Land

Indy-Area M&A Pick-Up Gives Taylor Morrison Midwest Entree

Pyatt Builders' co-founder and president Todd Pyatt -- a market-tested homebuilding success-story since the 2009 demise of C.P. Morgan -- will lead TMHC's inroads into America's Heartland.

Carmel, IND-based Pyatt Builders – an affordable entry-level and move-up poster child for the higher-for-longer and lock-in-effect era's twin towers of competitive advantage owned by the big national homebuilders – agreed to become Taylor Morrison's launching pad into America's heartland.

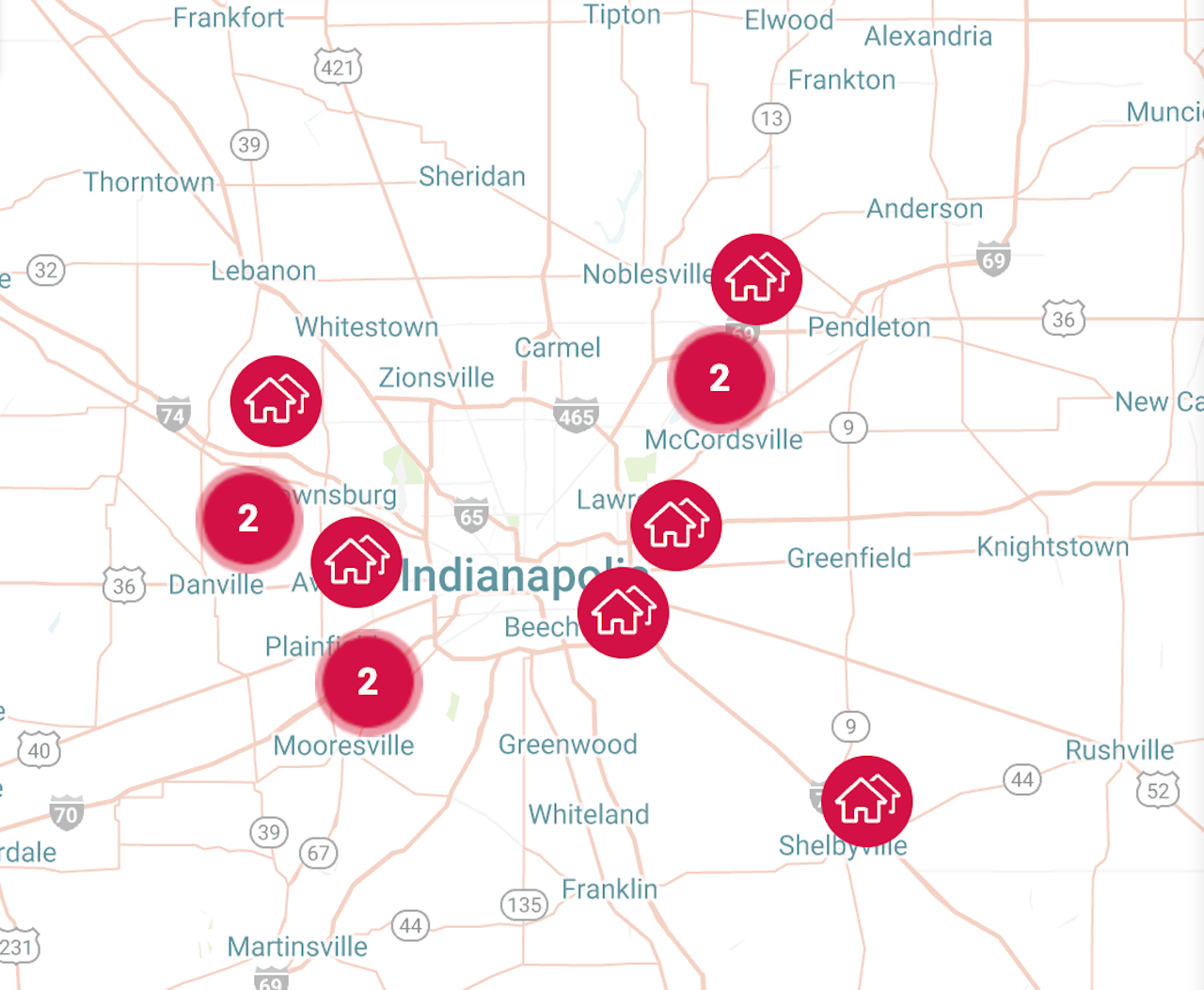

Pyatt Builders, a testament to resilience and local market mastery, was founded in 2009 by Todd Pyatt amidst the 2009 Global Financial Crisis. It emerged from the wreckage of erstwhile Indiana-area power builder C.P. Morgan, where Pyatt had spent nearly 15 years. Operating as a top-10 local builder in 13 communities flanking Indianapolis to the east and west prior to its deal with Taylor Morrison, Pyatt Builders owned and controlled 1,500 lots, a clear sign of its strength in the market.

