Policy

What Builders Lose If ENERGY STAR Gets Eliminated In EPA Cuts

A sudden move to sunset the EPA’s ENERGY STAR program threatens to unravel 30 years of progress, hitting homebuilders hard — just when they need every edge to close a sale ... and every reason to keep building higher performance homes.

The ENERGY STAR for New Homes program has stood fast as a rare competitive lever that delivers value, trust, and operational efficiency in an already punishing economic and capital environment for U.S. homebuilders.

That lever may soon be gone.

According to internal Environmental Protection Agency (EPA) reorganization documents reviewed by the Associated Press and CNN, the Trump Administration is preparing to sunset the EPA's 30-plus-year-old ENERGY STAR initiative, dismantling the offices overseeing the program. While the administration frames this as a "streamlining effort" to cut climate-related initiatives, for many builders, this is a headwind they can ill afford.

"People recognize it right away," Francis Dietz, spokesperson with the Air-Conditioning, Heating, and Refrigeration Institute, tells NPR. "They see ENERGY STAR and say, 'I should probably go with this one.'"

More than 3,400 builders, developers, and manufactured housing firms participate in the ENERGY STAR Residential New Construction program. It's not just a badge — it's a business tool. Homebuilders like KB Home, Meritage Homes, Clayton Homes, Beazer Homes, and Fulton Homes incorporate ENERGY STAR certifications into their standard product offerings, marketing, and even their investor-facing strategy narratives.

That tool enables builders to:

- Signal energy performance to cost-conscious buyers

- Unlock federal 45L tax credits of up to $2,500 per qualifying home

- Participate in utility rebate programs linked to Energy Star specifications

- Differentiate on quality, comfort, and environmental responsibility

In 2024, approximately 350,000 newly built homes were Energy Star certified. That volume accounts for around 22% of all new U.S. housing starts—a significant share that reflects both builder adoption and homebuyer demand.

A Voice from the Field

A trusted Friend of The Builder's Daily contributed the following commentary, offering vital clarity on what this rollback could mean for the industry:

There were significant fears during the first Trump administration over potential cuts to the U.S. Environmental Protection Agency (EPA). Following recent reports that the ENERGY STAR Program is on the chopping block, it appears the second Trump administration will be following through on earlier promises.

Launched in 1992 under President George Bush and described on the ENERGY STAR website as “…a time when both business leaders and environmentalists recognized that economic growth and environmental protection can—and must—go hand-in-hand.”

What started as a public-private partnership to reduce energy consumption in computers and monitors has grown to encompass everything from light bulbs to furnaces and schools to homes. With 90 percent market recognition of the ENERGY STAR brand, it’s the most successful energy efficiency program in the country. In fact, it’s estimated that some 800,000 ENERGY STAR labeled products are sold each day.

Home builders also rely on the ENERGY STAR program to certify single family homes, apartments and even manufactured homes. The ENERGY STAR New Homes program launched in 1995 to help homebuyers easily identify homes that were more energy efficient than standard homes (i.e., energy code minimum) in their market. Several national home builders have committed to building all their homes to the ENERGY STAR requirements.

Spurred by the Energy Efficient New Homes tax credit (45L), last year, nearly 350,000 homes were certified under the ENERGY STAR New Homes program. Builders can receive up to a $2,500 tax credit per home for achieving the ENERGY STAR certification.

