Capital

Stanley Martin Grows Southeast Footprint With Windsor Homes

The North Carolina builder brings 2,100 lots and 270 homes into Stanley Martin’s fold, extending its reach across the Triad and coastal markets. For Daiwa House, the deal is another step in building regional “mini Daiwa Houses” as durable U.S. platforms.

When we acquired Stanley Martin we knew from its performance during its over 50 years in business that acquiring land to build on was one of its strengths, but it turns out that it is even better positioned than we anticipated, and it is adept at taking over other businesses and expanding its area coverage. Another aspect of Stanley Martin is that it serves not only actual-demand types such as first-time buyers, but a broad range of buyers including high-income groups who are inclined to buy and less sensitive to interest rates." – Q&A Session at Presentation on Management Policies, Daiwa House Industry Co., Ltd.

The words—offered by Daiwa House executives in their May 2025 management presentation—set the context for today’s announcement that Reston, VA–based Stanley Martin Homes is acquiring Windsor Homes, a Triad- and coastal North Carolina–focused builder with 2,100 lots and 270 homes underway.

They don’t just explain a transaction.

They underscore a deliberate strategic nuance: Stanley Martin is more than Daiwa’s East Coast operator. It is one of the group’s growth platforms in the United States, a “mini Daiwa House” engineered to replicate, scale, and diversify.

The Deal

We are thrilled to welcome Windsor Homes to the Stanley Martin family,” said Steve Alloy, President of Stanley Martin Homes, in a provided statement announcing the transaction. “Their strong presence in the Triad and coastal North Carolina markets, and their reputation for building high-quality homes, make them an excellent fit with our growth strategy.”

From Windsor’s side, President Tom Hall puts the transaction in a personal and professional context:

Joining Stanley Martin allows us to continue doing what we do best—building homes and communities that people love—while giving our team greater resources and opportunities to grow.”

Windsor Homes, headquartered in Greensboro, comes to Stanley Martin with a 25% expansion to its community count—32 neighborhoods in all—plus 2,100 entitled lots and 270 homes underway. It’s the kind of profile Stanley Martin has consistently targeted: a respected, cycle-tested regional operator with deep municipal relationships, a trusted trade base, and an embedded cultural alignment that allows for smooth integration.

For Daiwa, the calculus is straightforward. First, Windsor sharpens Stanley Martin’s penetration into the Piedmont Triad—one of the fastest-growing job-and-population corridors in the Southeast—while extending reach to coastal Carolina demand centers. Second, it adds ready-now volume in a market where local entitlement, capital constraints, and permitting bottlenecks make organic growth harder to secure.

Windsor Homes, headquartered in Greensboro and led by president Tom Hall, comes to Stanley Martin with a 25% expansion to its community count—32 neighborhoods in all—and a deep pipeline of entitled lots in markets where demographic demand continues to outstrip supply. Windsor’s active projects and reputation as a solid, locally attuned operator make it a classic Stanley Martin target: a respected, cycle-tested regional builder with strong municipal and trade relationships that can be integrated without disrupting cultural alignment.

For Daiwa, the appeal is twofold. First, the deal sharpens Stanley Martin’s penetration of one of the nation’s fastest-growing corridors—the Piedmont Triad, stretching from Greensboro to Winston-Salem and High Point—while extending reach to coastal Carolina demand centers. Second, Windsor offers ready-now volume in a lending and permitting environment where organic starts have grown more difficult to secure.

Maynard Nexsen provided legal representation for Stanley Martin. Williams Parker represented the sellers. Whelan Advisory served as the exclusive financial advisor to Windsor Homes in the transaction.

The Strategic Meaning

Through Stanley Martin, Daiwa House has proven what the quotation at the top makes plain: acquisitions are not defensive bolt-ons, but deliberate capability expansions. Windsor is less about unit volume in 2025 than it is about embedding Stanley Martin as an acquirer of choice in the U.S. Southeast.

The deal also highlights how Daiwa’s U.S. strategy differs from that of many U.S. public companies. While the publics chase market share with balance-sheet heft, Stanley Martin—backed by Daiwa—competes through an asset-light land model, cultural alignment with acquired operators, and breadth of buyer reach. Windsor’s communities strengthen Stanley Martin’s coverage not only for entry-level demand but also for higher-income move-up and discretionary buyers, smoothing out the cyclical risks that trap smaller privates.

In other words, the Windsor acquisition is not just growth by geography. It is Daiwa’s platform logic in action: turning Stanley Martin into a diversified, long-run, regionally rooted enterprise that can acquire, absorb, and scale with the same durability as its parent in Osaka.