Taylor Morrison executives noted in their Q1 2024 financial performance commentary this morning that the acquisition nets the enterprise a 12th state to its operating footprint, opening a big, brand new arena to play out an operational, land, and customer-focus platform that has made it a strong top 10 or top 5 player in most of its markets. The expected immediate incremental growth pick-up of 174 closings in 2024 in 10 operating communities will drive an estimated full-year revenue impact of upwards of $70 million.

In short order, that figure might be expected to more than double, given the cadence of communities Pyatt had under development.

The company has a healthy land pipeline of approximately 1,500 lots and has averaged an annual delivery volume of around 220 home closings over the last four years, with strong growth to the 300-500 range in the next two years anticipated based on new communities already under development." – Taylor Morrison

In opening remarks to investment research analysts, Taylor Morrison Chairman and CEO Sheryl Palmer notes:

We're excited to add this healthy and growing market to our map within our central region under the leadership of Pyatt's strong existing team of tenured operators. Indianapolis boasts meaningful net migration that ranks Top 10 in the country, fueled by above-average employment growth of 3% over the last 12 months, and favorable affordability that is highest among the country's top 30 major metros. Due to its low land residuals, its housing market has been remarkably resilient over time, and we are encouraged by the capital efficient growth opportunity the market presents."

Taylor Morrison's M&A deal – as modest in size and cost as it may be – runs consistent with some of other precision-targeted "launch pad" deals that have proliferated since the end of last year into the first half of 2024. These combinations frequently focus primarily on a baseline "under-built" imbalance between current supply and growing demand and offer a stack of value-creation opportunities: affordable price points; a strong operational team with local land intel and relationships; and a logical map of regional expansion directions, into neighboring states, infill tracts, and the era's newly-activated, post-pandemic paths of growth girding the outer rings of more and more secondary and tertiary markets.

Of the 387 US metro areas, Indianapolis ranked 23rd in total population change (17,807).

Whereas the US rate was 69%, 61% of Indianapolis’ population growth can be attributed to domestic and international migration compared to natural increase (births & deaths), which is the 3rd highest rate among AI peers." – Indy Chamber.com

On the Pyatt deal, Palmer adds:

For us to go back into any sort of M&A transaction, it would really have to be strategically appropriate and accretive to the business. When we look at Indianapolis and we look at a top 25 homebuilding market, [... we look at] the immediate generation of outlets, the access to finished lots along with other pipeline deals in that market, and the percentage of control being consistent with Taylor Morrison. [We're also looking for] a veteran management team and an unbelievably respectable historic financial position the company's had. It's just a wonderful alignment for us."

The transaction reflects that the nation's largest public enterprises — and those owned all or in part by Japan-, China-, or Canada-based mega-players, along with the Clayton Homes single-family builder portfolio — now build upwards of six of every 10 new homes in the U.S., an unprecedented market share. Unlocking both immediate and longer-term hockey-stick type of growth is on more and more of those top-tier players.

That concentration of fewer, more mammoth players can be expected to continue, at least as long as higher costs and constrained supplies of land, labor, and lending affect – and weigh on – nearly all but the largest privately held homebuilding firms.

As is the case with Todd Pyatt, who joins Taylor Morrison as Indianapolis Division President, a seller's upside is the opportunity to ride a wave of growth with an order of magnitude greater resources bolstering his and his team's entrepreneurial instincts.

Palmer's expectations of the new Indy beachhead – for growth, immediate financial impact, and sustained profitability consistent with Taylor Morrison's benchmarks – are clear:

When we look at the Midwest, we've been looking at Indianapolis for years. We had to be very patient. It had to be the right deal, management team, and strategy. So today, our focus is to get the business integrated – which given Todd Pyatt's leadership – is going to happen relatively quickly.

We'll see what happens from there. Anything we do from here, from an M&A standpoint, would have to meet those high thresholds, as we've talked about. But is there additional organic growth coming from Indianapolis? Certainly, that would be something we look to do in every other market."

MORE IN Land

What Daiwa House's Latest Acquisition Means For U.S. Homebuilding

The purchase of North Carolina-based Prestige tells of a strategic roadmap that includes plans to secure and sustain asset-light land control, build technology and manufacturing platforms, and gain advantages to a deeper domestic talent pool as well as better strategic M&A opportunities.

A Start-Up With A Model Built To Scale Up In Scattered Infill Sites

A competitive advantage for a new homebuilding firm in a hotbed of market share-thirsty rivals in North and Central Florida can come only one way – and it's not by outspending them in any part of the end-to-end building lifecycle – the hard way.

Here's A NextGen Homebuilder Start-Up Model In Lift-Off Mode

Three young and driven guys left Lennar to start their own homebuilding and development company outside Houston. Their origin story and early momentum could serve as a next-gen startup blueprint.