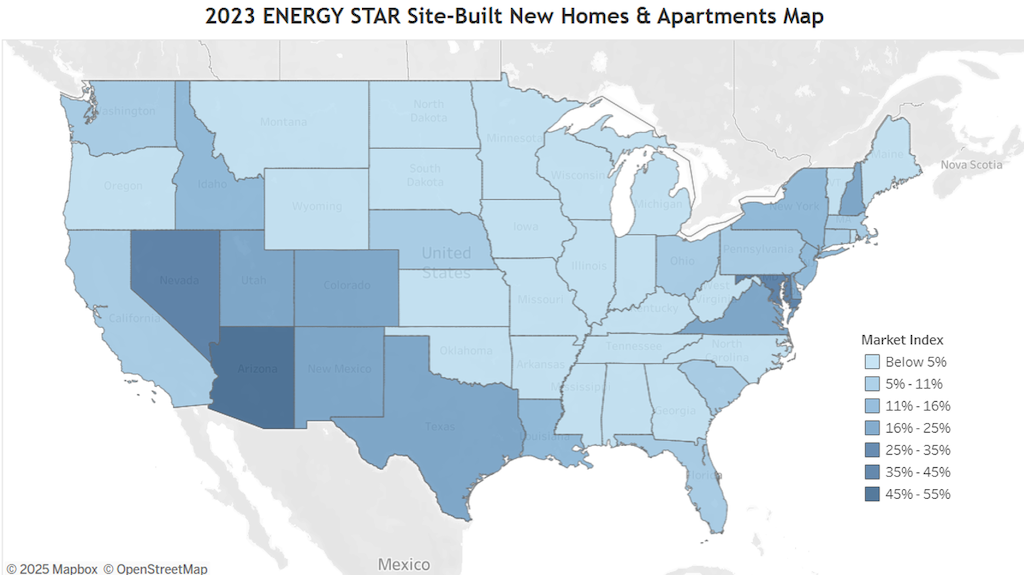

The map below shows the number of market share ENERGY STAR Site-Built Homes certified in 2023. States with the highest numbers of certified homes may be most impacted by the elimination of the ENERGY STAR New Homes Program.

Federal tax credits are not the only incentive for builders to improve the efficiency of their homes; many electric and gas utilities rely on the ENERGY STAR New Homes program for builder rebates and incentives. This could be a double whammy for builders of energy efficient new homes.

What does the future hold?

After more than 30 years of the ENERGY STAR program being a staple for businesses and consumers alike, the potential winding down of the program leaves many more questions than answers.

- Will the program be resuscitated by the private sector?

- Will the 45L energy efficient new homes tax credit survive?

- How will utility programs pivot away from incentives based on ENERGY STAR?

- Will home builders roll back the efficiency of new homes in the absence of ENERGY STAR brand recognition and incentives?

One thing is certain, if this decision by the Trump administration stands, it’s sure to shake up energy efficiency practices in the home building industry.

What Builders Stand to Lose

1. Financial Leverage: Without ENERGY STAR, builders lose access to 45L credits that, for mid-size builders delivering 300–500 homes annually, can amount to hundreds of thousands of dollars in direct tax credit value.

2. Market Differentiation: ENERGY STAR is a trust trigger for homebuyers. As consumers face energy price uncertainty and demand sustainability, builders who can no longer offer the Energy Star label lose a visible, government-backed edge.

3. Operational Alignment: Many builders have optimized product specs, supplier relationships, and trade workflows around ENERGY STAR standards. Removing the program injects ambiguity into quality assurance and process alignment.

4. Utility Partnerships: Many utility programs hinge their efficiency incentives on homes achieving ENERGY STAR certification. These rebates—often several thousand dollars per home—may evaporate.

"Eliminating the Energy Star program would directly contradict this administration's promise to reduce household energy costs," said Paula Glover, president of the Alliance to Save Energy. "The program delivers a 350-to-1 return on investment." (TechCrunch, May 7, 2025)

A View from Inside: Sam Rashkin's Perspective

Sam Rashkin, former Chief Architect of the Department of Energy's Building Technologies Office and a foundational leader of the ENERGY STAR New Homes program, offered a clear-eyed, deeply informed take in a conversation this week with The Builder's Daily.

"It’s hard to find a better example of good government than Energy Star — efficiently using taxpayer resources to transform homes and buildings. But like many long-standing programs, it became bloated over time. There’s talent loss, scope creep, and inefficiencies that can’t be ignored."

At the same time, Rashkin emphasizes ENERGY STAR's pivotal role in transforming U.S. housing:

Back when we launched the program, we were aiming to work ourselves out of a job. The code-minimum house today is about three times more efficient than the 1995 ENERGY STAR home. And that’s thanks in part to the program building an ecosystem — the HERS industry, verification infrastructure, and a performance mindset."

