Policy

Arizona’s Starter Home Push Stalls Amid Local Pushback

Legislative bids to remove zoning and design mandates in Arizona’s housing-starved metro areas are stuck in limbo. While the bill aims to fast-track affordable homes, local municipality opposition and concerns over investor ownership have derailed it again.

As housing affordability continues to dominate political agendas, state legislatures attempting to encourage once-ubiquitous starter homes face stiff resistance from local governments that fear losing control over zoning.

Lawmakers have been trying to neutralize or circumvent zoning rules and regulatory hurdles at the local levels that drive up costs and stall new construction, heeding calls for relief to give first-time homebuyers a fighting chance.

State after state has repeatedly tried to make building housing easier. Florida is on its third iteration, and California continues to peck away with more legislation, for example.

Arizona, a state that experienced a glut of homes during the Great Recession, has struggled to build fast enough recently.

To meet demand, it has tried for the past two years to pass the “Arizona Starter Homes Act.”

The legislation restricts municipalities from imposing many design and development standards, such as minimum lot sizes, home sizes, and aesthetic requirements, on new single-family homes, aiming to make it easier and more affordable to build housing.

The bill would allow the home buyer to choose how they want to build their home and how they want it to look, not some unelected government bureaucrat," State Sen. Shawna Bolick, the bill's sponsor, said on the Senate floor in March.

The bipartisan bill made it to Gov. Katie Hobbs’s desk last year, but she vetoed it. This year, it has stalled in the state legislature.

The biggest impediment: Arguments from the League of Arizona Cities and Towns that the legislation would lead investors to buy and rent those homes.

While supporting the need for more affordable housing, the organization, like similar ones around the country, advocates for its 91 member cities and towns to retain total control over their zoning.

A poll the league conducted this month — finds that “85% [of respondents] say residents should shape local development — not Wall Street.”

Arizona builders say the focus on investors is a red herring to deflect from their real concern, a loss of complete control over zoning. Builders don’t typically want to sell to investors because investors tend to want a bulk price lower than what the homes could be sold for individually.

Arizona’s Bust to Boom

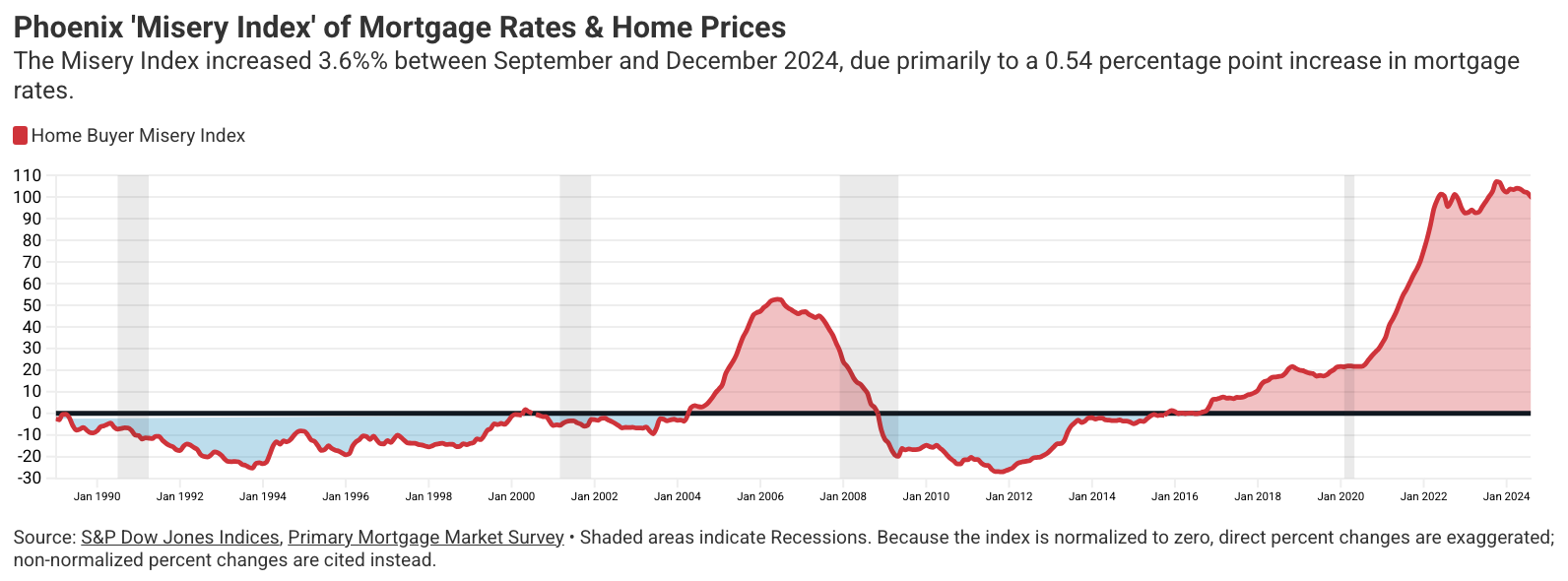

Leading up to the 2008-2009 housing bust, an influx of new residents that exceeded the national average drove the Arizona home construction boom. Affordability had become a problem then.

