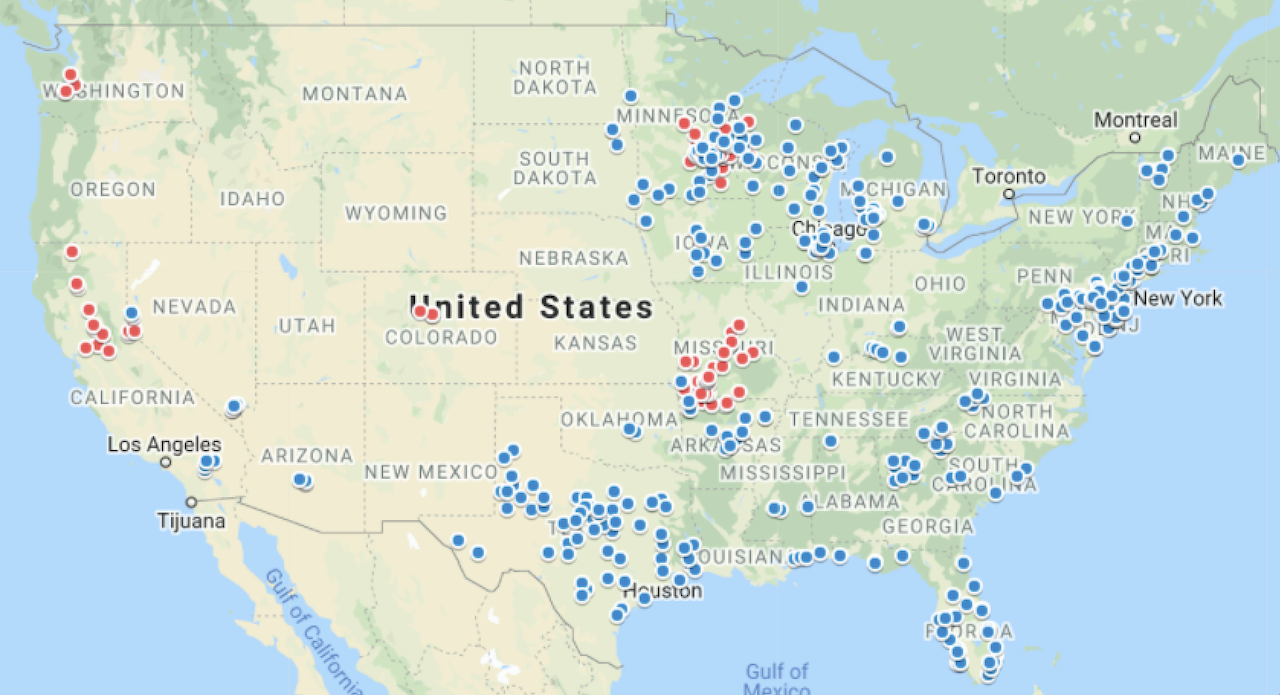

Flush with cash and pent up demand in an opportunistic post-COVID exuberance, LBM mergers and acquisitions took off in May with two game-changing deals that shook-up Webb Analytics' Construction Supply 150 rankings.

Builders FirstSource's acquisition of Alliance Lumber group in the Phoenix area reinforced BFS's hold on the number 3 position on the Webb rankings, behind only The Home Depot and Lowe's. A day later, BFS purchased John's Lumber in Detroit, which had 2020 sales of $49 million, and on May 24 bought Alliance Lumber's multiple operations, with $330 million 2020 revenues, according to Craig Webb, founder of Webb Analytics. Those deals, combined with BFS's 2020 wheeling and dealing, takes the company's revenues to $13.15 billion, Webb says.

On May 25, US LBM acquired American Construction Source, which recorded $703.2 million in 2020 sales. The deal, combined with earlier purchases of Higginbotham Bros and its $130.9 million in 2020 sales, boosted US LBM past the $5 billion sales mark and moved it ahead of 84 Lumber for 9th place on the CS150 rankings.