But Rashkin says the real risk is less about elimination and more about erosion:

I’m not worried about the program going away. I’m worried it survives but loses the talent and leadership that made it flourish. The secret sauce was responsiveness to industry, the technical chops, and messaging that changed behavior. If we lose that, the label becomes hollow."

He believes the industry must rally with a contingency plan:

We need to prepare for Plan B. Get the best minds around the table and be ready to carry on the principles of ENERGY STAR, whether that means DOE stewardship or private-sector evolution. Disruption is inevitable — but it can also be the path to reinvention."

On incentives, Rashkin is equally candid:

We were tipping even before 45L existed. Seventy percent of certified homes got no incentives in the early 2000s. The business case drove it. Long-term incentives are valuable because they create a stigma when a home doesn’t meet the standard. But we must stop depending on short-term handouts and build a permanent value proposition."

And Rashkin's take on the consumer side:

Energy isn’t the [only] message. Quality is. Certified performance, verified by a trusted authority, adds emotional weight for buyers. ENERGY STAR needs to evolve to sell that emotional value of being in the top 2% of housing quality."

A Public Signal: Sara Gutterman and the Broader Response

Sara Gutterman, CEO of Green Builder Media, captured the frustration and resolve of a growing coalition of sustainability leaders in a recent LinkedIn post:

It’s baffling that the current administration would target a program as effective and widely supported as ENERGY STAR. Eliminating the program won’t save taxpayers meaningful money. Instead, it will:Create unnecessary confusion in the marketplace.Undermine decades of progress in smarter energy use.Disrupt a successful, voluntary, market-driven efficiency standard."

Her post drew engagement from industry influencers like Aaron Smith of EEBA, Peter Pfeiffer, Steve Easley, and Sam Rashkin himself. Rashkin noted:

I believe industry will lobby the new administration to keep ENERGY STAR ... it's too good for business and jobs. Thus, I predict ENERGY STAR will stay, but probably relocated to DOE away from its home as a climate initiative."

Connor Dillon added that the implications stretch well beyond new homes:

This also impacts the residential and commercial programs. Think about how interconnected energy codes in different states and cities are with the program requirements."

The network of responses—from offsite construction advocates to corporate executives—shows that ENERGY STAR is not just a policy. It's a signal, a standard, and increasingly, a non-negotiable.

What Comes Next?

If the administration succeeds in dissolving the EPA’s oversight of Energy Star, multiple uncertainties arise:

- Will 45L tax credits remain in place but become harder to achieve?

- Can DOE or a third-party framework keep the label alive?

- Will homebuilders drop below energy code baselines if voluntary programs vanish?

What’s clear is that for a homebuilding industry already navigating extreme affordability headwinds, the loss of Energy Star would be more than symbolic. It would strip away a functional layer of performance, economic value, and brand trust—precisely at a time when builders need every tool to close the sale.

This story is still unfolding, but one that deserves the full attention of U.S. homebuilding leaders, especially those navigating shrinking margins, rising buyer expectations, and volatile public policy.

MORE IN Policy

The 50-Year Mortgage And The Real Work Hiding Behind Its Idea

President Trump and Bill Pulte’s 50-year mortgage idea may not be a solution—but it should be looked at as a spark. What matters most is the local work it could ignite on affordability, access, and upward mobility.

Homebuilders Urged To Invest In Frontline Jobsite Workers Now

As homebuilding slows, workforce investment becomes the make-or-break factor for long-term capacity. Building Talent Foundation CEO Branka Minic warns that cutting training and career-path spending now will deepen the industry’s structural labor crisis for years to come.

NYC Voters Back Affordability — Now Comes The Hard Part

New Yorkers have voted for change. Four sweeping housing charter amendments promise faster reviews, digital mapping, and more affordability—but the real battle begins as City Hall, the Council, and Albany clash over control.