“Strong housing demand coupled with escalating home prices served as a dual incentive for builders to increase the supply of homes, arguably at a rate that exceeded short-term demand,” a 2009 Federal Deposit Insurance Corp. report on Arizona and three other so-called “Sand States” Nevada, California and Florida that suffered the most when the bottom fell out."

New home construction had exceeded the national demand for several years before the crash. Second-home buying rose to drive demand for housing. The FDIC noted that investors or speculators also contributed to the growing imbalance, giving some credence to the argument that the League of Arizona Cities and Towns is making now against the legislation.

“Ultimately, the housing boom in the Sand States proved to be mostly a mirage,” the report said.

Arizona experienced tremendous job loss, more than 300,000, and foreclosures rose dramatically. Entire streets lined with new homes turned into ghost towns. Home values dropped.

The state steadily recovered. Building permits hit the highest level since 2006 in 2022 during the pandemic. Jobs took a hit in 2020 but rebounded quickly, unlike taking years after the Great Recession.

Home prices soared. People in high-cost states sold and paid cash for homes in Arizona, a similar story that played across Sun Belt states.

“The consequence was housing prices went up roughly 50%,60% on average,” said Glenn Farley, director of policy and research with think tank Common Sense Institute in Arizona. “You could easily find examples of prices going up 70%.”

Since 2019, the average home price has increased from $276,054 to $425,590 last year, a 54% gain, according to the institute’s research.

By comparison, Farley said price increases were smaller before the Great Recession and prices came back down.

“What's interesting about this time is we had bigger price increases, and they haven't come down,” he said. “What they've done is stop growing.”

The average home price hasn’t changed much since 2022, when mortgage rates more than doubled.

Trying to Eliminate Hurdles

According to the institute’s research, Arizona’s housing shortfall was 56,616 last year, more than half of that in the state’s most populous county Maricopa. That’s down from 100,043 in 2021. Permitting, however, isn’t keeping pace with population growth now, and the institute projects the deficit to be much higher.

Higher interest rates have dampened demand for new housing. Builders have sought to induce demand by buying down interest rates.

Builders are also dealing with higher construction costs. And, of course, regulatory barriers increase cost, too. The National Association of Home Builders has put the regulatory cost at about a quarter of the final price of a new home, 40% for multifamily developers.

Arizona home builders say 30 years ago a subdivision would take six months to reach the point of constructing homes. That period grew to two years before the pandemic. Now they say, it takes four years, with 18 months to two years on entitlement and zoning alone.

Design standards require such requirements as pools and parks, which means forming a homeowners association to maintain.

The Start Homes Act would address the challenges:

Municipal Restrictions on Home Design

Municipalities are prohibited from requiring:

- Shared features or amenities necessitating a homeowners' association, condominium association, or similar body for maintenance or operation, unless mandated by federal law.

- Screening, walls, or fences.

- Private streets or roads.

Limits on Development Standards

Municipalities cannot enforce or adopt requirements that:

- Set minimum lot sizes greater than 1,500 square feet for new developments of five or more acres in single-family residential zones.

- Require minimum square footage or dimensions for single-family homes that exceed those for any other dwelling unit as of the bill’s effective date.

- Impose maximum or minimum lot coverage for single-family homes and accessory structures.

- Require building setbacks greater than 5 feet from side lot lines and 10 feet from front and rear lot lines.

- Mandate design, architectural, or aesthetic elements for single-family homes.

Builders and housing advocates hope the legislation will pass through the Arizona State Legislature to the governor's desk and become law.

The legislation has bipartisan support and opposition. It narrowly passed the Senate and two House committees in March but has seen no additional action.

The Senate floor discussion on the bill reflected concerns about state control over local regulations.

State Sen. Mitzi Epstein voted against it because of wording she believes is too broad. She cited the line that:

a property owner's right to use the property owner's property, protected from unreasonable abridgment by municipal regulation and enforcement, is a matter of statewide concern and is not subject to further regulation by a municipality."

Epstein feared wealthy property owners could sue a city claiming an ordinance is unreasonable and point to the Starter Homes Act.

"Although I value property rights very much, I also value the ability of cities to help neighbors get along with each other by setting ordinances that are fair and just and have gone through a good process," she said.

Bolick, however, presented the scenario playing out today based on her experience.

My own parents bought their starter home in their 20s," Bolick said. "I was in my mid-20s when I bought my first home. Today, the average age is 38 years old for first-time homeowners. How old were you?”

She added that her son and wife, both in their 20s, are looking to buy their first home, noting that her son had told her the inventory wasn't good.

MORE IN Policy

Pulte Brings Homebuilder Know-How Inside Fannie Mae

Washington is tightening the link between federal housing finance and builder operations. Liquidity, land strategy, and affordability are now intertwined.

Grappling With State-Mandated Density, Sharp Local Pushback

Seattle is deep into a big push to reshape its housing landscape: Dismantling single-family zoning to comply with Washington’s 2023 law that legalizes middle housing. Richard Lawson examines how the One Seattle Plan could double capacity and create 120,000 new homes. But not without a fight.

Vacant To Vibrant: Baltimore’s $6B Housing Play To Revitalize

Baltimore launches a $1.2B redevelopment initiative—leveraging $5B private capital—to tackle vacant homes and rewrite zoning for “missing middle” housing.