The magnitude of the activity reveals a quickening pace and impact, coming out of 2020 when deals dropped to 69 from 83 in 2019, although the number of facilities exchanges in 2020 was more than double the number in 2019 indicating fewer, but bigger deals.

So what's driving this activity?

Matt Ogden, Managing Partner of Building Industry Partners (and a TBD Dream Team member), sees a combination of extraordinary factors making a prime time to sell and a rush to buy.

"The dealer M&A consolidation burst is the result of the extraordinary framing commodity price spike on top of the unexpected Pandemic-induced housing construction and remodeling activity life the building products community had experienced. These forces have produced record results for many independent LBM dealers, and caused those considering a sale in the years ahead to sell now; and caused some dealers not considering selling to reconsider.

"Concurrently, acquirers’ own performance has been extremely robust, creating strong balance sheets and boosting their confidence to grow through acquisitions, and even pay record valuations for highly strategic assets they’ve long coveted but weren’t previously for sale. The result is upward M&A activity spiral we see now in the LBM market."

In sum, Matt Ogden's big-picture take expresses the M&A mood and motivation at work even more broadly across the real estate and construction landscape:

- Big money, parched for yield opportunity, is cheap and plentiful

- Entity-owner age demographics remain a strong catalyst – i.e. many company principals are in their 50s, 60s, and 70s, and are looking actively for exit and succession options as well as timing to pull the trigger on getting out before the cycle turns negative

- Simultaneously, fewer bigger players, whose balance sheets are capable of weathering pan-cyclical business conditions, require geographically local scale for pricing and efficiency opportunity

- Lastly, technology's algorithmic impact – building information modeling, real-time housing activity data, and global supply sourcing down to the bill of materials level – has begun to take hold of marketplace that to-date has worked hyper-locally. We're now seeing a rotation to pan-geographic, pan-cyclical building and materials channel investment and strategic management.

So, with the tailwinds behind the distribution channel M&A flurry may remain gale-force steady for some time to come, TBD Dream Teamer Tim Seims of John Burns Real Estate Consulting, sees some transformative opportunities to come from it.

"Surely, the deals don't stop here," Seims says. "We often bemoan the lack of innovation and productivity advances in the building industry. Consolidation, however, reminds me of how dynamic and fast-moving things can be. The burst of huge deals over the past few weeks and months could be a catalyst for great change."

As examples, Seims notes:

- for independents to hold or take space either in head count, coverage, or offering as the newly formed company integrates.

- for the newly formed organization to pool human and operational capacity to invest in new technology like prefabricated products.

- for Building Product Manufacturers to review promotional programming to renew with the merged company or reset with local, nimble independents.

- for private equity and independents to have more visibility on valuations, potentially spurring more innovation and growth investment.

But a word of caution comes from Ken Pinto, principal and President of Kenzai USA.

"I’ve seen much consolidation of LBM companies in my career as a builder," he says. "Sometimes you gain a higher level of service, product offering, and availability, sometimes you lose your sales rep, and the next guy/gal doesn’t know you from Adam.

"I know that builders have a reputation for choosing suppliers based only on price, but this is not always true. The current pricing crisis aside, suppliers that are easy to work with and add value, not just an exception-free procurement process, but by making me smarter about products and keeping me apprised of the latest product or installation deficiencies, are the ones that I tend to favor. Builders want to be better builders. LBMers can show the value of their consolidations by meeting our procurement needs and making us better."

MORE IN Products

How Precision Can Shave Time From Homebuilders' Build Cycle

Sales may be priority No. 1 right now. And that needs to be bolstered by virtually flawless operations. Boise Cascade’s SawTek gives builders speed, savings, and first-time-right quality when it matters most.

In Uncertain Times, Capability Investment Is A Survival Tool

Boise Cascade’s $140M mill improvements reflect a long-game commitment to builders under pressure from volatility, costs, and customer hesitation.

Margins Tighten, Value-Add Matters In Construction Supply

Even as overall construction supply revenues inch upward, Webb Analytics’ deep dive into the $600B pro channel reveals a shifting reality: declining unit volume, cautious outlooks, and strategic bright spots in value-added manufacturing and service partnerships.