Context: The Daiwa House Platform Model

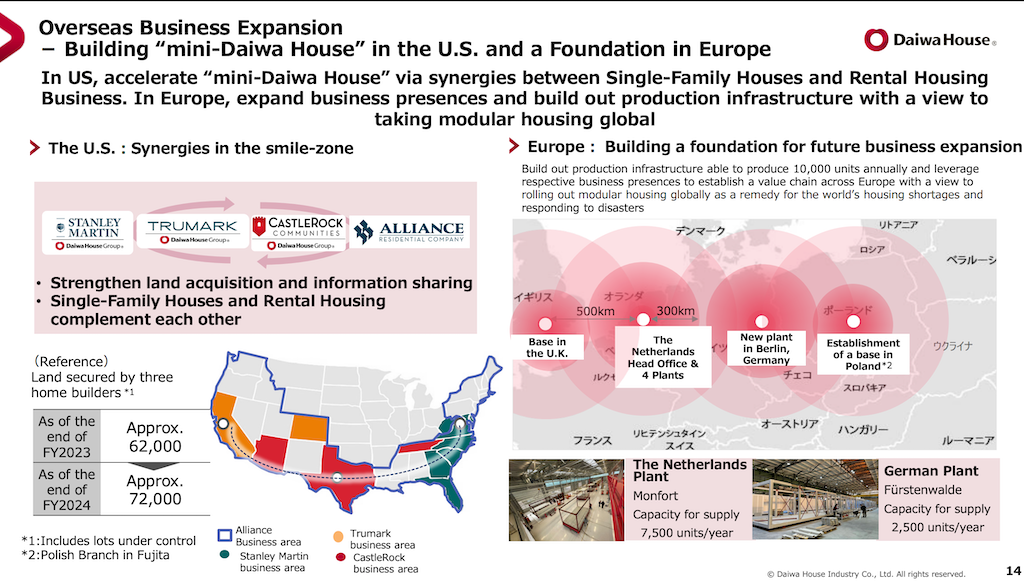

The Windsor transaction doesn’t stand in isolation. It marks the next step in a carefully sequenced, hub-and-spoke strategy that Daiwa House has pursued in the United States since 2017. With Stanley Martin anchoring the East Coast, CastleRock in Texas, and Trumark in the West, Daiwa has methodically assembled a tri-regional foundation capable of nesting bolt-on acquisitions like Windsor into a larger operating framework.

Each spoke is designed as a “mini Daiwa House”—a self-sustaining platform spanning land control, homebuilding, and adjacencies such as site development and multifamily. This is no quick-flip aggregation. It is a strategy rooted in cultural alignment, operational patience, and deliberate capability building. Daiwa knows its long-term success in the U.S. depends less on quarterly volume spikes and more on building durable, diversified enterprises that mirror its own integrated model in Japan.

The Prestige deal in 2024 foreshadowed this approach. By embedding land development and site work under Stanley Martin’s umbrella, Daiwa signaled that U.S. growth would hinge on asset-light land access, steady pipeline control, and the talent to manage them. The Windsor move extends that same logic: broaden the platform, deepen the reach, diversify the buyer base.

The Broader Competitive Frame

Daiwa’s march also can’t be divorced from the broader M&A race reshaping U.S. homebuilding. Sekisui House’s $4.9 billion acquisition of M.D.C. Holdings, Sumitomo Forestry’s consolidation of DRB and Brightland, and Clayton Homes’ relentless expansion all point to a new reality: Japanese-backed enterprises and Berkshire Hathaway now compete directly with the largest American publics for land, talent, and private-builder candidates.

For private builders like Windsor, the calculus is stark. Local operators still command trust capital with municipalities, trades, and land sellers—but scale, balance-sheet power, and cultural alignment determine whether they can convert that capital into long-run resilience. Daiwa, through Stanley Martin, offers a pathway: become part of a diversified, well-capitalized, talent-focused platform rather than try to weather cycles alone.

The Pattern

Across the past five years, Daiwa House’s U.S. playbook has revealed itself in stages:

- 2017–2020: Market entry with Stanley Martin, Essex, FD Communities, and the foothold in Virginia and the Carolinas.

- 2021-2023: Scale and diversification with CastleRock in Texas and Trumark in California, giving Daiwa coast-to-coast hubs.

- 2024: Capability deepening with Prestige, embedding land development and site work into the model, and Castlerock expanding into Nashville with the Jones Co. acquisition.

- 2025: Expansion and consolidation with Windsor, sharpening Stanley Martin’s Southeastern footprint and extending its reach into the Carolinas’ Triad and coast.

Each step adds not just volume, but a new lever of resilience: geography, land optionality, capability, or cultural alignment. In doing so, Daiwa has built a U.S. growth latticework where Stanley Martin, CastleRock, and Trumark function as acquirers in their own right—platforms that can nest regional builders and adjacencies into a broader ecosystem.

This is not opportunistic deal-making. It’s an epic of replication: creating multiple “mini Daiwa Houses” in the U.S., each diversified and locally rooted, yet aligned with the parent’s long-term growth and cultural DNA.

The Takeaway

For U.S. homebuilding strategists, the Windsor deal is another wake-up call. A North Carolina operator with 2,100 lots and 270 homes underway may look modest compared with billion-dollar MDC or DRB transactions. But its significance lies in what it signals: the center of competitive gravity is shifting.

- Public builders still dominate access to capital.

- Private builders still hold community trust and local relationships.

- But Japan-backed platforms like Daiwa’s Stanley Martin increasingly control the middle ground: scalable, acquisitive operators with patient capital, cultural fit, and long-term integration models.

That leaves smaller, privately capitalized firms with fewer options. They can either:

- Compete in a world where publics and global platforms set the land and labor terms, and where capital constraints suggest a lower-margin-for-longer new normal; or

- Align themselves with one of those platforms as an acquisition candidate.

Daiwa House’s Windsor move shows which way the wind is blowing. In a U.S. housing environment beset by capital divergence, affordability strain, and operational constraint, the builders who survive will be those who can scale, diversify, and integrate at speed.

For Daiwa House, Windsor is not just a deal. It is a declaration: Stanley Martin is the consolidator-in-chief of the Eastern Seaboard.

MORE IN Capital

As Builders Face Bank Fatigue, New Financing Paths Emerge

Lending conditions have tightened for 14 straight quarters. A new era of private construction finance is taking shape — faster, leaner, more relationship-driven.

Hunt Companies Buys View Homes Amid M&A Wave

The early-October deal signals a growing M&A presence of patient capital platforms -- some of them global asset managers --backing operators as capital pressure mounts on private builders in a long-term bright-future backdrop for U.S. residential development.

Capital Optionality Is 2026's Winning Homebuilder Strategy

Tony Avila breaks down the competitive edge capital brings—and how private builders can win big in 2026’s reshaped landscape.